There is a great debate unfolding around whether AI will replace human headcount. The good news for Tax is that it is both highly technical and already stretched for capacity. Embracing AI means filling the headcount you wish you could budget for by extending the reach of existing resources.

The Future of AI Is Now. Is Tax Ready?

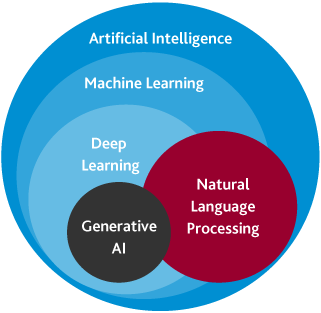

There will always come a time when the future becomes the present. Generative artificial intelligence (AI), once seen as a vision of tomorrow, has rapidly advanced to become an established part of the day-to-day operations for organizations in every industry. As its potential and capabilities continue growing, questions about AI’s impact to traditional tax functions and the employees who perform them are only getting louder. Organizations that can answer those questions will position themselves to capitalize on AI’s potential in both the short and long term.

Like any other emerging technology, the time to think about how AI will impact the future of business, including the tax function, is now. AI will turbocharge the capabilities of tax professionals, and it couldn’t have come at a better time. Fewer and fewer students are pursuing degrees in accounting. Compounding this issue, more than 300,000 accountants left their jobs between 2019 and 2021, according to The Wall Street Journal. This has left tax departments stretched to capacity, with organizations in need of a way to meet an increasing volume of work with fewer people. AI can help meet that need by amplifying the capabilities of existing resources and functioning as a new resource to help address staffing shortages.

It’s crucial to understand that AI isn’t a plug-and-play solution, but rather a technology that relies on data that is high quality, organized, accurate, and meaningful. By integrating AI gradually and effectively implementing automation technology, organizations and tax professionals can benefit from:

- Enhanced efficiency

- Optimized operating models

- Advanced data insights

- Improved talent acquisition and retention

AI’s Role as a Smart Assistant

AI is not a replacement for the knowledge and skill of tax professionals; it’s a supplement to the understanding and experience they already bring to their roles. Much like a calculator isn’t a replacement for an accountant, AI isn’t replacing tax professionals but is instead serving as a tool to augment the way they work.

AI within tax has a range of uses that can include checking documents for errors, identifying patterns of fraud, and highlighting regulatory noncompliance. But before it can perform any of those tasks, it requires the right data. For example, when provided with the same low-quality, unorganized data, a tax professional and an AI platform will both produce poor, ineffective outcomes. AI will just do it faster.

Conversely, with the right information to work from, AI offers a growing number of use cases within the tax function, including:

- Creating reports from raw data

- Generating summaries of existing reports

- Analyzing patterns within datasets

- Integrating with other technology and automation platforms

SHARE