2017 BDO Technology Outlook Survey

Trump Talk Casts Cloud Over Optimistic Growth Prospects

Tech is feeling the Trump effect.

The president’s surprising victory in the 2016 U.S. presidential election and vocal support for “America First” trade and immigration policies are colliding with increasingly stringent data privacy laws to cast a cloud of uncertainty over the sector. Despite these unexpected circumstances—and the surprises 2017 may yet have in store—technology executives are optimistic about growth prospects in 2017, the 2017 BDO Technology Outlook Survey reveals.

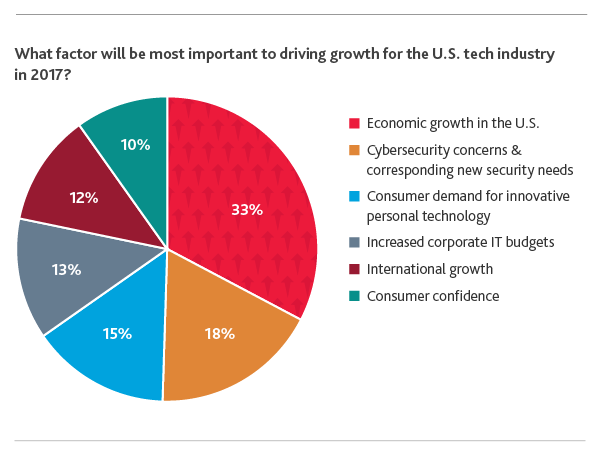

The survey, conducted post-election, shows that technology CFOs ranked U.S. economic growth as most important to expansion of the sector, ranked first by a third (33 percent) of executives compared to 18 percent in 2016 and 25 percent in 2015.

Just 15 percent say consumer demand for innovative personal technology is the most important factor to driving growth in the U.S. technology sector—dropping from 32 percent and falling from its No. 1 spot in 2016.

Echoing this sentiment, the Consumer Technology Association (CTA) predicts that consumers around the world this year will spend $929 billion on smartphones and other tech products, down from $950 billion in 2016, as reported by AFP News.

In other words, tech CFOs are placing greater importance on economic output in the U.S. than the arrival of the next big thing.

“This year marks a trifecta of challenges for U.S. technology companies. In an industry that garners a significant portion of its revenue from abroad, a strengthening U.S. dollar, paired with the anticipated decline in the global sales of smartphones (and other tech), and a potential increase in trade barriers, presents certain challenges, making U.S. economic growth even more important. As our survey indicators illustrate, however, we are confident the industry is up to the task.” - Aftab Jamil, Assurance partner and national leader of BDO’s Technology practice

Corporate Reform Top of Mind as Tech Talks Tax

While the plural majority (25 percent) of tech CFOs predict tax changes will present the biggest challenge to their organizations this year, in line with findings from previous years, perhaps more telling are their concerns specific to corporate tax reform.

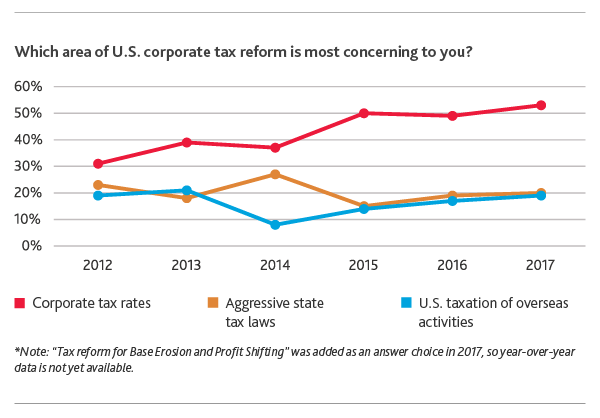

More than half (53 percent) of respondents rank corporate tax rates as most concerning when it comes to corporate tax reform, up from 49 percent last year and reflecting a steady increase over the last six years. Twenty percent cited aggressive state tax laws as their greatest concern, followed closely by concerns around U.S. taxation of overseas activities, cited by 19 percent of respondents. Tax reform for Base Erosion and Profit Shifting (BEPS) trailed furthest behind, with just 8 percent citing it as their greatest concern.

