Correct reporting of units can have significant impacts on various HUD compliance and financial reporting. It can also affect the amount of fee revenue that the central office cost center (COCC) earns. Public Housing occupied units, HUD approved vacant units, and special use units must be reported correctly to maximize public housing operating subsidy, fee revenue to the COCC, and maximization of the Management Assessment Subsystem indicator and the Capital Fund indicator of the Public Housing Assessment System (PHAS). Furthermore, reporting units correctly in the Voucher Management System (VMS) will maximize the administrative fees for the Section 8 programs and allow the COCC to earn more fees from the Section 8 programs.

A PHA should begin with the correct reporting of units in the Public & Indian Housing Information Center (PIC). Section 5.4 of PIH Notice 2024-3 provides the latest guidance on the types of unit reporting that can affect funding levels and their performance scores in PHAs and what a PHA must do in PIC to ensure units are reported accurately.

Let us begin with Public Housing and how unit reporting can affect operating subsidy, PHAs, and fee revenue to the COCC. HUD Form 52723 is completed each year, for each Asset Management Project (AMP) to receive operating subsidy. HUD Form 52723 will be pre-populated with data that was submitted in PIC by the PHA. The PHA will be funded based on the number of eligible unit months, which primarily consist of occupied units, HUD approved vacancies, and certain special use unit. If these units are not reported correctly in PIC, then the PHA will lose subsidy for these unit months that is rightfully due to them.

HUD approved vacant units include:

- Undergoing modernization

- Court litigation

- Natural disasters

- Casualty loss

- Market conditions

Special use units include:

- Resident services

- Resident organization offices

- Self-sufficiency

- Anti-crime

PHAs currently consists of four indicators:

- Physical Assessment Subsystem (PASS)

- Financial Assessment Subsystem (FASS)

- Management Assessment Subsystem (MASS)

- Capital Fund Subsystem (CFP)

Each indicator has a series of sub-indicators. Included in the MASS and CFP indicator is an occupancy sub-indicator. Both sub-indicators for occupancy are calculated differently. The occupancy sub-indicators represent over 21% of the possible score of 100 points of PHAs, so it is critical to report unit status correctly. The occupancy sub-indicator for MASS is calculated from the Financial Data Schedule (FDS) and this information is self-reported by the PHA and does not come from PIC. This sub-indicator measures the occupancy for the PHA’s fiscal year, for each AMP, adjusted for HUD approved vacancies. Therefore, if the PHA is not reporting correct information on the FDS for occupied and HUD approved vacant unit months, then the PHA can lose points. It is typical to see several PHAs not reduce unit months available by the number HUD approved vacancies, thus reducing the score for MASS indicator and the overall PHAs score. Although this is self-reported by the PHA, the auditors will verify the calculations and leasing activity for occupancy and HUD approved units. HUD has starting cross referencing fees charged with leasing activity reported on the FDS to PIC.

Unit Months Leased

(Unit Months Available – HUD Approved Vacant Unit Months)

The occupancy sub-indicator for CFP is calculated differently. This sub-indicator measures the PHA's occupancy rate as of the end of the PHA's fiscal year. This sub-indicator score is calculated from only the last PIC submission for, the PHA’s fiscal year. The PHA needs to be strategic when submitting the last PIC submission since they have 60 calendar days from the effective date of any action recorded on line 2b of HUD Form 50058 (including MTW agencies). For example, a PHA is a December year-end, and the PHA had lots of move outs from the AMPs in December and occupancy dropped. If the PHA did a submission in in November with higher occupancy levels for the AMPs, then the PHA does not have to submit PIC in December because it would lower their score as long as it the PHA is in the 60-day window. This formula is different from the MASS occupancy sub-indicator that the PHA does not get the benefit of the HUD approved vacant units counts against the PHA for this indicator. This indicator is equivalent to HUD’s Agency Priority Reporting Goal.

