BDO Health and Life Sciences Rx - 2019 Predictions

Shattering Silos is the Name of the Game

The health and life sciences supply chains are converging, and both industries are blurring together.

It’s a period of accelerated disruption, driven by a confluence of internal and external triggers: political and regulatory uncertainty, mounds of consumer data, evolving business models, industry consolidation, shifting global boundaries and healthcare consumerism giving rise to greater calls for transparency amid rising drug prices.

In response, we’ve seen a growing number of healthcare bankruptcies, and companies in both health and life sciences arenas are fighting for access to capital amid pressure to transform assets. Insurers will continue to expand Medicare Advantage plans, giving further boon to home health and treatments and devices that support improved outcomes.

To thrive in this environment, organizations must strive for Shared Care, Shared Value: breaking down silos to drive value across the health and life sciences ecosystem. Here are our predictions for how they’ll work toward ‘Shared Care, Shared Value’ in 2019.

Health

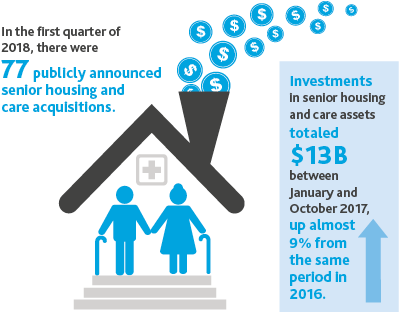

REITs will continue to pull away from the post-acute care space, making room for private equity to come in and inject much-needed capital to refocus and transform senior care assets.

The growing aging population is attracting PE with cross-portfolio capabilities to the post-acute care space, while bricks-and-mortar senior living facilities are failing to bring in returns for REITs.

.png)

Source: BDO PErspective In Healthcare

Life Sciences

.png) Life sciences companies will focus more on building government contracting and grant opportunities into their overall business strategy to maximize revenue and profitability.

Life sciences companies will focus more on building government contracting and grant opportunities into their overall business strategy to maximize revenue and profitability.

Companies like GE Healthcare are partnering with governments to open innovation centers that compliment and facilitate the commercialization and manufacturing capabilities of new technologies. The Swedish government has invested EUR 10 million in a GE Center to illustrate their dedication to increasing collaboration and capabilities between the public sector, business and research teams. Both are examples of the potential in public-private partnerships.

Health

Amazon, JPMorgan & Berkshire Hathaway will organize as a benefit corporation, prioritizing positive impact for employees and communities in its decision-making processes over profits.

Amazon, JPMorgan & Berkshire Hathaway will organize as a benefit corporation, prioritizing positive impact for employees and communities in its decision-making processes over profits.

Traditional corporate structures are legally obligated to prioritize shareholder returns over other obligations. Benefit corporations have modified obligations, committing them to higher standards of purpose, accountability and transparency.

Source: BDO/NEJM Catalyst January 2018 Survey

Life Sciences

We’ll see new R&D momentum in 2019, and Academic Medical Centers will balance their books with significant revenue sources from new discovery royalties.

We’ll see new R&D momentum in 2019, and Academic Medical Centers will balance their books with significant revenue sources from new discovery royalties.

Inspired by more than 25 patent expirations on the horizon, an FDA focused on encouraging competition, and a charge to break down silos to drive more improved outcomes and shared value, R&D innovation and growth will boom across the life sciences and health ecosystem.

The entrance of pioneering biotechnologies like cell therapy, gene therapy, microbiomes, and the potential impact of biosimilars should drive growth, further motivate deal-making and help find revolutionary treatments.

Health

A company will develop a crowd-funded health plan targeted entirely to rural communities with telemedicine and remote patient monitoring as the central focus.

A company will develop a crowd-funded health plan targeted entirely to rural communities with telemedicine and remote patient monitoring as the central focus.

Telemedicine reimbursement is expanding across the country, facilitating the move from care that is traditionally provided in the costly hospital setting to the home and mitigating access to care issues in rural communities.

