Retail in the Red: BDO Bi-Annual Bankruptcy Update - 2H 2023

An overview of the state of U.S. retail, including bankruptcies and store closings, for the second half of 2023, and a forecast for 2024.

2023 was a year of economic growth, job creation, low unemployment, and easing inflation. These factors contributed to strong 2023 retail holiday sales. Some of the key issues that challenged the retail industry in 2022, such as supply chain slowdowns and excess inventory, subsided in 2023. Despite the easing of these challenges, 2023 was also a year marked by cautious consumers who searched for discounts and focused their spending on essential goods over discretionary purchases, battling both high prices and high interest rates. Price-conscious consumers contributed to the continued success of dollar stores and discounters, while some discretionary retailers suffered. Going into 2024, historically high consumer debt may handcuff consumer spending. BDO’s Spring 2024 Retail in the Red Report examines 2023 retail bankruptcy filings, store opening and closing, and macroeconomic data, and provides our predictions for retail in 2024.

Retail Bankruptcy Update

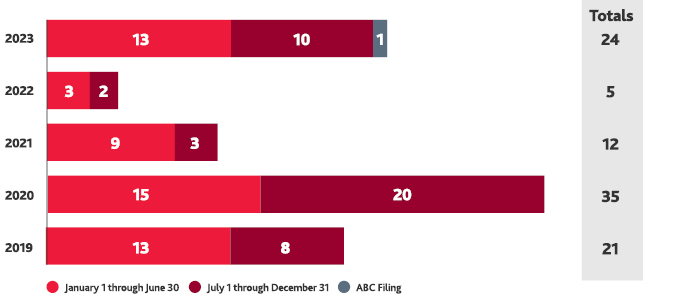

Retail bankruptcies picked up in 2023, with 10 new filings in the second half, plus the filing of an Assignment for the Benefit of Creditors (ABC) by the online apparel retailer Zulily, resulting in a total of 24 filings (including the ABC) for the year. This is a marked increase from the past two years and more in line with the number of annual filings seen prior to the pandemic.

Retailers That Filed for Bankruptcy in the Second Half of 2023k

| Company | Filing Data | Description | Bankruptcy Strategy | Bankruptcy Result or Latest Intent | Stores as of Petition Date | Store Closures Announced | |

| 4th Quarter | Zigi USA | 12/31/23 | Footwear | TBD | TBD | 0 | 0 |

| Hello Bello | 10/23/23 | Baby Care Products/Apparel | Asset sale | $65.8 million sale to stalking horse bidder, Hildred Capital Management affiliate. | 0 | 0 | |

| Z Gallerie | 10/16/23 | Homefurnishings | Asset sale | Approval to sell eCommerce assets to Karat Home Inc for $7.2 million. Wind down operating store and liquidate inventory. | 21 | 21 | |

| Rite Aid | 10/15/23 | Pharmacy | Dual sale processes for retail business and the Elixir pharmacy services business; close 400 stores. | Sold Elixir pharmacy benefit management business to MedImpact for $567.5 million. Retail business to be sold either to Lenders via credit bid or by auction. | 2,100 | 425 | |

| Shift Technologies | 10/09/23 | Automotive | Wind down business and liquidate assets. | Working with Hilco Streambank to auction various IP assets. | 2 | 2 | |

| 3rd Quarter | Noble House Home Furnishings | 09/11/23 | Homefurnishings | Asset sale | Sold assets to stalking horse bidder and DIP financing lender GigaCloud Technology. | 1 | 0 |

| Soft Surroundings (Triad Catalog Company) | 09/10/23 | Apparel | Asset sale | Sold online retail business to Coldwater Creek to continue as going concern and brick-and-mortar operations will be liquidated. | 44 | 44 | |

Off Lease Only | 09/07/23 | Automotive | Complete wind-down and allow it's lender to collect proceeds from vehicles securing a credit facility. | Converted to Chapter 7 liquidation. | 6 | 6 | |

The Mitchell Gold Co | 09/06/23 | Homefurnishings | Asset sale and liquidation | Stalking horse bid for assets rejected and DIP lenders pulled support. Converted to Chapter 7. | 30 | 30 | |

| Benitago | 08/30/23 | ECommerce | Asset sale | Confirmed plan of reorganization providing debt for equity exchange. | 0 | 0 |

