PE Add-Ons Drive M&A Transactions

Private equity (PE) funds face a new economic reality, defined by higher costs of capital and challenging macro conditions. BDO’s 2023 Private Capital Survey, which surveyed hundreds of PE fund managers and operating partners, showed that the current environment has forced funds to focus on tending to their existing portfolio companies instead of pursuing new platform investments. This has played out in the market in the months since the survey launched. According to PitchBook’s Q3 US PE Breakdown, PE deal value declined for the second straight quarter, cratering to the lowest quarterly level since the Great Financial Crisis (GFC).

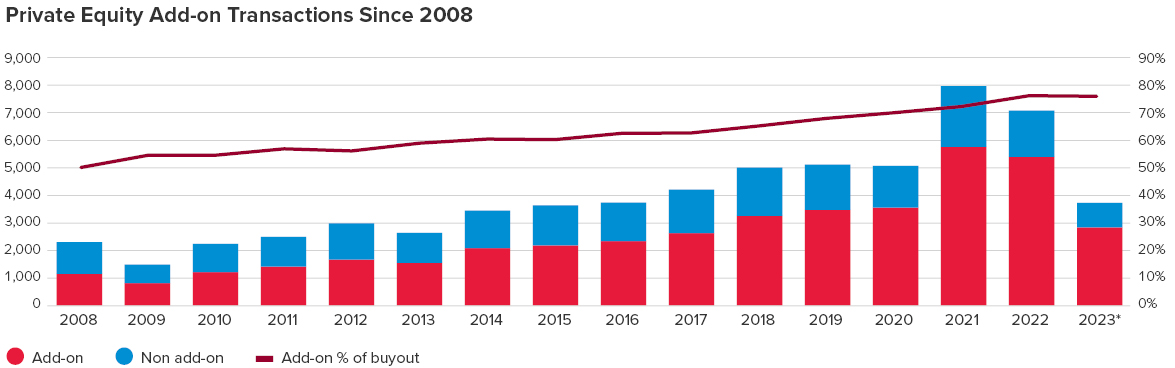

However, add-on transactions — smaller deals executed by PE-backed portfolio companies — have helped keep overall PE M&A volume afloat. Because of this, there has only been a modest drop in the number of PE transactions even as the value of PE M&A has steadily declined since the high watermark of Q4 2021. According to data, 76% of PE deals by volume in Q3 2023 were add-on transactions, a number that has steadily climbed year-over-year. A WSJ story attributed this trend to larger funds shifting focus to smaller transactions. As these funds face longer holding periods, smaller deals can add incremental value to their investments as part of their buy-and-build strategies.

More of these deals are on the horizon, and integrating these companies to deliver scale and create value should be top of mind for PE funds.

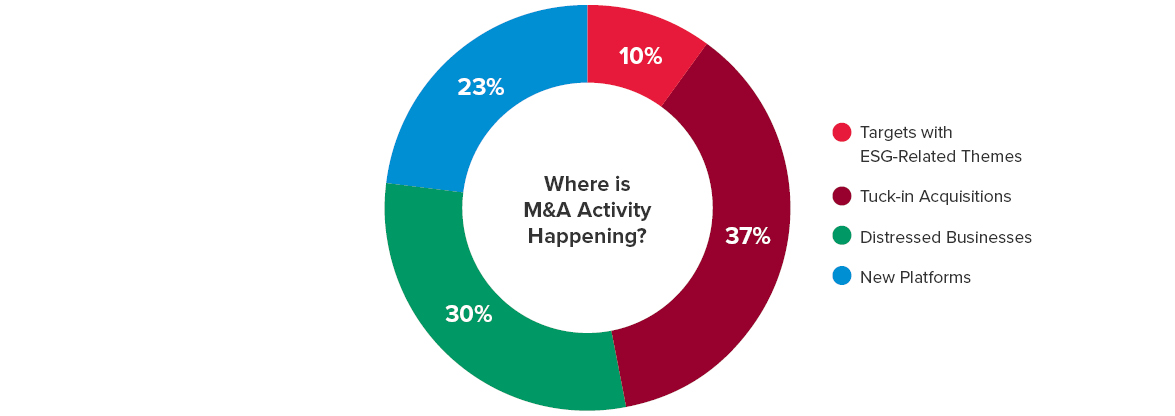

37% of fund managers see tuck-ins, a form of add-on deal, as the primary driver of M&A activity, according to BDO’s webinar poll.

