Biotechs Take a Cautious Step Back into the Market

Introduction

Post-pandemic economic conditions have left biotech initial public offering (IPO) activity in the lurch, but there are signs of a return, with eight IPOs in the first quarter of 2024 alone compared to 19 in the whole of 2023.

Over the past year, many companies have been waiting out less-than-ideal financial positions for an opportunity to go public. High interest rates have encouraged investors to focus on their current portfolios rather than seek out new prospects. As a result, many venture capitalists (VCs) have shifted from large fundraising awards to smaller but more frequent funding offers. Still, these funds are not awarded often enough to make up for the large funding amounts many biotechs were used to in years past. Because of this new fundraising pace, many companies found that they had spent down their cash reserves before they were able to raise enough capital to keep up with the pace of spending. Now that the market is thawing, companies that have had strong clinical trial data, but may have struggled to raise private funds, may have the opportunity to go public. As some companies begin to take a cautious step back into the market, their success may encourage more biotechs to go public in the latter half of 2024.

A Rebalancing of the NASDAQ Biotech Index

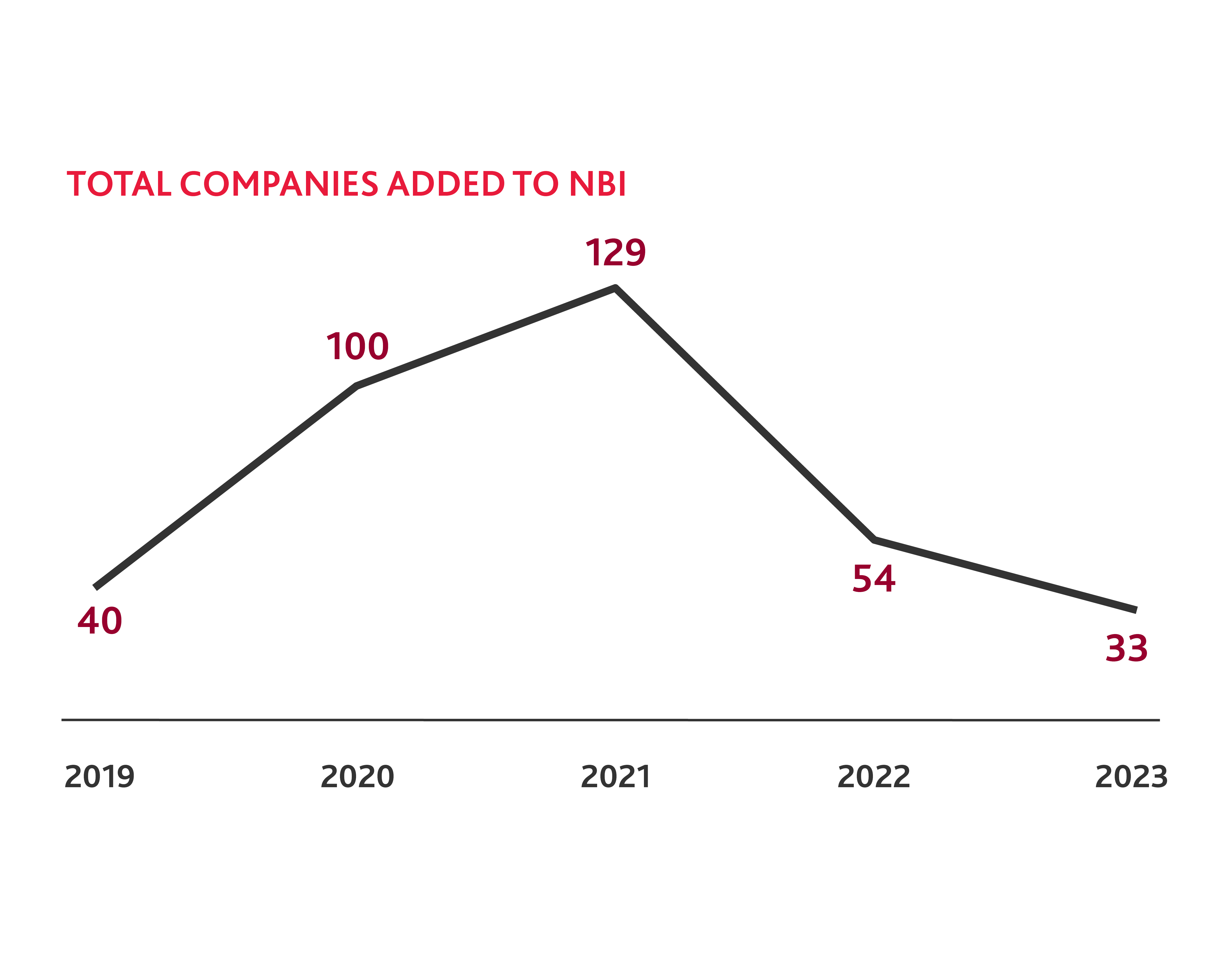

Last year, only 33 new companies were added to the NBI, four times fewer than the 129 companies added in 2021. Additionally, 82 companies were removed from the index either because they were acquired or merged (14 companies) or they failed to meet the eligibility requirements for the index, which include having a minimum market capitalization of $200 million and an average daily trading volume of 100,000 shares. While hundreds of new companies, many pre-clinical, went public in 2021 and 2022, some lacked the resilience to endure a low-funding environment and subsequently went bankrupt. Others experienced disappointing readouts following their clinical trials and underwent layoffs or other cost-cutting measures. Others may not have met marketcap requirements because they were spending money to advance their research and trials without an increase in valuation, as they remain pre-revenue. The result is a new equilibrium for the NBI.

