Nonprofit Heart, Business Mindset: The Business of Impact

Are the words “nonprofit” and “business” completely at odds?

At first glance, the two appear to be polar opposites. One inspires images of volunteers hard at work, and the other evokes thoughts of corporate profits—painting two worlds that are seemingly diametrically opposed.

Yet the most effective nonprofit leaders aren’t afraid to borrow ideas and practices from the for‑profit world. In fact, they champion them.

The world needs nonprofits to continue pushing for positive change, and it needs them to stay financially healthy.

What’s the formula for a strong, sustainable nonprofit?

Put simply, balancing a nonprofit heart with a business mindset.

Your mission is the heartbeat of your nonprofit. Just like the heart is the primary organ of the body, your mission is the driving force of your organization’s work.

But the heart can’t do it on its own. One clogged artery puts stress on another element of the system—and while it may go undetected for some time, eventually that stress starts to show. If you block one ventricle, the other ventricle starts working harder, picking up slack to keep the heart pumping: to keep your mission moving. And eventually, the whole system could shut down, often with little warning. A healthy heart and a strong organization rely on the full functionality of all supporting systems.

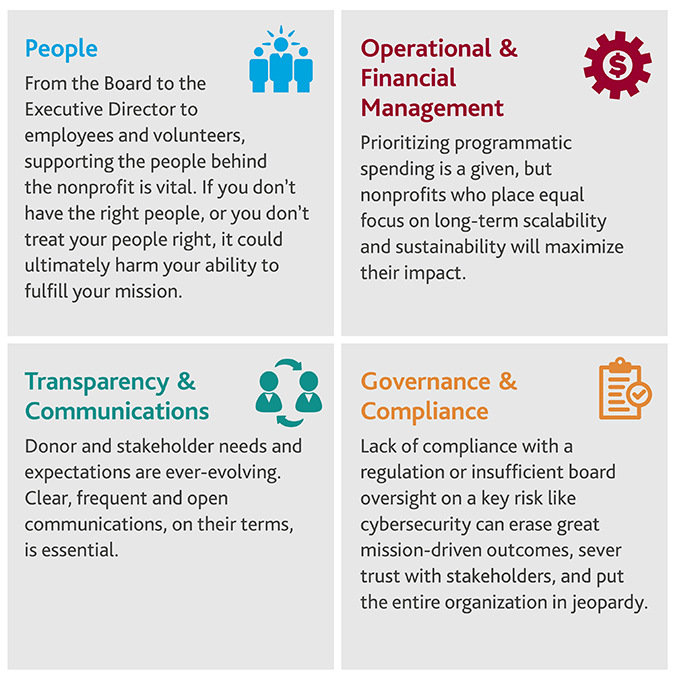

In the nonprofit world, these critical systems include:

When each of these systems, like the four chambers of the heart, are considered and given priority in setting and executing strategy, nonprofits are poised for greater success and long‑term impact.

PEOPLE

Behind every mission is a group of passionate, committed professionals and volunteers. Each person in an organization expects to be respected, valued and to see the output of their work in moving the mission forward. While the typical nonprofit professional is highly motivated, it’s critical for the nonprofit leadership team to ensure the skills of their people align with the needs of the organization today and tomorrow.

RETENTION

Recruiting and retaining talent remains a major obstacle for the industry. In our annual Nonprofit Standards survey, 60 percent of organizations say staff retention and recruitment is a high or moderate challenge. When looking at employee satisfaction issues, maintaining competitive compensation levels is at the top of the list: 59 percent of executives say compensation levels are a high or moderate challenge for their organization.

The nonprofit industry has long had a reputation for lower compensation levels compared to for-profit industries. However, changing demographics and worker trends may help nonprofits begin to close this perception gap.

With a strong job market and historic lows in unemployment, competition for talent continues to escalate. But, the nonprofit industry holds a key advantage. According to The Society for Human Resource Management, a whopping 94 percent of millennials want to use their skills to benefit a cause. And, many in the for-profit sector are growing disillusioned with companies that market social impact but don’t live up to the promise. By 2025, Brookings Institute reports that millennials will make up 75 percent of the workforce. As this group gains more influence, there’s more promising news: 86 percent of millennials would take a pay cut to work at an organization aligned with their values, according to a LinkedIn Workplace Culture survey.

