Regulatory Compliance Continues as a Top Challenge

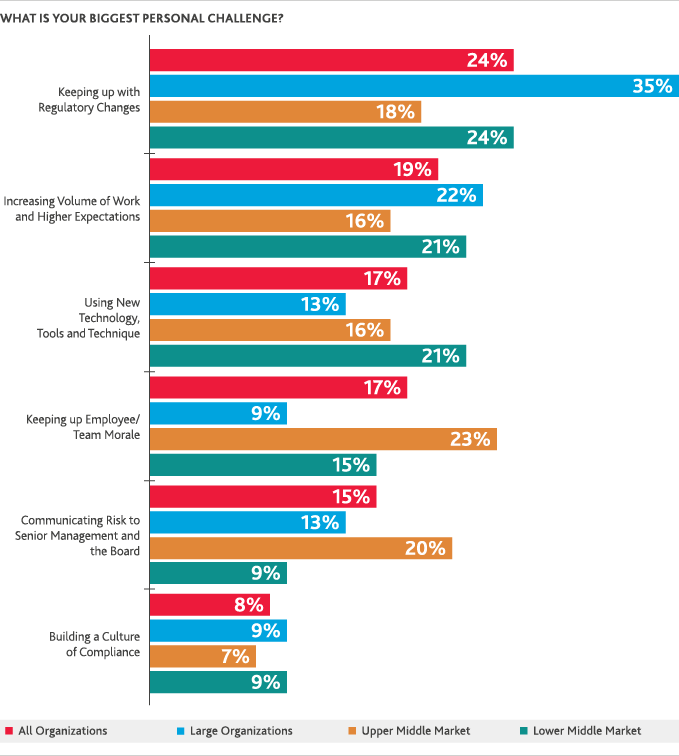

Last year saw a flurry of global and domestic regulatory activity, and this year won’t be different. Given the volume and complexity of these laws, keeping up with regulatory changes is corporate counsel’s top personal challenge (24 percent), a figure that rises among general counsel and chief legal officers (38 percent) and large organizations (35 percent).

Organizations in heavily regulated industries, such as financial services, healthcare, life sciences, and energy face a particular burden. In addition to having to actively monitor news from federal, state and local legislators and regulatory agencies, general counsel in these industries have to be attuned to trends that could produce potential regulatory changes down the road.

The consequences of noncompliance are serious—ranging from lawsuits and fines to business dissolution.

.png)

3 C’s of a Successful Compliance Program

|

Customize Your Program |

|

Cultivate a Culture of Compliance |

|

Constantly Re-assess |

SHARE