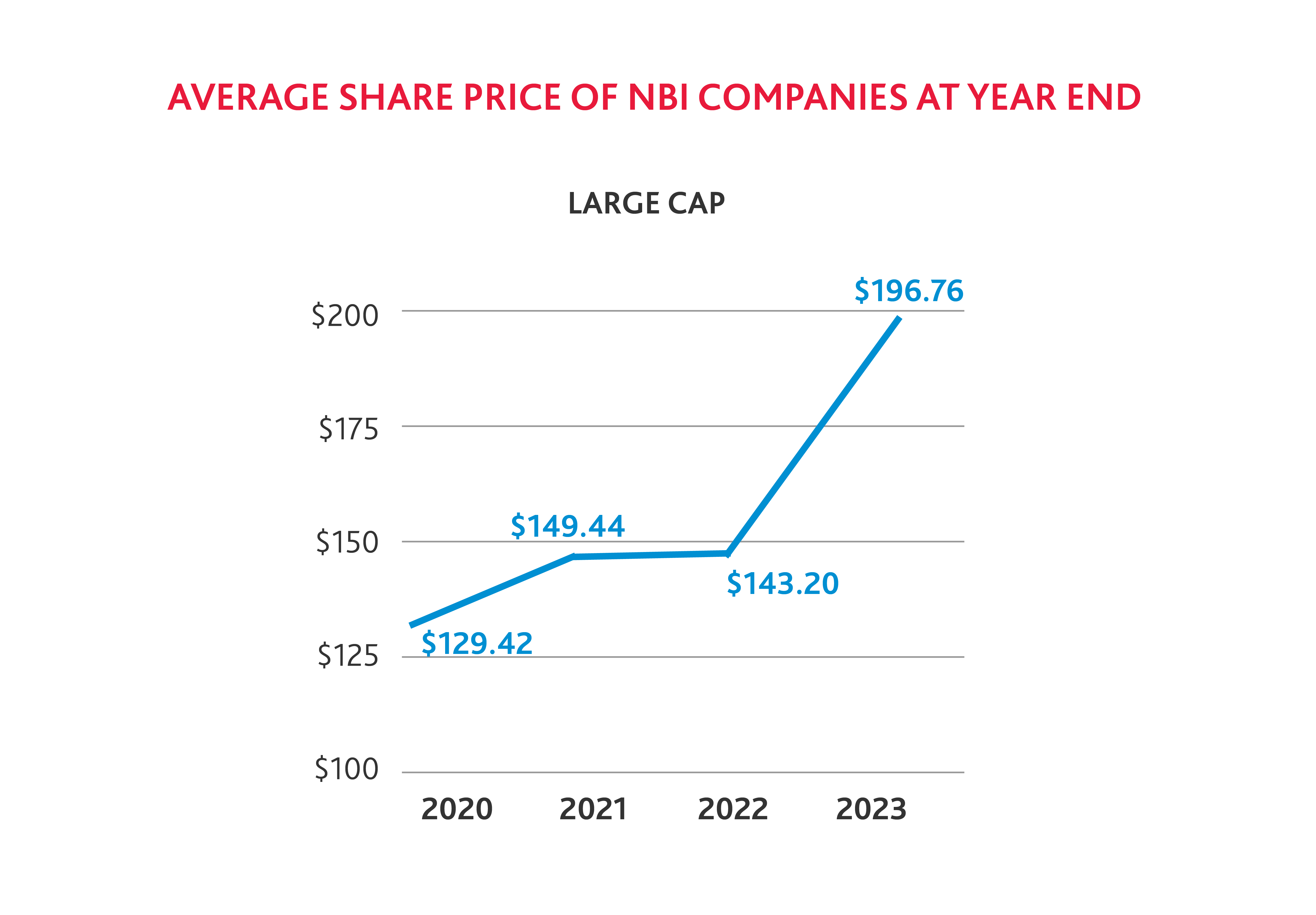

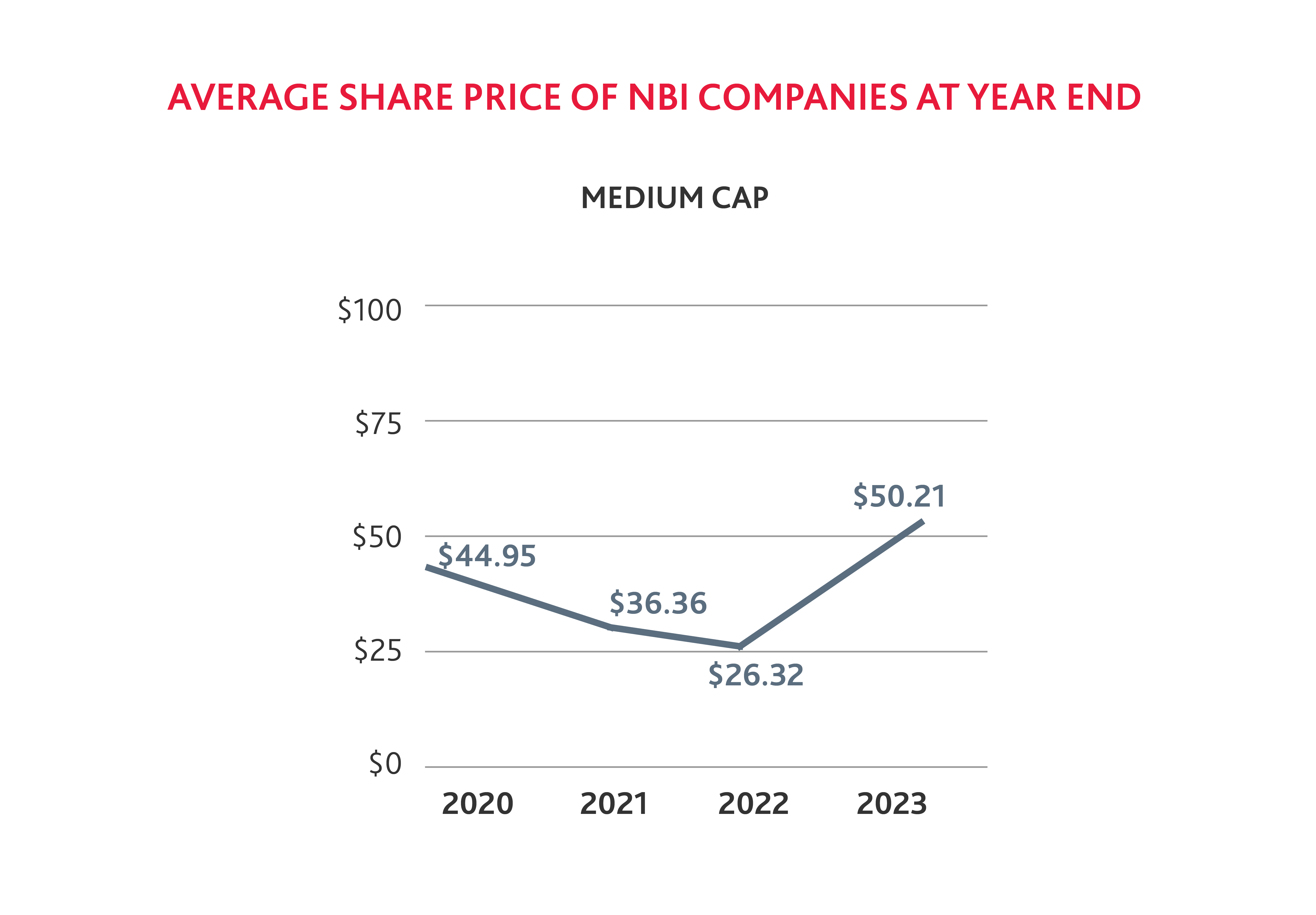

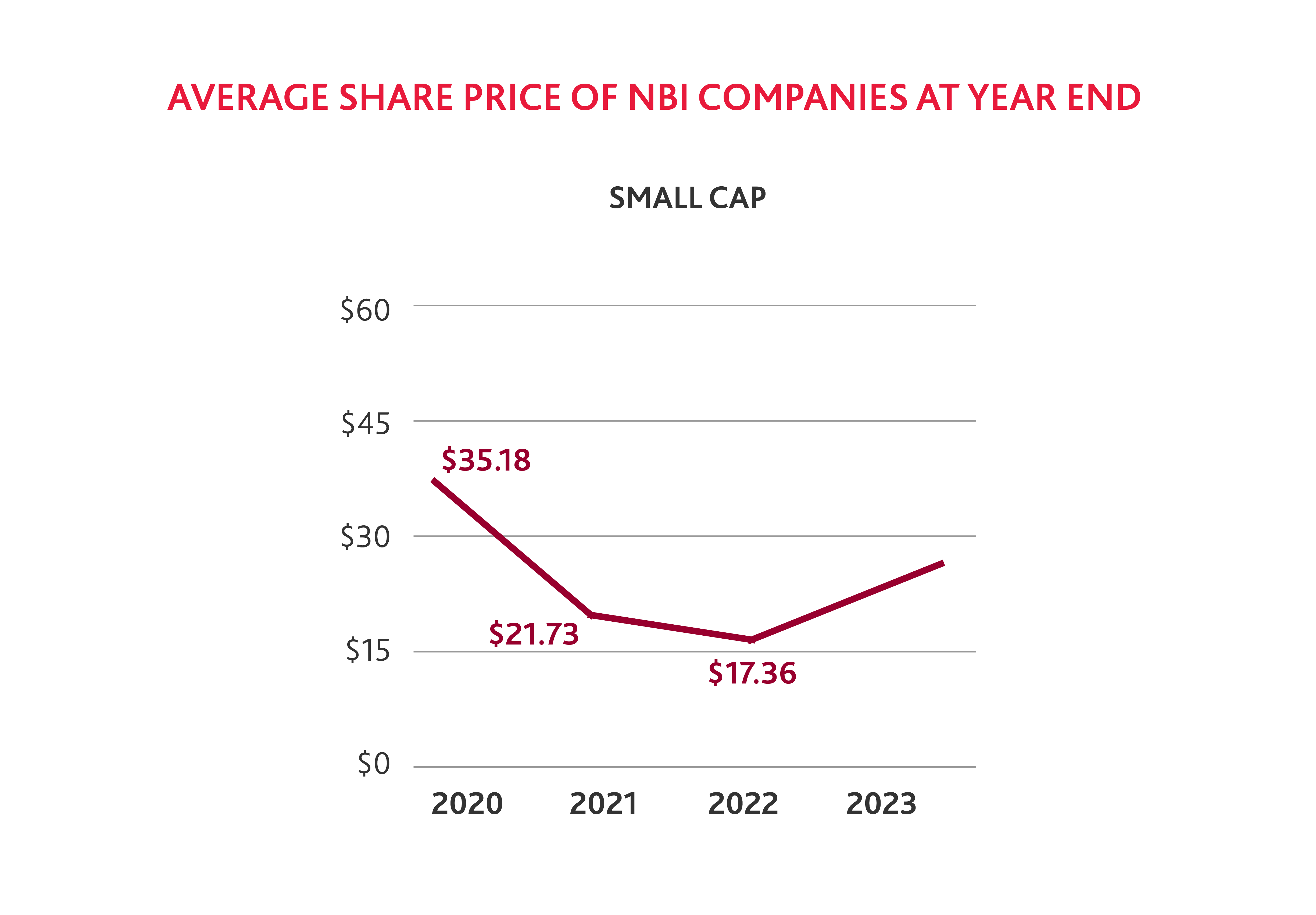

It is not surprising that fewer biotech companies were added to the NBI in 2023, as the average share price of small and medium biotechs has declined from 2020 to 2022. But stock prices across small, medium, and large cap companies saw a notable increase by the end of 2023 compared to 2022, which suggests that the industry is rebounding.