Nonprofits who take a business mindset to their recruitment and retention policies will work with their best assets—highly impactful and rewarding work—to promote internally and externally the holistic value of a nonprofit career.

SUCCESSION PLANNING

Successful organizations have strong leaders at the helm, but they also plan ahead for the inevitable day when a change in leadership must occur. Unfortunately, leadership succession planning can be neglected in the nonprofit world, where devoted leaders often stay for long tenures and can be hesitant to pass the reins to a new leader. As such, 58 percent of nonprofits say succession planning is one of the top concerns for their board, according to BDO’s Nonprofit Standards survey.

A standard business practice for large corporations, succession planning is critical to ensuring an organization’s mission doesn’t falter when a new leader takes over. This process includes multiple steps, from getting board and employee buy-in to drafting a reasonable timeline, to communicating with key stakeholders about the change. As part of this process, it’s also critical to examine what leadership qualities will help the organization achieve its future goals.

The best solution isn’t always what works well in the immediate term. As nonprofits embrace a more business-oriented mindset, for-profit business leaders and private equity investors are increasingly popping up on the boards of nonprofits. Leaders with background in emerging skills like cybersecurity, digital donor communications and regulatory compliance are also in hot demand. Innovation should not be overlooked. Fostering a culture of innovation should be a key goal of succession planning in order to cultivate a team of creative thinkers to champion new ideas and solutions. Take a page from the corporate world and consider appointing a Chief Innovation Officer to integrate a culture of innovation from the top-down.

CFO/FINANCIAL LEADERS

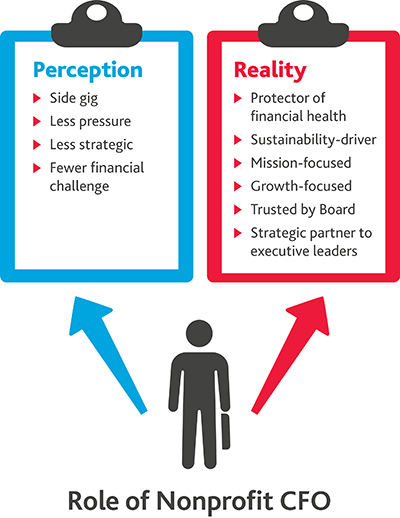

While the CEO and executive director are critical leaders who set the tone and mission of the organization, nonprofits cannot overlook the importance of their financial leadership.

94% of millennials want to use their skills to benefit a cause. – SHRM.

The CFO is so much more than a numbers person. Yes, they are the chief advocate for fiscal management, but they are also a strategic partner who needs a seat at the table to advise on the best financial and operational moves to maximize outcome and ensure sustainability.

The CFO is so much more than a numbers person. Yes, they are the chief advocate for fiscal management, but they are also a strategic partner who needs a seat at the table to advise on the best financial and operational moves to maximize outcome and ensure sustainability.

Effective nonprofit CFOs help optimize an organization’s activities, strategically interpret financial data and serve as a key partner to presidents, executive directors and boards. A nonprofit CFO can help an organization grow and expand its programming or geographic footprint, or maneuver revenue shortfalls.

Our Benchmarking Survey found that the CFO also has a unique vantage point on the organization that the board and broader C-suite should factor in. Nonprofit CFOs were more likely to see maintaining liquidity—a KPI of overall health—as a major challenge. They were also more likely than their colleagues to see regulatory compliance as a high or moderate challenge, suggesting a bigger responsibility for implementation.

Tom Waite, the CFO of the Humane Society of the United States puts it this way, “the biggest change that we will have to undertake in the coming year is more focus on individual programs, more strategic planning and a focus on bigger picture issues.” The CFO should play a huge role in shepherding change and planning for emerging issues.