Companies that filed for bankruptcy in the second half of 2023 included one retail pharmacy giant (Rite Aid), and various small retailers, including e-commerce and direct-to-consumer retailers (Benitago and Hello Bello), two automotive companies (Shift Technologies and Off Lease Only), and discretionary retailers selling home furnishings and apparel. The online apparel retailer Zulily commenced an ABC in December 2023 to wind down its operations, including the sale of $85 million of inventory and fixed assets located in two 775,000 square feet fulfillment centers.

The increase in bankruptcy filings in 2023 is likely due to several factors, including high interest rates, higher operational costs due to inflation, and the tightening of discretionary spending by consumers, resulting in a reduced ability for distressed retailers to obtain financing.

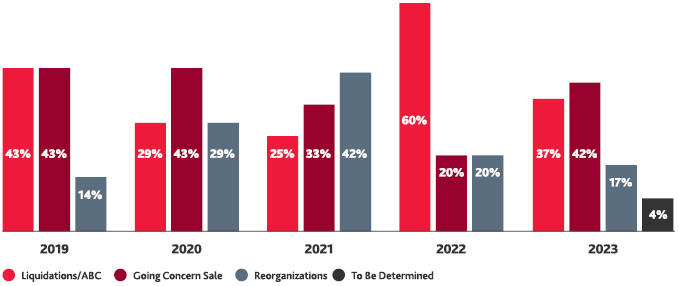

The outcome of retail bankruptcy filings between liquidations, sales, and reorganizations in 2023, as a percentage of total bankruptcies, also closely resembled the mix of bankruptcy outcomes seen pre-pandemic. In 2020 and 2021, we saw a trend toward reorganizations, whereas in 2022, there was a spike in liquidations. Retailers were more likely to reorganize prior to 2022 while interest rates were still low and lenders provided leeway. Times were less forgiving in 2022, with interest rates rising quickly and retailers facing huge amounts of excess inventory, leading to a preponderance of liquidations. In 2023, we saw a return to the 2019 distribution of bankruptcy outcomes, as supply chain and macroeconomic headwinds shifted. It is notable that with present interest rates much higher than in 2019 — a condition that would normally contribute to an increase in liquidations — we are not seeing more liquidations. This a trend we will continue to watch closely.