Slower Biotech IPO Activity in 2023

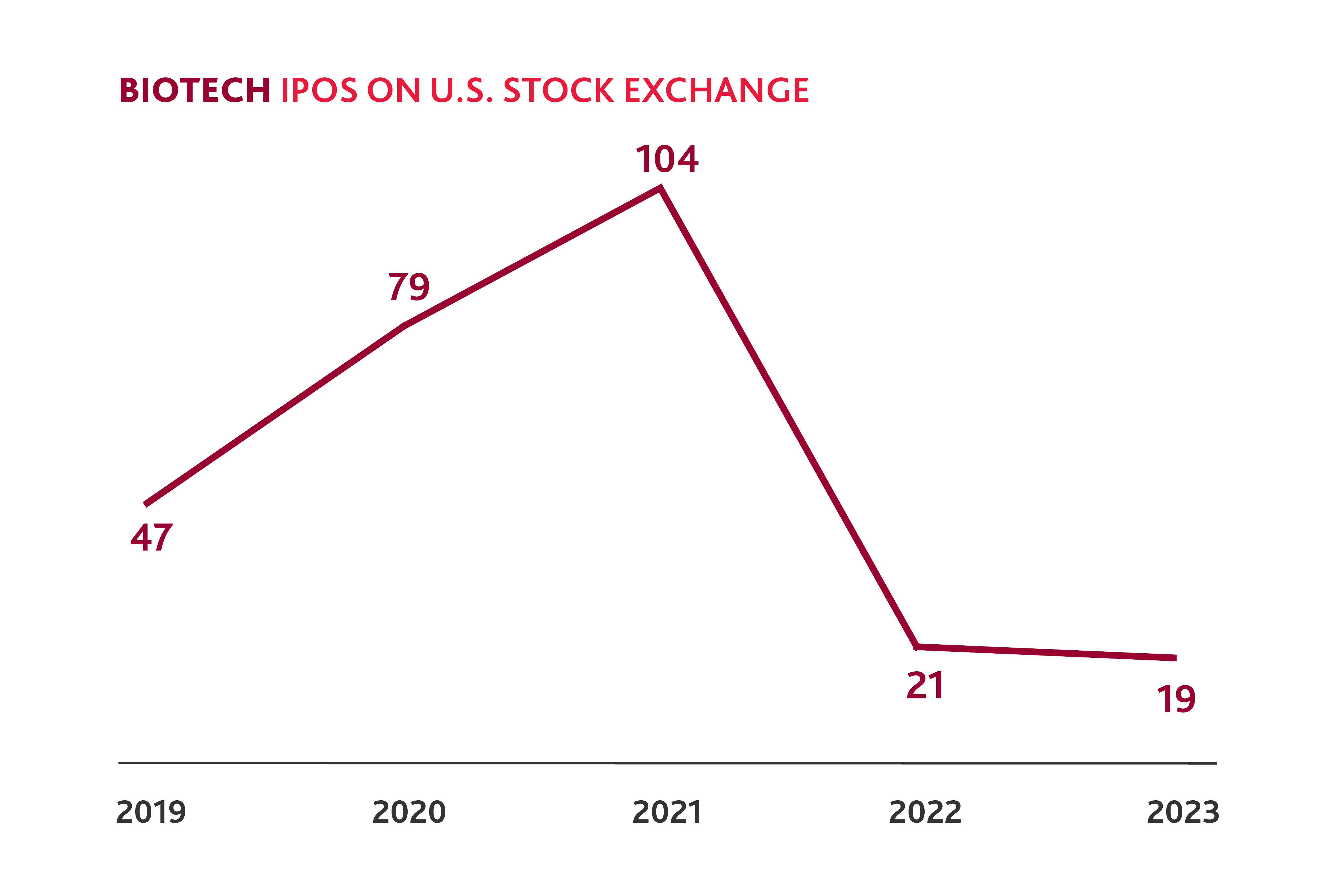

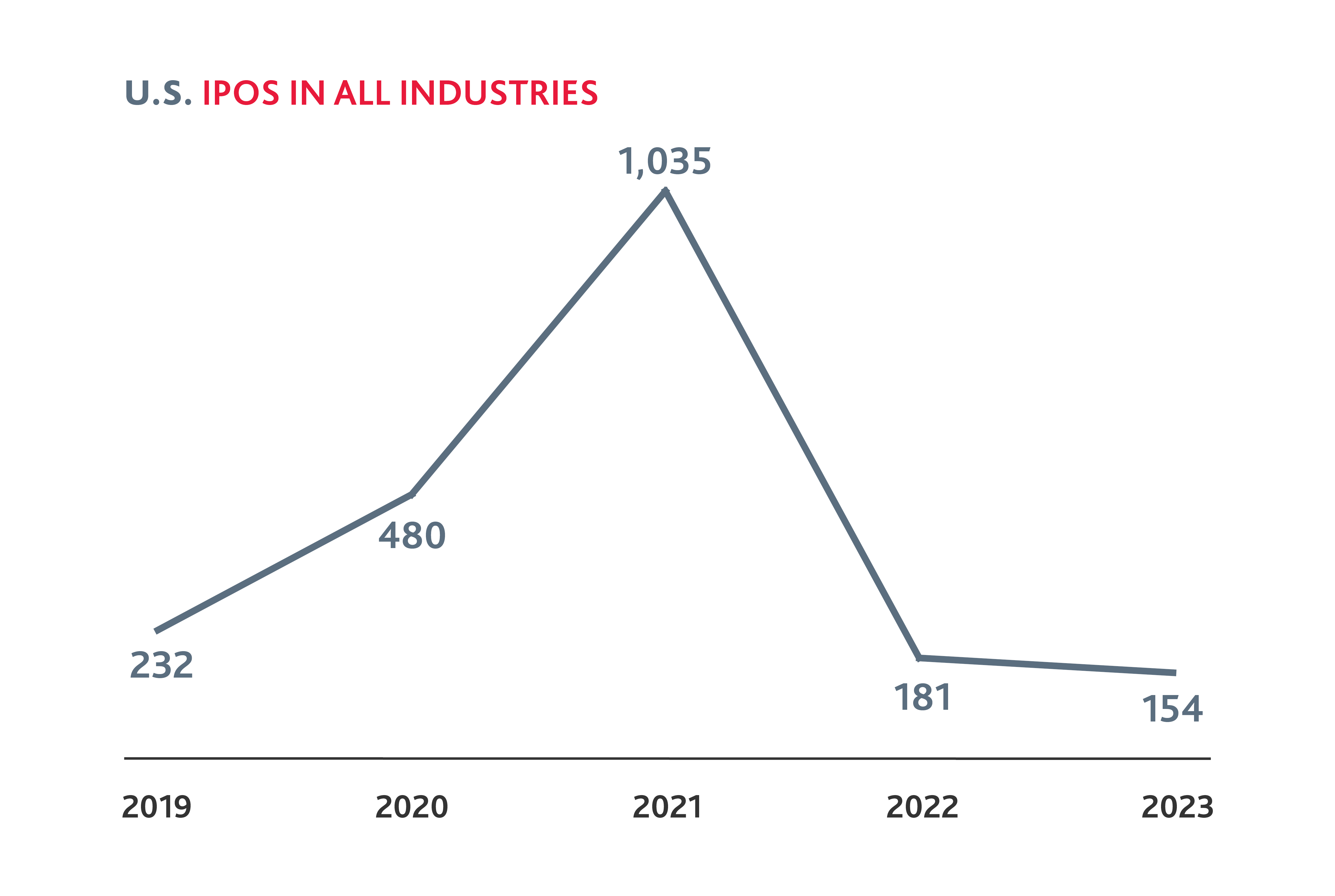

After a spike in 2021, biotech IPOs fell to levels less than half that of 2019 in both 2022 and 2023.

And yet, in the first quarter of 2024, eight biotech companies have gone public — almost half of the total number of biotech IPOs in 2023 — which could signal pent-up demand following the preceding IPO lull. For the companies that have strong clinical trial data, there may now be a window to go public, as investors are looking for opportunities to invest in the public markets. Other companies may be able to leverage this momentum to attract new private funding and consider if and when a public offering may be right for them.