OPERATIONS AND FINANCIAL MANAGEMENT

A laser focus on mission and programmatic spending is no doubt essential to nonprofit success and impact. However, if mission spending is built on inefficient infrastructure, overcommitted operations, or a flimsy financial foundation, failure is certain. Without strategic operational investments, nonprofits risk failing to build up the foundation they need for sustainable success.

Roughly 1 in 5 nonprofits surveyed in Nonprofit Standards report spending between 90 to 99 percent on program-related expenses. Charity rating sites have put additional pressure on organizations to minimize their overhead spending. The unfortunate consequence is that many donors now assume, incorrectly, that low overhead costs are a good measure of a nonprofit’s performance—what is commonly referred to as the “overhead myth.” Low overhead may serve as a nice, short-term talking point for donors, but it’s an unsustainable strategy.

In reality, high programmatic spending could mean the organization is underfunding critical areas necessary for long-term growth—a phenomenon known as the “starvation cycle” that creates an unhealthy environment for the organization. Failing to invest in infrastructure such as new technology, security, employee training, and fundraising capabilities, can be detrimental to organizational growth. Nonprofits must look at their operations with a more critical business mindset to find the appropriate balance between programmatic spending and the investments required for continued growth and stability.

Just like their for-profit peers, they must develop and analyze the KPIs aligned with their goals and needs and prove out return on investment (ROI) – not just in terms of impact – but in terms of improved operational efficiencies or financial health. These managerial processes are proven to drive success.

In a study by Stanford University Professor Walter W. Powell, the managerial practices of 200 nonprofit organizations were examined over a decade. Powell observed, “In the early part of study, we saw the growing adoption of managerial processes commonly associated with business. For example, using auditors to perform internal financial reviews.” His team found that nonprofits that were early adopters of managerial practices gave more attention to strategic planning, pursuing operational efficiencies and measuring progress. Ultimately, those organizations were more transparent and less insular, actively collaborating with other organizations.

We’ll delve deeper into strategic spending choices in our companion article Maximize Good.

TRANSPARENCY AND COMMUNICATIONS

.jpg) Maintaining strong donor relations requires extra effort now that the profile of the average donor is changing. Millennials now make up the largest portion of the overall population and have begun to take on a key role in philanthropy worldwide. These donors differ significantly from their predecessors: They not only demand increased transparency and reporting around impact and outcomes, but also expect faster reporting times thanks to social media and other technologies.

Maintaining strong donor relations requires extra effort now that the profile of the average donor is changing. Millennials now make up the largest portion of the overall population and have begun to take on a key role in philanthropy worldwide. These donors differ significantly from their predecessors: They not only demand increased transparency and reporting around impact and outcomes, but also expect faster reporting times thanks to social media and other technologies.

It’s not enough to create an annual report and share it online. It’s not enough to send regular email and mail communications on impact and outcomes. Donors expect real-time reporting, 24-7. Nearly three-quarters of nonprofits use social media to communicate with external stakeholders, according to our Nonprofit Standards report, nearly double the amount who did so in 2017—and that is only likely to increase.

Meeting these demands requires new tactics enhanced training and education and creates opportunities for automation to improve and streamline processes.

Prospective donors are increasingly thinking like discerning shoppers—researching organizations like they would a major purchase. They are seeking convenience and fewer clicks to donate. They are reading reviews and third-party endorsements from monitoring and watchdog organizations like Charity Navigator. Nonprofits, like for-profit businesses, must be aware of their external reputation.

Nonprofits also have numerous other stakeholders, including boards, external partners, volunteers and members. Here too, nonprofit leaders could borrow lessons from the business community. In many ways, nonprofit executives should operate like a public company in terms of transparency with their stakeholders and measure and report impact and ROI as if they had a private equity investor. Indeed, the relationship between a nonprofit and its donors and stakeholders has very similar dynamics to that of a portfolio company and its PE fund. Funds and donors alike expect the organization to be accountable and transparent and to improve key parts of operations while planning for expansion. Ultimately, PE funds are looking for return on their investment, just as donors are looking for proof of impact.

