Lease Accounting for the Retail and Restaurant Industries

By accessing the FASB documents on this site, you accept and agree to these FASB terms and the website terms as applied to your use of this site or any FASB licensed documents.

Lease Accounting Under ASC 842 - An Industry Supplement to a BDO Blueprint

Leasing is a significant activity for most retail and restaurant companies. Retailers and restaurants often lease their store locations and equipment. Retailers and restauranters can obtain the right to use those assets under lease contracts or in service arrangements that contain embedded leases. With ASC 842, Leases, now effective for all companies, retailers and restauranters must determine whether those contracts are or contain leases and if so, record leases on their balance sheets.

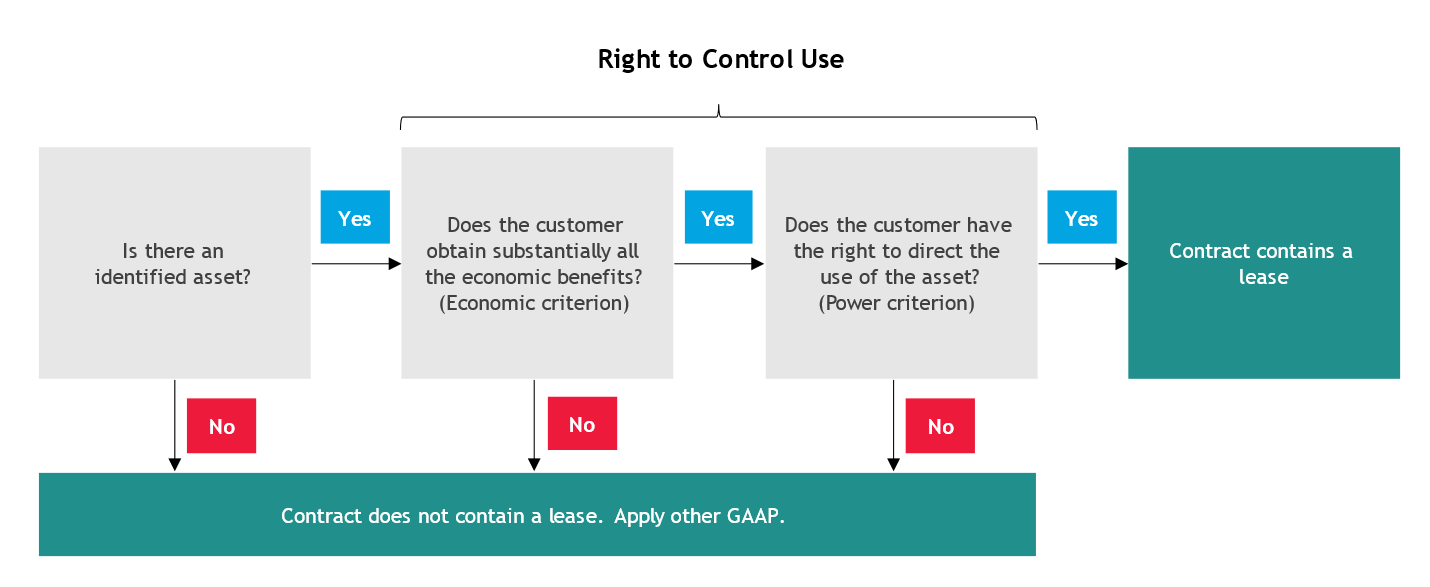

The definition of a lease focuses on three criteria as described in the following flowchart:

The recognition of a lease in the financial statements is not a “set it and forget it” exercise after the commencement date of a lease. Business decisions and other events may affect the accounting for existing leases in various ways. For example, the entity could be required to remeasure the lease on balance sheet, test the asset (asset group) for impairment and potentially recognize impairment losses, or shorten the useful life of a right of use asset .

Lastly, retailers and restauranters must track specific information about their leases, existing or new, to prepare lease disclosures.

This publication discusses the ASC 842 provisions most applicable to companies in the retail and restaurant sectors, primarily from a lessee’s perspective.

We encourage you to read the interpretations and examples in this publication, along with our Blueprint: Lease Accounting Under ASC 842. Find additional information on the accounting for leases under International Financial Reporting Standards (IFRS).

SHARE