Today’s Business Imperative: Shared & Sustainable Value Creation

For many years, sustainability was little more than a footnote in corporate strategies—written on paper, but disconnected and low on the priority list. Yet the case for sustainable business was steadily building, underpinned by the belief that how companies manage environmental, social and governance (ESG) issues influences long-term resilience, reputation and ROI. Visionary leaders began integrating ESG considerations into their decision-making calculus in earnest, setting a new standard for ethical and responsible business. The nexus of inequality and climate crisis, alongside mounting public pressure for businesses to be part of the solution, upped the ante.

Sustainable transformation as a strategic imperative is the culmination of years of change and a confluence of trends:

- COVID-19 exacerbated many existing inequalities, widened the wealth gap and pushed more people into extreme poverty.

- The tragic deaths of George Floyd, Breonna Taylor and other Black Americans sparked a movement that changed the conversation on race in corporate America.

- Employee activism is on the rise, taking shape in the form of everything from walkouts to unionization to jumping ship as part of the ‘great resignation.’

- Investors are pouring money into sustainable funds and green bonds as the connection between financial performance and societal and environmental impact grows clearer.

- A dramatic increase in appetite among private equity funds for sustainability linked loans has spurred new opportunity for lenders and borrowers alike to benefit from stronger values-based relationships with the investment community

- A new breed of sustainability-oriented shareholder activists is focusing on environmental, social and corporate governance failures.

- The observable effects of climate change paint a grim picture of the future of our planet, and the fault lies at our feet: The scathing Sixth Assessment Report by the U.N. Intergovernmental Panel on Climate Change states that humans are "unequivocally" to blame for global warming.

Together, these changes have wrought a paradigm shift in the purpose of business: a reckoning of the systemic weaknesses in the current economic system, and recognition that businesses have a vital role to play in mitigating them. Organizations of all sizes are stepping up to do their part to operate within the limits of the world’s ecosystem and contribute to the betterment of society, the protection of the planet, the transparency of business, and the prosperity of the economy. But this isn’t just a responsibility; it’s an opportunity to do things a better way—to build a stronger and more resilient organization. Businesses built to last will be built sustainably.

What is a sustainable business?

Sustainable businesses prioritize long-term stability over short-term financial reward – focusing on creating long-term value for all company stakeholders and seeking to eliminate business practices that harm people or planet or compromise the needs of future generations. They continually evaluate where their business intersects with economic, environmental and social issues and aim to both mitigate risk and improve performance in those areas where they have the most ESG impact. By focusing on and reducing ESG-related risks and integrating impact into the innovation pipeline, sustainable businesses build the resilience to weather times of crisis and generate more return over longer time horizons.

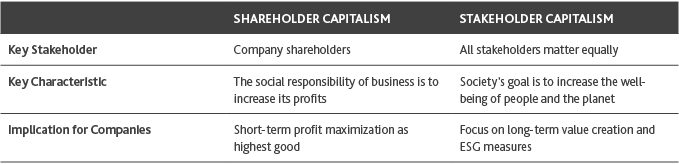

The New System of Stakeholder Capitalism

In 1971, Chicago University economist Milton Friedman published an essay asserting that the sole responsibility of a business is to its shareholders. For nearly five decades, his shareholder value theory remained the prevailing view of the purpose of a business. Only in the last few years has stakeholder capitalism – the notion that businesses must address the needs of all constituents – begun to overtake Friedman’s doctrine as the preeminent management theory. Stakeholder capitalism, however, is not a new concept. It was a common approach in the 1950s and 1960s until Friedman’s ideology supplanted it.

Adapted from the visualization by Peter Vanham, World Economic Forum

Adapted from the visualization by Peter Vanham, World Economic Forum

August 19, 2019 marked the official herald of stakeholder capitalism’s revival. The Business Roundtable (BRT), an association of CEOs at some of America’s leading companies, issued a statement that redefined the purpose of a corporation as “a fundamental commitment” to deliver value to all stakeholders “for the future success of our companies, our communities and our country.” Signed by nearly 200 CEOs, it formally rejected the principles of shareholders as the dominant priority primacy that had been codified in its Principles of Corporate Governance since 1997.

It’s a powerful sentiment, a higher purpose that elevates business as a force for good. The goal isn’t to end capitalism but to create a more equitable and inclusive version of it—a “conscious capitalism” that considers interdependencies in serving all stakeholders.