However, biotechs will need to plan carefully when pursuing an IPO in the future. Companies should not try to “time the market,” but rather should pursue an IPO when the organization is ready, a process which takes 1-2 years. Learn more in our Guide to Going Public.

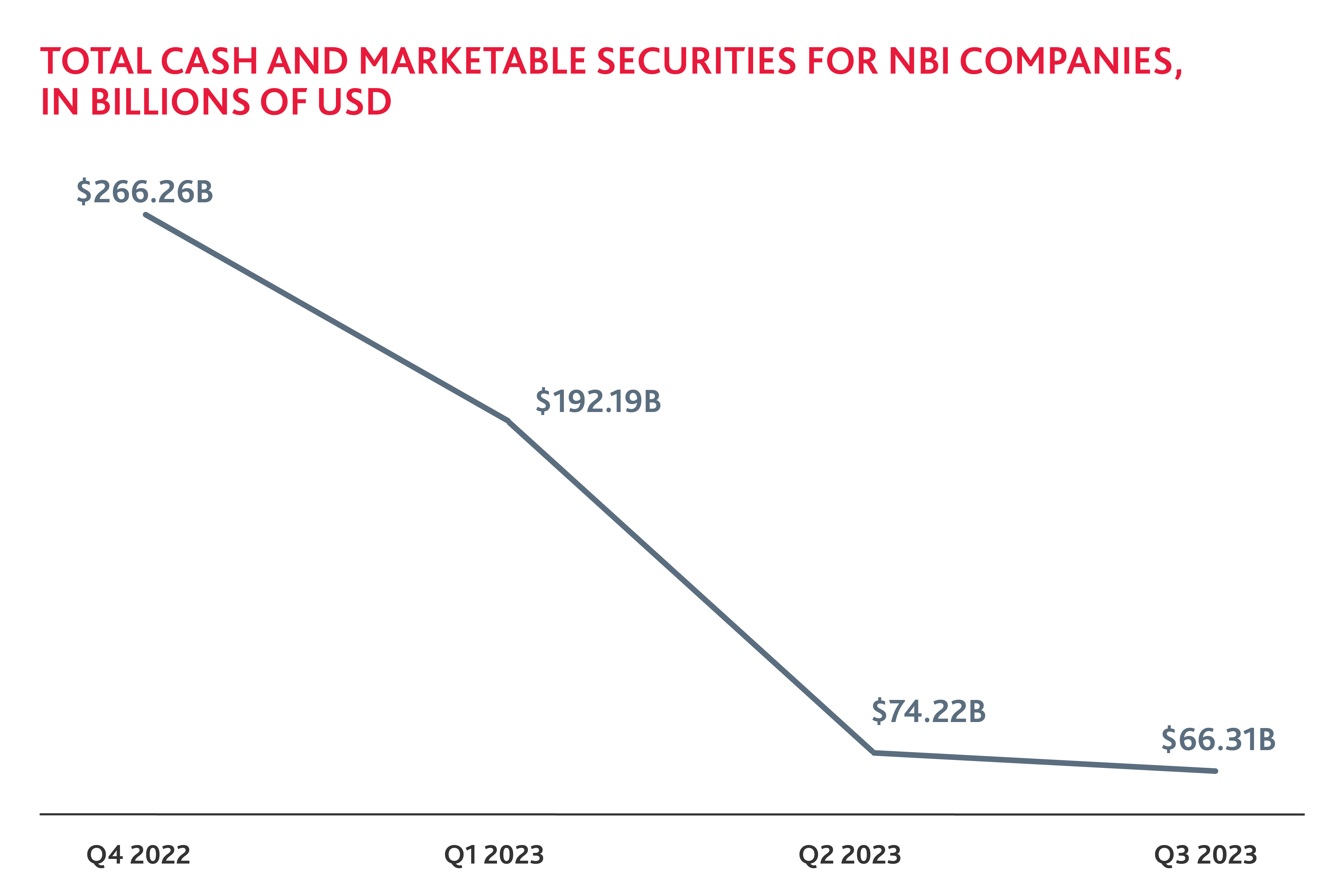

Cash Declines in a Challenging Financial Environment

Biotech companies saw a significant decline in company cash and marketable securities in 2023. Companies have spent their cash reserves over the past year to fund research and development and drive value but have struggled to raise funds to refill their coffers. With the market reopening and anticipation that the Federal Reserve will lower interest rates later this year, there is hope that more cash will be available in 2024, along with venture capital investment. Additionally, investor confidence may increase as more companies successfully go public, encouraging further investment.

