BDO Knows SPACs: Understanding Special Purpose Acquisition Companies

BDO is dedicated to helping both sponsors and target companies navigate going public through Special Purpose Acquisition Companies. In a series of articles, we’ll provide an introduction outlining the current SPAC market and discuss tax, accounting, and valuation considerations to keep in mind. You can find the full series on our Special Purpose Acquisition Companies Resources Page.

SPACs as an Express Track to IPO

Special Purpose Acquisition Companies, or SPACs, have seen a resurgence in popularity since becoming all but extinct after the 2007-2008 financial crisis. These publicly-traded companies are formed with the sole purpose of raising capital to acquire one or more unspecified businesses. The management team that forms the SPAC (the “sponsor”) forms the entity and funds the offering expenses in exchange for founder’s shares.

Although the COVID-19 pandemic has caused significant economic hardship for most, SPAC deals have accelerated at record-breaking pace. For investors, SPACs are low risk as they can recoup finances, and the potential for returns are higher than ever given the access to capital, low interest rates, and the ability to move quickly to close an acquisition. This provides target companies with the potential to grow exponentially despite the economic downturn as companies seek access to additional capital.

Why Choose a SPAC IPO?

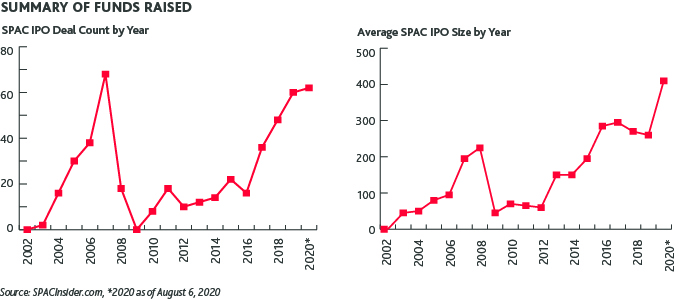

SPACs, underwritten by prominent backers such as Goldman Sachs, Credit Suisse, Deutsche Bank, and Citigroup, have solidified their legitimacy and raised over $10 billion a year since 2017, with $13.6 billion raised across 59 IPOs in 2019 according to SPACInsider.com. In 2020, SPACs are set to have their best year yet with $25.3 billion raised over 62 IPOs averaging the highest SPAC volume yet of $407.4 million – and that’s just through July. Additionally, with the success of the likes of Virgin Galactic, DraftKings, and Nikola going public through SPACs in recent years, we saw the highest funding in history with Pershing Square Tontine Holdings raising $4 billion.

The increase in SPAC IPOs can be linked to their advantages and benefits the structure has for investors, sponsors, and the operating companies that are ultimately acquired. As there is no significant operating history, SPAC financial statements in the IPO registration statement are less cumbersome and voluminous and can be prepared in a few weeks as compared to a few months as is common in a traditional IPO. Months of roadshows and marketing the SPAC IPO are not necessary since the primary purpose is to raise funds in order to acquire a private operating company. SPAC deals typically also require less debt than a private equity deal. Furthermore, initial investees often retain approximately 20% of the outstanding shares of the target, providing significant investment upside in the new combined company.

However, the SPAC IPO process along with the De-SPAC transaction are highly regulated and complex transactions that require experience and intensive preparation.

A typical SPAC offering security consists of a unit that is made up of one common share and a warrant component, with units typically priced at $10 each. The warrant offering is an incentive to attract investment due to the relatively short timeframe and additional risks associated with executing a successful De-SPAC transaction, however the all-time high demand in the SPAC space in mid-2020 resulted in the first ever SPAC IPO of common shares without warrants with Therapeutics Acquisition (TXAC). The warrant component offered is generally based on the availability of investment funds; higher availability of investors’ funds will lead to a smaller lower warrant offering per share, but sponsors typically increase the warrant component to ½ or a whole warrant when investment is low to match the risk profile in the market. Each whole warrant generally entitles the holder to purchase one common share at an exercise price above the value of the common stock at the time of issuance. The shares and warrants comprising each unit begin trading separately shortly after the offering, and holders can separate their units at that time.

The sponsor usually agrees to purchase a set amount of warrants (or, in some cases, units) in a private placement occurring simultaneously with the closing of the IPO, typically referred to as the sponsor’s at-risk amount – which is generally a very small percent of the SPAC’s capital. The proceeds of the IPO plus the sponsor’s at-risk amount are placed in a trust account, with a very small portion withheld for working capital. The funds held in the trust represent the amount available to fund an acquisition.

The De-SPAC Transaction

If an acquisition is approved by the shareholders and other conditions specified in the acquisition agreement are satisfied, the acquisition is consummated. This is otherwise known as the De-SPAC transaction. Generally, the funds in the trust account may not be released (except for permitted withdrawal of interest as required to pay any income or franchise taxes or other specified expenses) until the earlier of the completion of an initial De-SPAC transaction or the redemption of any shareholders who elect to not participate in the De-SPAC transaction.

Public shareholders generally have the right to redeem all or a portion of their shares in connection with the completion of an initial De-SPAC transaction. The redemption price is typically equal to the aggregate amount then on deposit in the SPAC’s trust account divided by the number of then-outstanding public shares. The warrants may generally be exercised at any time following the later of one year after the closing of the offering, or 30 days after the completion of an initial De-SPAC transaction.

SHARE