Outcome of Retail Bankruptcy Filings in BDO Retail in the Red Reports

| 2023 | 2022 | 2021 | 2020 | 2019 | Total | |

| Liquidation/ABC | 9 | 3 | 3 | 10 | 9 | 33 |

| Going Concern Sale | 10 | 1 | 4 | 15 | 9 | 38 |

| Reorganization | 4 | 1 | 5 | 10 | 3 | 23 |

| To Be Determined | 1 | 0 | 0 | 0 | 0 | 1 |

| Total | 24 | 5 | 12 | 35 | 21 | 97 |

Store Openings and Closings

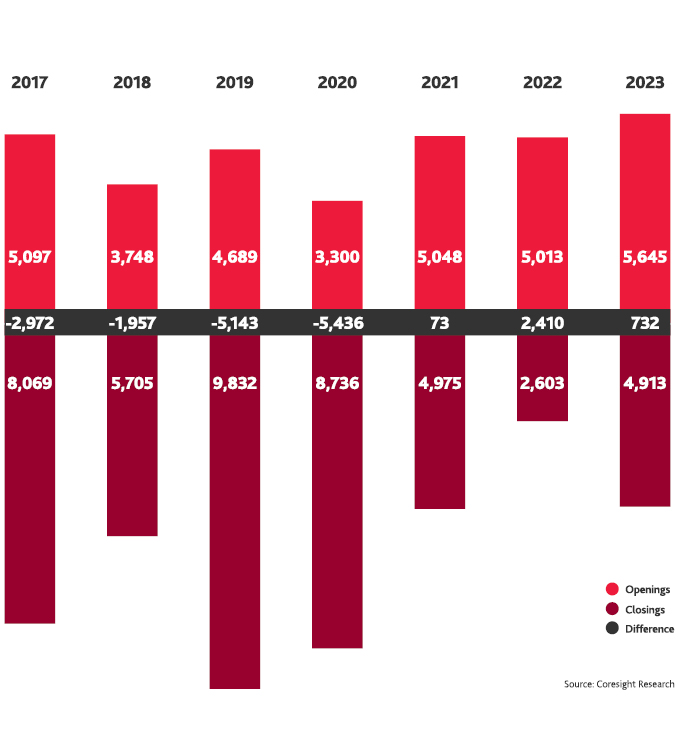

Except for Rite Aid, bankruptcies in the second half of 2023 did not result in many store closings. Net closings substantially exceeded store openings through 2020. However, since 2021, net store openings have exceeded closings as shown in the following chart:

Most store openings are by dollar and discount stores. Price-conscious consumers continue to be drawn in by low-price essential goods and groceries. For example, Dollar General has announced 800 new stores slated for 2024. Additionally, convenience store counts have also grown, increasing by 1.5% in 2023 from the prior year (2024 NACS/NIQ Convenience Industry Store Count).

There was a net opening of approximately 2 million square feet of retail space in 2023, but there was also an estimated 10% reduction in the average store size. An estimated 88.0 million square feet of retail space closed, with an average store size of 17,921 square feet, while 90.1 million square feet of new retail space opened, with an average store size of 16,136 square feet (Coresight Research). According to CoStar Group, store sizes by square footage are the smallest they’ve been in at least 17 years. Shrinking physical store square footage is tantamount to store closings as retailers replace large-format stores with small-format stores. Additionally, some traditionally mall-based retailers are shifting to neighborhood strip centers to take advantage of high-traffic locations with lower rent costs. Recent retailer store announcements include:

![]()

Macy’s has closed 80 department stores since Feb. 2020 and has since opened a dozen small-format stores that are 30,000 to 50,000 square feet (one-fifth the size of Macy’s mall locations) and plans to add an additional 30 locations by the end of 2025.

![]()

Nordstrom announced plans to open 23 Nordstrom Rack stores, in mostly suburban markets, through spring 2025, with locations ranging from 23,000 to 36,000 square feet.

![]()

IKEA opened more than 70 new, mostly small-format stores in 2023.

![]()

Bath & Body Works plans to have two-thirds of its stores outside of malls as part of its long-term strategy, as off-mall sales performance exceeded in-mall stores.

![]()

Walmart announced a 5-year plan by 2029 to convert 150 locations to new concept stores featuring improved layouts, expanded product selections, and new technology to add to the consumer shopping experience.

![]()

CVS is rationalizing its store base and plans to close dozens of pharmacies located within Target stores in early 2024.

Available rental space is sparse and rents are rising, further compounding the shift in store footprints and adding to retailers’ challenges. Vacancies at U.S. shopping centers fell to 5.3% in the fourth quarter, the lowest level since real estate firm Cushman & Wakefield began tracking the metric in 2007. These challenges are byproducts of a slowdown in new development and increased construction costs. From 1999 through 2021, new construction of retail space averaged more than 100 million square feet per year. This dropped to 82 million square feet in 2022, and 46 million square feet in 2023 (CoStar – commercial real estate analytics provider).

Additionally, over the past decade, traditional brick & mortar retailers have been challenged by the growth of e-commerce, whose share as a percentage of total retail sales has been above 15% since early 2023 (U.S. Census Bureau) and is forecasted to grow to close to 25% (Statista). This trend was highlighted during the 2023 holiday season as online sales grew 6.3%, while in-person sales were only up 2.2% (Mastercard). As retailers adapt to service and experience-centered models and inflation stabilizes, e-commerce strategy continues to be a critical component of a retailer’s business model alongside rethinking the physical footprint.

Profitability Negatively Impacted in 2023

Based on the reported financial results for our sample of 13 of the top 40 retailers in the U.S., BDO continues to observe a trend discussed in our first half of 2023 report: When adjusted for inflation, retail sales have been relatively weak. Retailers reporting sales increases primarily sold essential or discount goods, while those that reported a decline primarily sold discretionary products.