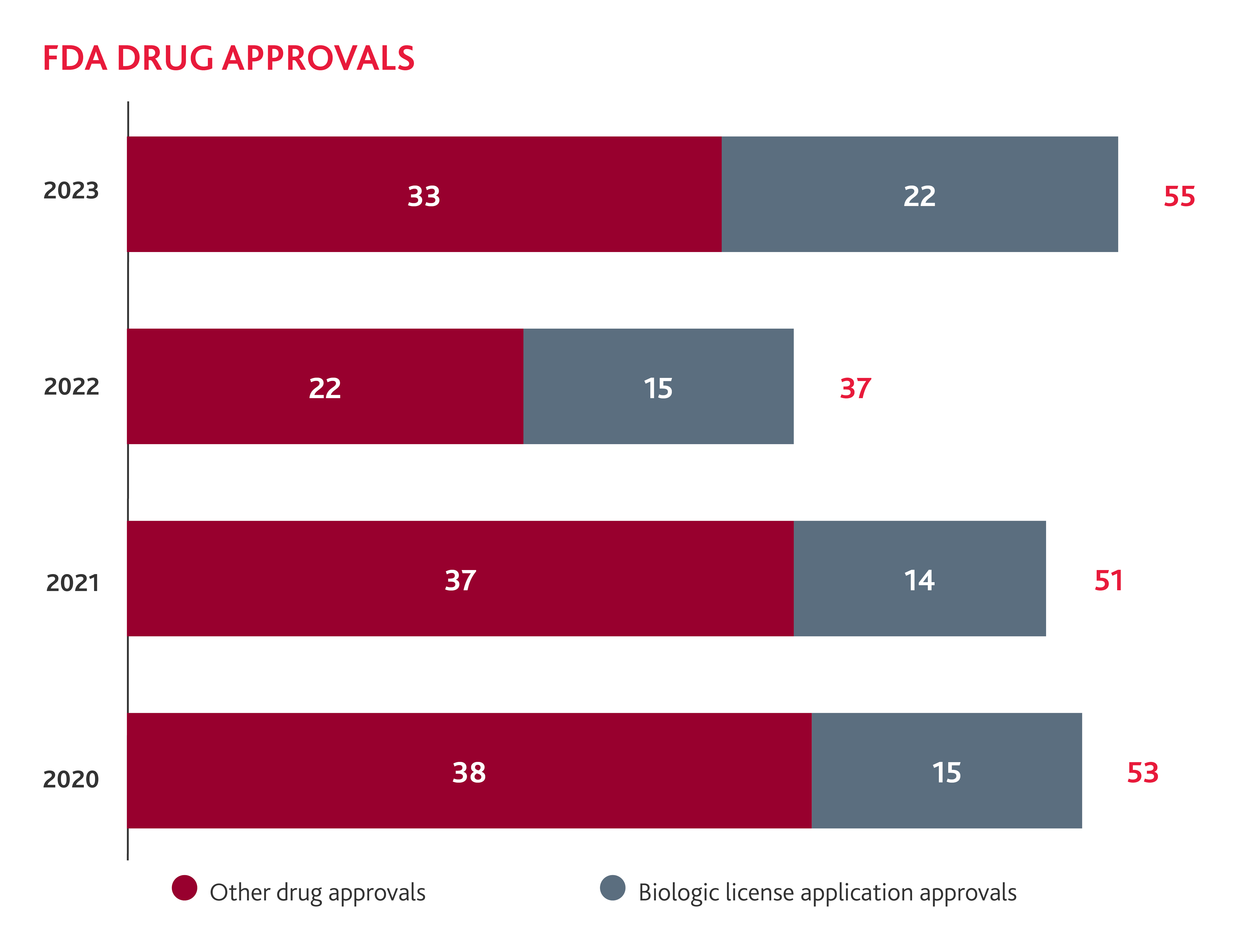

The FDA Increases Approvals in 2023

Following a lull in 2022, 2023 saw a return to a more typical rate of novel drug approvals, with 55 novel drugs approved, 18 more than the year prior. Twenty-two of these approvals were new Biologics License Application (BLA) Approvals, which included seven total cell and gene therapies.

The FDA has shown they are embracing these cuttingedge treatments, with another gene therapy treatment already approved in 2024. While it has taken some time for the FDA to understand how its existing regulations and processes apply to these new classes of medicines, the spike in approvals of cell and gene therapies indicates that they have determined how they will regulate these new medicines. Therefore, we should continue to see more cell and gene therapies approved in 2024 and beyond. FDA Commissioner Robert Califf has further stated that the FDA is embracing these drugs and that we are likely to see more of these treatments in the future. “This is just the beginning,” Califf told HPLive. “We’re going to see a huge number of cell and gene therapies.” This increase in cell and gene therapy approvals could encourage more of these therapies in the year ahead. Learn more about how BDO can help with the unique challenges faced in the development and commercialization of cell and gene therapy products.