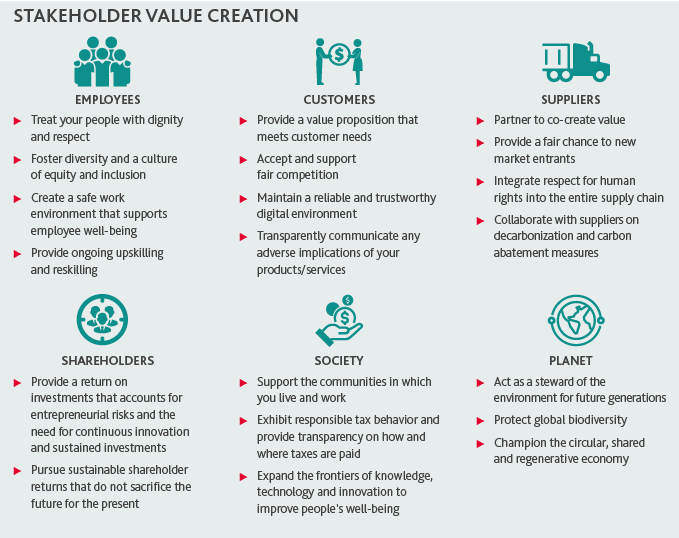

Stakeholder capitalism recognizes the broader role companies play in a capitalist system and cautions against a myopic, short-term view. If it feels difficult, that’s because it is. Businesses need to have a clear understanding of the systems in which they operate and assess the ripple effects of their actions across the global economy. Growth should not be achieved through measures that exacerbate systemic issues. The interests of all stakeholders must be factored into any decision that affects them. Value should be collectively defined through stakeholder engagement and consensus. And outcomes are best realized by committing to concrete sustainability goals and instituting mechanisms for accountability.

Adapted from the Davos Manifesto 2020

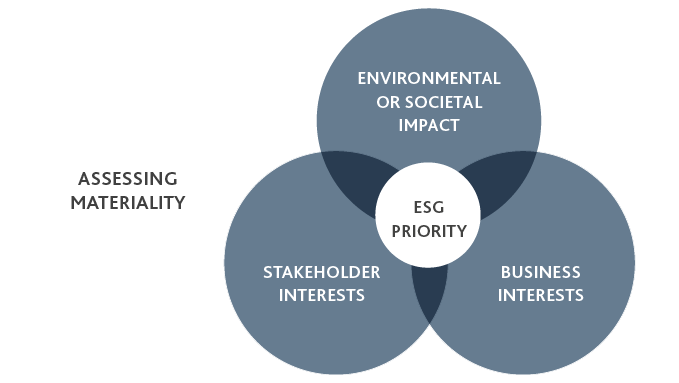

That’s where ESG comes in. ESG is the “system of accountability” that takes stakeholder capitalism from principle to action. ESG factors provide a framework for prioritization and measurement of non-financial business impact. The universe of ESG issues is vast and varied, so an assessment of material risks and opportunities helps companies concentrate on those that are most important to their stakeholders and most strategically and financially relevant to the business. Once ESG issues have been prioritized in order of materiality, a strategy can be developed to address gaps and capitalize on value creation opportunities.

Disclosure Requirements and the ESG Framework Frenzy

Like financial metrics, ESG metrics are intended to hold businesses accountable to their stakeholders on sustainability matters. Over the past few years, demand from investors and other stakeholders for more consistent corporate disclosures on ESG factors--climate impact and human capital, in particular—is rapidly growing.

However, when it comes to ESG reporting, the challenge is the lack of standardization. Today there are approximately a dozen “major” measurement and reporting frameworks and standards, as well as over a thousand ESG reporting requirements around the world. Efforts to harmonize the frameworks are underway, with standardization anticipated within the next two to three years, if not sooner. The IFRS Foundation recently created the International Sustainability Standards Board which will produce a comprehensive sustainability reporting framework. National and supranational regulators aren’t waiting on standardization to address perceived disclosure gaps or take enforcement action. In the U.S., the Biden administration and the SEC have made that abundantly clear with the formation of the new Climate and ESG Task Force, with disclosure rules likely to follow. And in the EU, regulators are also moving quickly, adopting the EU Taxonomy and putting into force the new Corporate Sustainability Reporting Directive (CSRD), which will require nearly 50,000 EU public and private companies that meet certain size criteria to report on their climate and environmental impact beginning in 2023.

In the U.S., and across the globe, companies can expect more rules, and greater scrutiny going forward. And while framework adoption isn’t mandatory in this country yet, releasing sustainability reports—a common practice among public companies—is already becoming a baseline best practice in response to stakeholder and societal pressure. Companies that don’t report on sustainability will soon find themselves in the minority.

While sustainability reporting may alleviate stakeholder concerns regarding transparency, measurement shouldn’t be conflated with momentum. It’s the strategy behind the reporting that will ultimately lead to meaningful performance improvements. Communication of sustainability commitments may temporarily bolster share price, but a recent study shows that failure to show demonstrable progress can negatively impact valuation.

Great Expectations

Adoption of ESG strategy may begin as a reactive response to regulatory, investor, employee or other stakeholder pressures, but that shouldn’t be where it ends. To reorient business strategy from shareholder to stakeholder and from short-termism to long-term value creation, organizations need to tackle the following primary actions:

In a future where businesses are accountable to all stakeholders, the most successful businesses will be those that aim to generate positive impact for the world at large by harmonizing people, planet, purpose and performance, and optimize value and benefits for all stakeholders.

Is your business ready for the ESG imperative? Talk to one of our ESG leaders.

SHARE