Source: BDO Webinar Poll “Taking Stock of Private Equity Mid-2023” – June 28, 2023

Add-on Transaction Landscape

Between 2021 and 2022, the total value of PE M&A dropped substantially, while the overall volume (number of deals) stayed level. The recent resilience of add-on deals belies a broader trend happening in private equity since the GFC: Smaller-add-on deals are becoming a primary driver of PE M&A activity. In 2008, add-ons represented 49% of the total PE deal count. By 2016, that number had climbed to 62%, and reached 76% during the first three quarters of 2023.

*As of 9/30/2023

Source: PitchBook Q3 2023 US PE Breakdown

The major factors driving this activity include:

- Financing: The high interest rate environment raised the cost of capital, making it harder to finance big-ticket deals via traditional debt markets. Because of their size, PE funds can more easily digest smaller deals and are financing them with equity—which at present is less expensive than debt.

- Valuation: The market volatility of the last few years damaged many portfolio company valuations, forcing some funds to write down investments. Add-ons provide a way for funds to add scale incrementally and improve valuation.

- Longer Holding Periods: According to PitchBook, exit markets are the roughest they’ve been since the GFC, causing many funds to extend their holding periods. With capital deployed to secondary and continuation funds and the absence of exit opportunities, fund managers are putting that capital to work via add-on deals.

- Rise in Limited Partners and Co-Investment: In today’s deal landscape, GPs often partner with an LP or partner GP on platform transactions. This emerging dynamic makes it more difficult to create consensus for larger acquisitions.

Healthcare and technology are the top two industries seeing the most add-on deal activity, with 436 and 415 deals year-to-date, respectively. In healthcare, add-ons are usually roll-ups of smaller entities like individual facilities and centers that are easy to integrate into a larger network. Technology add-ons typically take the form of tuck-in deals, involving small companies with products or services that the buyer can seamlessly integrate into its larger offering.

The Integration Conundrum

While add-ons provide incremental scale with each successive deal, proper integration can prove challenging — especially when buying smaller and less sophisticated companies. The thinnest margins or smallest problems can break deal models. Below are some common themes our professionals often see when working with PE on integrating deals:

- Not all add-ons are created equal

Add-on acquisitions can come in all shapes and sizes, each requiring varied levels of integration support. A tuck-in transaction, where the acquiror usually adds a product or service to its offering, will require less support than a bolton acquisition, where the acquiror often adds a company with an entirely different business model to its existing platform. Approach and degree of difficulty can also vary by industry. - Departing staff can be a deal lynchpin

BDO’s survey showed how private equity firms and their portfolio companies are struggling with staffing. Most add-on deals are typically followed by the departure of talent. Sometimes this is a requirement of the deal model meant to add value, but sometimes it’s because the target company’s executives want to move on. In either case, those departing individuals sometimes hold institutional knowledge that can help ensure a successful integration. They might understand some obscure piece of the company tech stack or have a relationship with a priority vendor or supplier. The loss of this information can become a barrier to securing value down the road. - Don’t overlook systems

Continuity of systems often becomes a problem in small-scale PE deals, especially if the add-on transaction is a bolt-on. For example, a manufacturer might purchase a trucking company to bring its transportation needs in-house. The trucking company operates a completely different business than the manufacturers and will need the trucking company’s systems to speak with its own. Even with tuck-ins, problems can emerge as the platform stacks acquisition on top of acquisition. The accumulation of tech debt, especially given how data is managed and integrated across each small deal, can present problems when the platform company looks to make a transformative deal or nears an exit.

In this redefined economic environment, private equity funds will continue to create incremental value with smaller deals. The days of quickly combining companies and hoping for an immediate return are over. Proper integration and operational savvy are now prime determinants of success in this new era.

Learn more about how our PE practice can assist with your add-on strategy.

SHARE