Board Composition Shows Progress, Not Parity

Much focus continues to be placed on board composition and how such fosters differing viewpoints and perspectives that may help propel a company forward. This summer, gender parity in the boardroom reached a new milestone. For the first time, all companies in the S&P 500 now include at least one female board member. The news was a significant step forward in leadership diversity at the largest U.S. companies, but with the S&P 500 representing only a small fraction of U.S. publicly-traded companies, there’s still work to be done. When looking at the Russell 3000, for example, women represent only 18% of corporate directors.

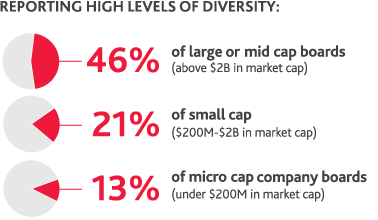

Marking notable but seemingly incomplete progress, two-thirds of directors (67%) report high or moderate levels of diversity on their board.

.png)

Board diversity has been directly linked to better company performance and shareholder return by McKinsey in numerous studies, and that is correlated to the board diversity breakouts reported by company size.

Boards are also increasingly transparent and proactive about their composition. This year, 46% of directors report conducting diversity reviews as a board refreshment tool, up from 33% in 2018. In addition, following the SEC’s move to encourage expanded disclosure related to board policies and application of self-identified diversity characteristics considered in the appointment of directors, 34% of directors currently include diversity disclosures in their proxy and SEC filings.

“The progress made on this initiative in the past five years alone gives us reason to uphold a positive outlook toward the future of board diversity. But there is still much to be done. While concrete steps like diversity reviews may help push the needle in the right direction, true gender parity in the boardroom will never be possible without challenging traditional thinking and breaking down the barriers that limit boardroom opportunities for the troves of capable female executives in the workforce.”

AMY ROJIK

AMY ROJIKBDO USA’s National Assurance Partner - Communications and Governance, writes in Corporate Compliance Insights

As organizations assess whether their board has the needed diversity of perspective and experience, board refreshment strategies are critical. Two-thirds of companies report conducting skill set reviews to ensure the board includes a variety of relevant expertise and experience. Another 24% report that they have expanded the size of their board, which allows for new talent to emerge without disrupting or removing current contributing members. Fewer directors (16%) indicate the use of tenure limits as a strategy, likely driven by the fact that the majority of seasoned directors with deep industry and business knowledge continue to remain viable contributors to corporate governance.

Organizations have also been focused on the problem of “overboarding” in the past several years. If board members are serving too many companies, their ability to focus and prioritize any one board role is challenging. Roughly one-third of directors (30%) say their company places limits on the number of boards upon which a director can serve, up from 27% in 2018. These guidelines appear to be promoting change effectively, as only 37% of directors report serving on two or more boards.

As directors approach 2020, they are readying companies to prepare for new risks, address current opportunities and find success in the new decade. The demands for corporate stewardship are growing every day, but directors’ guidance, oversight and foresight will help companies find stability through turbulence.

SHARE