Private Equity Trends: What’s Next for H2 2023?

Our 2023 Private Capital Survey described a private equity industry reassessing after more than a year of challenging economic headwinds. As fund managers and their portfolio company CFOs look to the remainder of the year and into 2024, they see a changing exit landscape, continued hurdles to meet their investment theses, and ongoing talent challenges to weather.

To take their pulse, on June 28, BDO held a webcast, “Taking Stock of Private Equity Mid-2023,” to talk through the survey findings and hear more from industry professionals on their private equity trends in the current market and their predictions for the future.

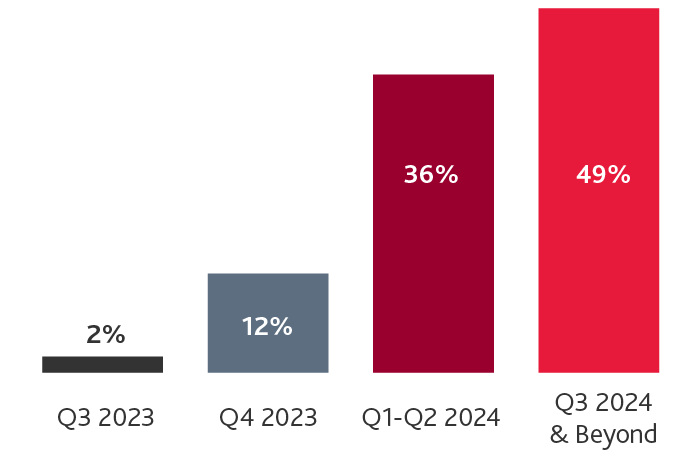

PE Looks to 2024 for IPO

When will the optimal IPO market return?

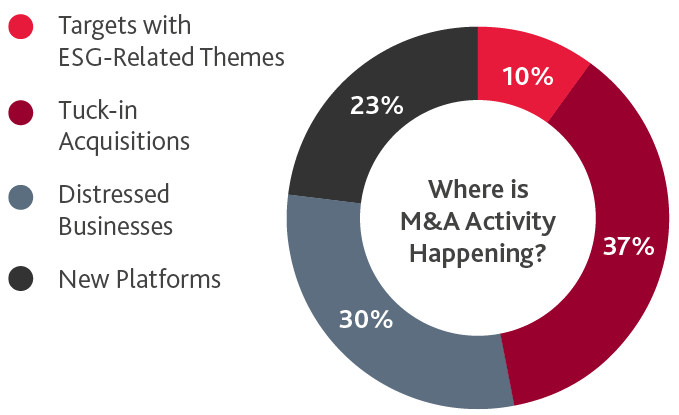

Tuck-Ins and Distressed Businesses Dominate the Deal Landscape

Where is M&A activity happening?

Source: BDO Webcast “Taking Stock of Private Equity Mid-2023” – June 28, 2023

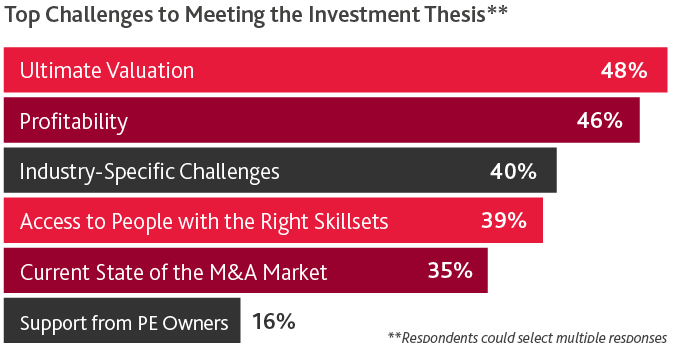

CFOs Challenged to Meet Investment Objectives

of portfolio company CFOs and board members expect it will be difficult to meet the objectives of their investment thesis this year.*

*According to data from BDO’s 2023 Private Capital Survey.

PE is Experiencing a Talent Crunch

of webcast respondents say that finding the right people with the right skills has become more challenging in the past year.

Looking Ahead

While the deal-making environment isn’t what it was in early 2022, it is stabilizing, with signs pointing towards improvement, including:

Exit values are starting to bounce back.

Large carve-out deals are making headlines.

Steadying interest rates make it easier to value targets.

Given the current labor market, which makes it costly to attract and retain top talent, staffing challenges won’t disappear overnight. However, PE funds are getting creative and pursuing options including:

- Revisiting staffing strategies and sourcing talent from outside of traditional avenues.

- Turning to outsourcing functions or departments and hiring interim C-suite leaders.

From pre-deal strategy and transaction guidance to post-deal value creation and exit support, BDO can help fund managers achieve the greatest potential from their portfolio investments. Want to know how? Contact us.

SHARE