The chart below shows the year-over-year (YOY) revenue percent change for the first three quarters of 2023 and comp store sales percent change for the third quarter for the same sample of the top 40 retailers in the U.S.

2023 Year-Over-Year Revenue Percent Change and Comp Store Sales

| Q1 YoY Rev Change | Q2 YoY Rev Change | Q3 YoY Rev Change | Q3 YoY Comp Store Sales YoY Change | |

| Pharmacy | 11% | 10% | 11% | 9% |

| Off-price apparel / Home Goods | 3% | 8% | 9% | 6% |

| Discounter - Apparel/Home | 4% | 8% | 8% | 5% |

| Sporting Goods | 5% | 4% | 3% | 2% |

| Discounter | 7% | 4% | 2% | (1.3%) |

| Home Improvement | (4.2%) | (2.0%) | (3.0%) | (3.1%) |

| Supercenter | 1% | (4.9%) | (4.2%) | (4.9%) |

| Supercenter | 8% | 6% | (5.0%) | 2% |

| Department Store | (3.9%) | (4.7%) | (5.2%) | (5.5%) |

| Apparel | (5.8%) | (8.0%) | (6.7%) | 5% |

| Electronics | (11.1%) | (7.2%) | (7.8%) | (6.9%) |

| Department Store | (7.0%) | (9.5%) | (7.8%) | (7.0%) |

| Home Improvement | (5.5%) | (9.2%) | (12.8%) | (7.4%) |

Retailers leaned on discounting and flexible payment plans to entice consumers to buy during the 2023 holiday season. The sample data shown above illustrates that consumers continue to focus more on price, as discount retailers, dollar stores, and mass merchants are generally performing better than specialty stores and department stores. According to financial statements, struggling retailers mainly cited reduced big-ticket and discretionary purchases as the causes of their year-over-year declining performance.

More than half of sample of retailers continued to underperform in the third quarter versus the first and second quarters. The high discounting during the holidays and anticipated returns in January 2024 are expected to result in marginal fourth quarter financial results for many retailers.

Macroeconomic Update: The Pendulum Swings in a Positive Direction

It appears that the Fed has managed a soft landing to lower inflation without a resulting recession. Pandemic related supply chain issues and a temporary drop in the size of the labor force seem to have contributed to high inflation. Now, it appears those issues will be mostly resolved. Consumers were able to keep spending by relying on savings or borrowing during the past couple of years.

Data Indicative of Soft Landing

- The U.S. GDP grew at a seasonally and inflation-adjusted annual rate of 3.3% in the 4th quarter, and 3.1% over the past year, up from less than 1% in 2022 and faster than any of the five years preceding the pandemic, according to the Bureau of Economic Analysts.

- U.S. employers added nearly half a million jobs in Q4 2023 and 3.1 million jobs in 2023. There were 353,000 new jobs in January, on top of 541,000 jobs added in December and November, and a very low unemployment rate of 3.7%, staying below 4% for nearly 2 years, the longest such stretch since the 1960s (Bureau of Labor Statistics).

- The Consumer Price Index rose to 3.1% for the 12 months ending in January 2024, whereas at the beginning of 2023 the CPI was 6.4%, after peaking at 9.1% in June 2022 (Labor Department).

- U.S. retail and food services sales were up a seasonally adjusted 5.6% in December from a year earlier and holiday sales beat expectations (The Commerce Department and NRF). Consumers spent $222.1 billion online from November 1 through December 31, up 4.9% year-over-year, which set a record for holiday e-commerce (Adobe Analytics).

- The Conference Board Consumer Confidence Index rose for a third straight month, to 114.8 in January, the highest level since Dec. 2021.

Data Indicating Consumer Spending Could Slow Further

- Consumers are becoming significantly more discerning in their purchases, cutting back on expenditures, prioritizing essential items, and delaying non-essential purchases. In addition, consumers are facing high rents, rising home prices, and repayment of student loan debt.

- Interest rates remain at a 23-year high, with expectations of some rate cuts in 2024.

- Consumer debt is historically high:

- U.S. consumer borrowing surged in 2023.