Biotechs Disclose Climate Risks

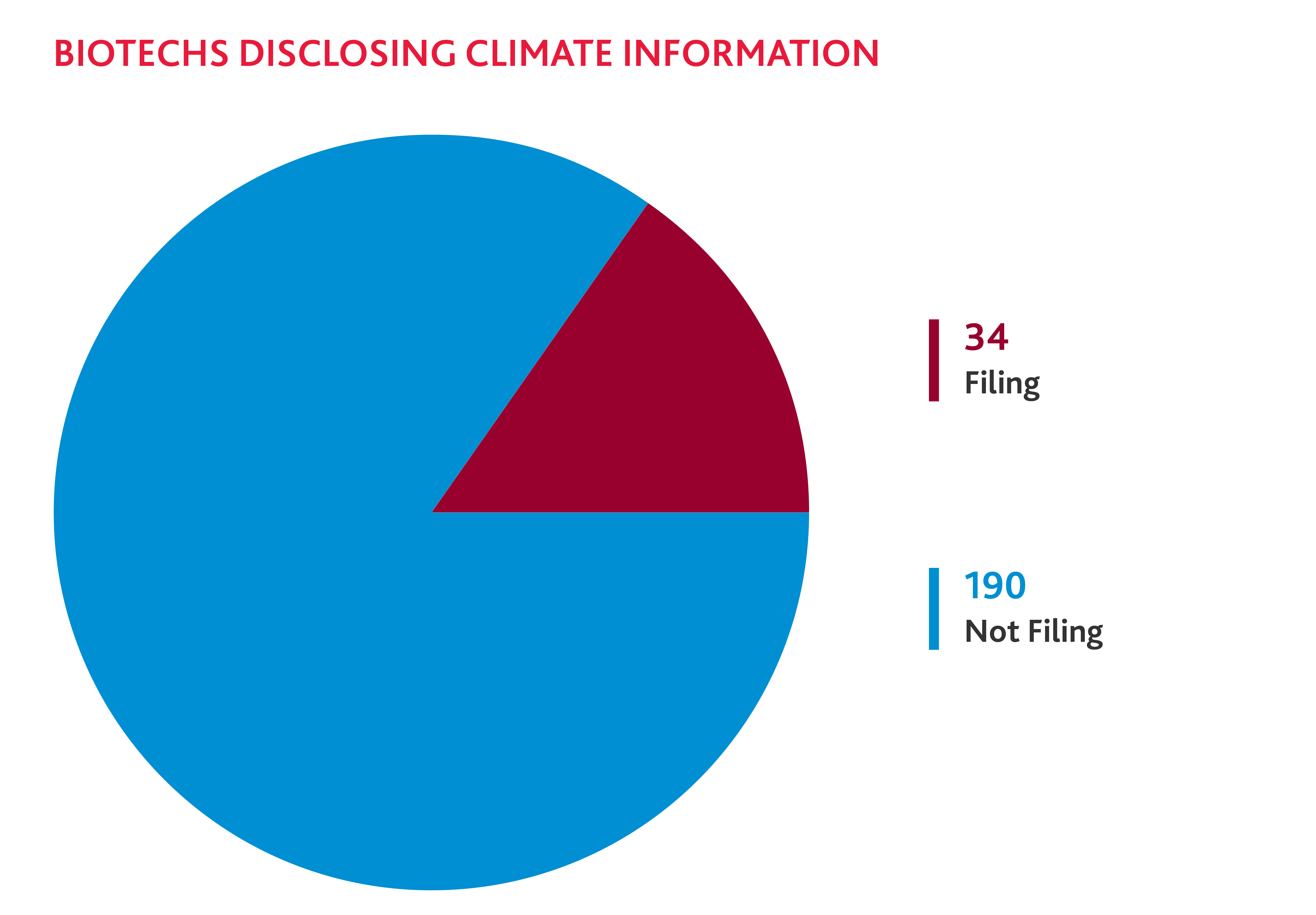

In 2023, a resounding 34 biotech companies disclosed climate-related risks in 10-K filings, despite the lack of immediate regulatory requirements to do so. Their proactivity signals that businesses are increasingly facing pressure from investors, regulators, and other stakeholders to disclose material climate-related risks.

In recent years, international and U.S. state legislatures have proposed or enacted climate-related disclosure requirements to give investors a more transparent view of companies’ material climate-related risks and carbon footprints. Additionally, in early March, the U.S. Securities and Exchange Commission (SEC) finalized its Climate-Related Disclosure rules.

According to the SEC, disclosure deadlines will cascade in order of filing status and revenue, starting with large, accelerated filers in 2025. Of the companies on the NBI, 66% of large companies disclosed climate information, 19% of medium-sized companies disclosed climate information, and 9% of small companies disclosed climate information. Not only are large companies more likely to be in-scope for the new SEC rule, but they may have more resources to meet the rule’s requirements. However, as expected, this rule is likely to face a long legal battle.

Regardless of size, companies should already be evaluating how these regulations may impact their business, determining what they will need to do to ensure compliance, and when that action may be required.

Looking Ahead

We expect to see more biotech IPOs in 2024 than in 2022 and 2023, as the biotech industry finds its new normal. Unlike the biotech boom of 2020 and 2021, we expect to see moderate, sustainable growth in 2024, bolstered by a more stable and predictable economy. Ultimately, we expect 2024 to usher in a new era of biotech success in the capital markets.

Ready to go public?

Contact us to learn more about how to launch a successful IPO.

Methodology

This edition of BDO’s Biotech Brief examines the December reconstitution of companies listed on the Nasdaq Biotechnology Index, which includes organizations classified as biotechnology or pharmaceutical companies according to the Industry Classification Benchmark with a minimum market capitalization of at least $200 million and an average daily trading volume of at least 100,000 shares. BDO used CalcBench to conduct this data analysis and supplementary sources where noted.

SHARE