This business mindset also helps make the most of another key tool for communications and transparency with nonprofit stakeholders: the financial statement. We’ve written and spoken extensively about the value of the financial statement as a means of communication with nonprofit stakeholders, and on the new financial statement reporting requirements that aim to provide further clarity to readers. While this was a major accounting change and could be viewed simply as a compliance headache, the reality is that it helps nonprofits share their story.

Finally, transparency and clear communication helps nonprofits minimize the fallout from hard times. It’s no secret that budgets have been constrained by limited federal funding, among other economic and donor shifts. At our Nonprofit Summit, Didi Salmon of the National Academy of Sciences discussed how limited funding for science has put pressure on nonprofit discretionary budgets. To mitigate surprises down the line, she suggests starting the budgeting process early and making projections to give a realistic picture of how the organization’s financial situation could shake out. By planning ahead and communicating early and often, stakeholders will be better prepared to advise and respond.

“We’ve worked with many nonprofit CFOs who move from the for-profit world to the nonprofit one. It’s common for them to feel like a fish out of water at first. But the most impactful nonprofits operate like a public company by having a higher level of transparency to stakeholders, and like a private equity-backed entity in how they measure impact and ROI to stakeholders. Understanding and prioritizing these concepts gives these CFOs the confidence that they can make a difference using their past experience.”

Adam Cole

Adam Cole

Partner and co‑leader of the BDO Nonprofit & Education Practice

GOVERNANCE & COMPLIANCE

The rules of business and philanthropy are being reinvented, and literally re-written in some areas. Indeed, they must be, because business is fundamentally changing thanks to digital transformation, geopolitical shifts, economic changes and more.

96% of nonprofits say cybersecurity is a challenge for their boards.

Regulating technology, data and the digital economy and protecting assets are some of the biggest challenges of our global society, and nonprofits—like it or not—are caught in the crosshairs.

The truth is, nonprofits can’t maximize good if they are constantly responding to data privacy breaches or cyberattacks. A hack can take down a great organization by erasing trust and diverting resources from the mission. That’s why 96 percent of nonprofits say cybersecurity is a challenge for their boards.

The professionals inside and out of a nonprofit organization who proactively manage risk, digest and implement new regulation and prepare for compliance changes are unsung heroes. They do behind-the-scenes, labor intensive work to ensure the broader organization can focus on mission without worry of hitting costly roadblocks.

Nonprofits should think of good governance as their secret weapon, not an anchor weighing them down. Even with limited resources, nonprofits must take a proactive approach to regulatory compliance and risk mitigation, because the alternative could mean betraying donor and public trust and could result in financial ruin.

GDPR is one such wake-up call for the nonprofit industry. The EU General Data Protection Regulation (GDPR) went into effect on May 25, 2018 and was the most sweeping change to data privacy in 20-plus years. Many nonprofits with global reach were impacted by the rule, and we expect that a widespread change in domestic privacy laws is only a matter of time.

The strategic move for nonprofits? Start planning now. Consider a holistic data privacy strategy as part of your data governance program. A Privacy Operational Life Cycle that helps keep employees apprised of new privacy requirements, embraces recordkeeping and sound data protection practices and offers enhanced data privacy for stakeholders is crucial with GDPR in effect and other state and national laws in motion.

Nonprofits also know that tax-exempt doesn’t mean they can ignore taxes. Tax reform provided another significant shift in rules for nonprofits to address. Major changes to unrelated business income (UBI), executive compensation, endowment taxes for Higher Education institutions and changes to charitable giving deductions, among other items, all impacted nonprofits and created significant compliance work for internal and external teams. Assessing guidance and understanding total tax liability is critical to strategic tax planning and maintaining operations. With further changes to the tax code expected, this may be a moving target of sorts for nonprofit leaders, but it’s one that can’t be ignored.

MISSION MATTERS. IN FACT,

MISSION MATTERS MOST.

But for a mission to succeed, expand and thrive, organizations need to apply a business mindset to core areas of the organization that are too often overlooked. Considering people, operations, finances, communications and governance as a part of an organization’s overall strategy is essential.

SHARE