When it comes to their tax reform wish lists, most CFOs (61 percent) say lowering corporate tax rates is their top priority, echoing rhetoric from candidates during the 2016 presidential campaign. Incentives for research and innovation ranked second (19 percent), followed by incentives to repatriate foreign earnings (11 percent) and overhauling tax rules for international activities (9 percent).

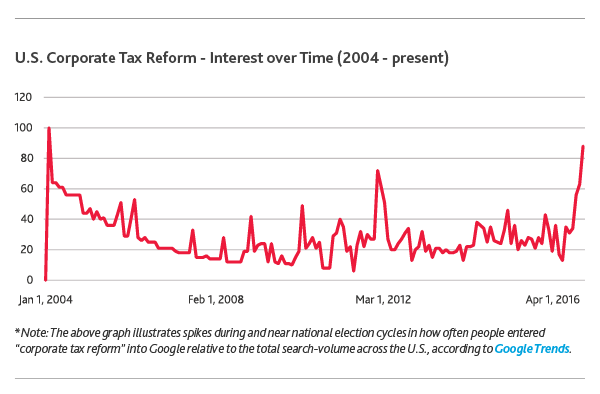

Cutting the U.S. corporate tax rate, which currently sits at 35 percent and is the highest among OECD nations, typically comes under greater public scrutiny during election cycles. Last year was no different, but when coupled with well-publicized global tax developments, perhaps no industry has felt the heat as much as technology.

Trump has openly criticized several American tech giants, which are taxed on global income but only for profits returned to the U.S., for relocating a large proportion of their taxable operations to foreign markets with lower corporate tax rates. But he has also hinted at significant cuts to the U.S. corporate tax rate (to 15 percent), among other incentives such as a one-time “tax holiday” on foreign cash repatriation (at a discounted 10 percent rate).

“While lower corporate tax rates get the most fanfare, it is the international tax provisions that could have the most profound impact on tech companies. The industry’s average effective corporate tax rate is actually well below the current top U.S. rate of 35 percent, largely due to lower foreign tax rates applicable to foreign activities of overseas subsidiaries and the indefinite reinvestment of those earnings abroad. However, some of the proposed tax plans are intended to upend the status quo, and if they become reality, tech companies will need to be nimble to avoid getting burned.” - David Yasukochi, Tax Office managing partner and partner in BDO’s Technology practice

Spotlight on Tax: A look at the GOP border tax-adjustment proposal

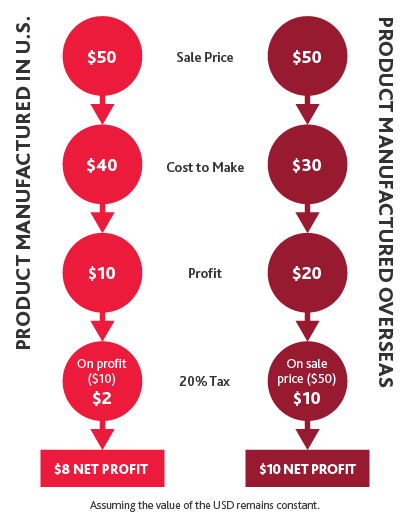

The border tax-adjustment proposal, contained in the House Republicans’ tax blueprint, A Better Way: Our Vision for a Confident America, seeks to change the way corporations are taxed. While the plan would cut the corporate tax rate from 35 to 20 percent, it also suggests transforming our tax regime from a worldwide approach to a destination-basis tax system with border adjustments. These border adjustments are among the proposals technology companies are watching most closely.

Currently, U.S. technology companies are taxed on worldwide income at a 35 percent rate, and to the extent that taxes are paid in foreign jurisdictions, they are allowed a foreign tax credit to avoid having the same income taxed twice.

Trump has given the GOP plan mixed reviews: He previously criticized it for being too complicated, but more recently he appears to have warmed up to it.