- Credit card balances exceeded $1.1 trillion in 2023 and delinquencies increased more than 50% in 2023 and debt that is 90 or more days past due amounted to 6.4% in the 4th quarter, a 59% jump from just over 4% at the end of 2022 (New York Fed).

- Buy Now Pay Later usage hit an all-time high during the 2023 holiday season, up 14% from 2022 (Adobe Analytics). Providers that offer this service don’t disclose how often these bills go unpaid, and the debts aren’t reported to credit bureaus.

The 2023 holiday debt hangover could be an issue for retailers in 2024. The lack of clarity regarding consumers’ ability to pay their accumulated debts has potential negative implications on retail and the overall economy.

What Retailers Can do to Avoid Competing on Price

In 2024, retailers may feel pressure to lower prices to entice customers to purchase. This could contribute to further margin erosion and harm profitability. Here are some ways retailers can boost customer engagement, without sacrificing profit:

- Redesign loyalty programs: Retailers should evaluate their existing loyalty programs and consider what changes to make to stand out among the competition. Adding loyalty tiers, whether based on total spend or a subscription membership, is one way to entice customers to make repeat purchases and increase a customer’s per-order spend. These programs allow retailers to offer special perks to customers, including exclusive offers and benefits. Members only access to new or exclusive merchandise, free returns, or cash-back offers and coupons can be crucial to incentivizing cash-strapped consumers.

- Rethink the in-store experience: In the age of the digital consumer, retailers should not neglect their brick-and-mortar stores. According to a survey from First Insight, 71% of consumers reported typically spending more than $50 when shopping in-store, compared to just 54% that said they spend more than $50 when shopping online. By getting customers in-store, there is an opportunity to sell more. Customers may be tempted to impulse buy, salespeople can cross-sell or upsell, and the likelihood of a return declines. In-store experiences can be improved by remodeling stores and using data and technology to create efficiencies. For example, technology such as mobile checkout can help lines at brick-and-mortar stores move quicker. To get customers to choose their store over a competitor, or over online shopping, retailers will need to offer a unique, exciting, and stress-free store experience to get customers to make return trips.

- Invest in AI: AI can help retailers optimize their costs and improve operations. BDO’s recently released 2024 Retail CFO Outlook Survey found that 48% of retail CFOs plan to leverage automation and AI for their cost optimization strategies. Areas where AI can help retailers include:

- Pricing & discounting: AI can provide retailers with the insights they need to inform their pricing strategies. By modifying prices in real time to reflect demand, AI can help retailers reduce discounting and improve their cost optimization strategies.

- Lease analysis & exploring relocation options: AI can develop more efficient lease analysis so retailers can make better decisions about store footprints, including moving out of major malls to neighborhood storefronts. This can help retailers get closer to target consumers, particularly as many customers now work from home and no longer commute every day.

- Prioritizing supply chain improvements: AI can increase warehouse efficiencies and improve inventory management. Retailers can also leverage predictive analytics to identify what SKUs are likely to perform well. This can result in fewer returned items and less need to discount excess inventory.

Retail Outlook for 2024

Consumers were able to rely on savings and borrowing to continue spending in 2023. Despite a strong job market and robust wage growth, consumer debt has reached an all-time high and credit card delinquency rates have spiked in 2023. The financial stress of credit delinquency, particularly on younger and lower-income consumers, could cause consumer spending to slow.

In addition, geopolitical conflict, a historically large U.S. budget deficit, and a closely fought presidential election all contribute to broader uncertainty. These phenomena could impact consumer behavior and the fortunes of retailers.

As consumers continue to be cautious about discretionary spending, we expect the number of retail bankruptcy filings in 2024 will be close to — but probably won’t exceed — the number of filings in 2023. It is also likely that we will continue to see average U.S. store size shrink as consumers are drawn to smaller, off-mall stores that offer personalized and omnichannel experiences.

Overall, we expect consumers in 2024 to be mindful of their costs and spending. Retailers will need to adapt their businesses to a climate of slower growth by focusing on marketing and clearly demonstrating the value they bring to customers who choose to shop with them.

See how BDO has helped retailers in distress by exploring our case study portfolio.

SHARE