“Clinician shortages and budget woes continue to plague rural communities forcing community hospitals to close their doors at faster rates than ever before. Improved access to patients through electronic telemedicine capabilities is one innovative way community providers can focus their services, reduce their financial burden and continue to provide crucial care to difficult-to-reach patients.” – Jim Watson, BDO

Sources: BDO’s Candid Conversations on Elder Care study, Rural Health Info

Life Sciences

Human and machine (AI) teams will begin to define the future of testing and analysis. Artificial intelligence is providing a paradigm shift toward personalized medicine.

Human and machine (AI) teams will begin to define the future of testing and analysis. Artificial intelligence is providing a paradigm shift toward personalized medicine.

AI can handle analytics, but lacks crucial human traits: communication and empathy. AI’s ability to interpret data and identify new opportunities for innovation can therefore be skewed. To balance predictive analytics with human characteristics to maintain a personalized treatment plan, hybrid human and AI teams will gain in popularity and become increasingly critical.

Health

Terminology like ‘Healthsumers,’ ‘Propayers,’ ‘Payviders’ and other hybrid words will become commonplace as vertical mergers become the norm and companies historically focused in the retail and beauty space begin rebranding to enter a healthcare market more focused on wellness and consumer convenience than ever before.

Terminology like ‘Healthsumers,’ ‘Propayers,’ ‘Payviders’ and other hybrid words will become commonplace as vertical mergers become the norm and companies historically focused in the retail and beauty space begin rebranding to enter a healthcare market more focused on wellness and consumer convenience than ever before.

Case in point: Weight Watchers recently rebranded as WW with the tagline ‘Wellness that works.’ The blurred health and life sciences ecosystem, driven by a need to improve health outcomes, will go beyond attracting new retail and beauty entrants, though. We’ll see several partnerships between retail and beauty companies and healthcare providers—offering new, more consumer-friendly incentives to get more proactive about health.

Life Sciences

Hong Kong will move to the forefront of the biotech scene on the heels of changes to its listing regime, which took effect on April 30, 2018. In a move to transform to compete, U.S.-listed biotechs will make moves to list on the market, unleashing a new innovation race and greater cross-border information sharing.

Hong Kong will move to the forefront of the biotech scene on the heels of changes to its listing regime, which took effect on April 30, 2018. In a move to transform to compete, U.S.-listed biotechs will make moves to list on the market, unleashing a new innovation race and greater cross-border information sharing.

As part of that innovation race, wearables will inspire and establish a ‘quality of life’ clinical trial metric, moving beyond traditional safety and efficacy metrics and bolstering empathy-centric elder care.

Considering that more and more companies are willing to share anonymized data and collaborate to more efficiently facilitate R&D of therapies, and with the growing popularity of wearable health devices, clinical trials may soon aggregate and leverage anonymized patient data to create and develop a ‘Quality of Life’ standard, in addition to safety and efficacy. But these developments will require greater levels of both clinical and financial due diligence from organizations to effectively manage risk.

Health

More healthcare organizations will turn to alternative sources as a means to raise capital.

Hospitals, public or private, stand-alone or members of a health system, need recurring capital sources to invest in or maintain technology requirements, facilities and clinical innovation. As lenders' credit requirements tightened in 2018, many not-for-profit hospitals either consolidated into multi-hospital systems or closed. We expect this trend to continue. Moreover, changing reimbursement measures and medical innovation are making securing adequate capital even more challenging for hospitals. Hospitals will need alternative sources of both capital and revenue to transform and be sustainable.

Life Sciences

A new wave of innovation in alternative therapies will be unleashed, spurred by the 2019 CMS IPPS Final Rule.

The rule, which took effect on Oct. 1, approved a new technology add-on payment for CAR-T cell therapy, paving the way for more next-generation treatments with CAR-T. Precision medicine will improve in the process.

.png)

SHARE