The formula is:

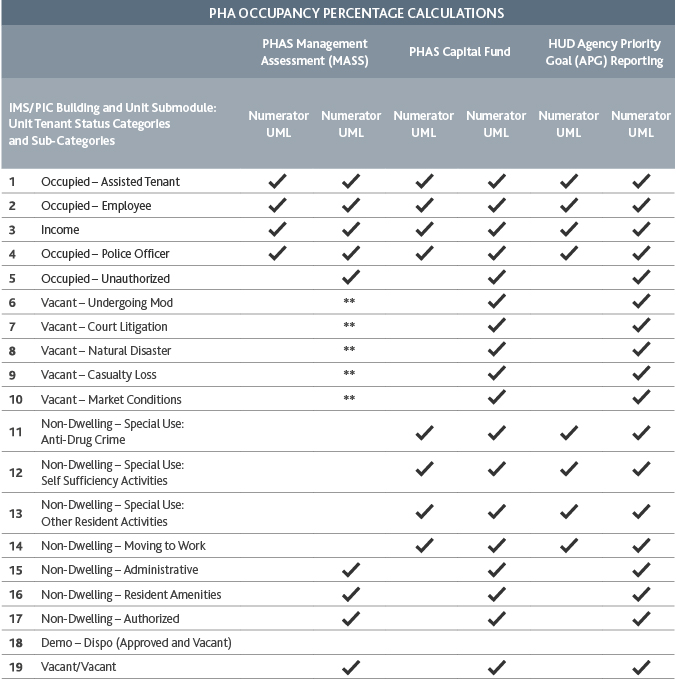

The chart below reports the difference between the MASS and CFP indicator calculations:

The COCC will charge management fees to the AMPs, Section 8, and other programs to offset expenses. The fees charged to the AMPs include a management fee, bookkeeping fee, and asset management fee. The management fee is published each year based on geographic location of the PHA and the bookkeeping fee has been $7.50 since the inception of asset management (2007). The calculation for both the management and bookkeeping fee is based on units leased and HUD approved vacant units each month either on the first day of the month or the last day of the month multiplied by the fee amount. The PHA must be consistent with the day of the month for the entire fiscal year. The asset management fee is based on unit months available. The fee amount has been $10 since per unit month available since the inception of asset management. The fee is payable to the COCC if the AMPs have Excess Cash from their prior fiscal year. Excess Cash is a HUD formula and be found in Chapter 6 of HUD’s Financial Management Handbook 7475.1, rev. The fees charged to Section 8 from the COCC include a management fee and bookkeeping fee. The management fee is the higher of $12 per unit leased as of the first of the month or 20% of administrative fees received. The bookkeeping fee is $7.50 per unit leased as of the first of the month. Although this is self-reported by the PHA, the auditors will verify the calculations and leasing activity for occupancy and HUD approved units. HUD has started cross checking fees charged with leasing activity reported on the FDS with PIC. The auditor should be checking as well.

To ensure a PHA is receiving the correct administrative fee revenue to the Section 8 program, the reporting of units leased as of the first of the month in VMS is critical as well as maximizing their SEMAP Lease Up indicator. Even though this is self-reported by the PHA, the auditors and HUD will verify the units leased as of the first of the month.

A PHA can be viewed as a real estate management and development company. They are also owners of real estate. Their niche is low-income, elderly and disabled individuals. As discussed, unit reporting is very important for funding and compliance purposes. Decreased occupancy raises concerns for HUD as it tends to lead toward insolvency and low PHAS scores. Receiving the correct amount of subsidy, having the COCC charge the correct fees, and proper reporting of units will help a PHA succeed financially and maintain compliance with HUD.

Contact us today to talk about the importance of correct unit reporting for your PHA. BDO’s Public Housing & Affordable Housing practice has served over four hundred housing organizations and is a premier provider of industry education to staff, executives, and HUD employees.

For more information on our service offerings, visit BDO Public Housing & Affordable Housing.