While subject to change as the administration further develops its tax reform policies, this so-called destination-basis tax system conceptually would tax tech companies on their sales to U.S. customers while excluding foreign sales from U.S. tax entirely. This means sales of imported goods would be fully taxable while the sales of exported products would be exempt from tax. Further, the costs of goods, services and intangibles purchased from foreign parties and sold to U.S. customers would not be deductible from taxable income, as they currently are. This could be a game-changer for an industry that frequently relies on foreign contract manufacturers.

Take a look at the graphic below for an illustration of the border adjustment concept.

The mechanics of a border adjustment tax are ultimately geared to reverse the U.S. trade imbalance, so the best gauge for its impact on your business, is your business: Does its reliance on imported goods overshadow sales revenue from global markets, or the other way around?

Get Outta Town: Uncertainties Around U.S. Trade and Immigration Policy

Domestic and political uncertainty could put downward pressure on upbeat growth forecasts, and our survey suggests it is a possibility weighing on the minds of CFOs.

Forty-one percent of CFOs expect political uncertainty, at home and abroad, to have the greatest impact on the U.S. IPO market, a factor we measured for the first time this year. This reflects uneasiness around potential policy decisions and the president’s public censure of companies that offshore jobs. The new administration has voiced opposition to the H-1B visa program and free trade deals like the negotiated 12-nation Trans-Pacific Partnership (TPP). (President Trump withdrew the U.S. from TPP negotiations on Jan. 23, after we conducted our survey.)

The former allows U.S. technology companies greater access to highly specialized—and highly sought-after—workers who are sometimes in short supply (32 percent of CFOs say recruiting or retaining workforce talent is their greatest challenge this year); the latter would have boosted U.S. technology companies’ access to large Asian markets and strengthened intellectual property protections there.

While just 10 percent of survey respondents cite trade and immigration policies as their biggest challenge in the year ahead, the technology industry relies heavily on outsourcing overseas. In fact, 40 percent of tech CFOs report outsourcing services or manufacturing to subsidiaries or companies based outside the U.S.

Whether the new administration’s vocal criticism will have an impact on companies’ outsourcing plans remains to be seen. Only 4 percent of survey respondents expect to increase their outsourcing activities in the year ahead, down from 14 percent two years ago. However, just 14 percent plan to bring any of the work they currently offshore or outsource back to the U.S. this year.

2017: Unicorn 2.0?

While tech IPOs struggled to get off the ground in 2016, our survey signals that activity will rebound this year—with CFOs the most bullish about an increase in IPO activity in our survey’s history. Seventeen percent expect it to increase significantly, compared to 7 percent last year. Forty-five percent expect it to increase slightly, 32 percent expect it to hold flat and just 6 percent expect it to decrease slightly.

Of course, 2016 set a low bar, marking the slowest year for tech IPOs since the recession. But the post-election market rally, in combination with pent-up demand, may see 2017 tech IPO activity return to, or even eclipse, the highs of 2014.

As the tech IPO market rebounds, concerns around overvaluing 2016’s class of unicorns are easing. Two-thirds (66 percent) of tech CFOs expect company valuations to increase this year, compared to just 48 percent last year and 62 percent in 2015. This reflects more upbeat forecasts from investors and analysts alike over the potential for several highly-valued companies like Snap, Spotify and Uber to go public.

Tech CFOs are also predicting an acceleration in revenue growth in the year ahead. More than three-quarters (80 percent) expect higher total revenues in 2017, projecting an average increase of 10 percent over last year—more than 2016 and 2015 growth projections (8.8 and 9 percent, respectively). Just 3 percent expect revenues to decline.

“Valuations in the technology sector have remained relatively buoyant, despite a selloff in the first quarter of 2016 and the dismal IPO market. And while the tech unicorn has gotten a bad rap after several disappointing public debuts, the extended market rally is helping justify higher price tags. That said, startup backers are exhibiting more caution, and while some companies will undoubtedly surpass that elusive $1 billion threshold, it won’t be at the same rate as 2014 and 2015.” – Anthony Alfonso, BDO Consulting’s Valuation & Business Analytics national leader

Tech M&A Holds Steady

In 2016, technology led all sectors in global M&A activity for the second time, totaling $612.9 billion, according to Dealogic. Our survey suggests 2017 will be another strong year for deal-making.

Nearly three-quarters (72 percent) of tech CFOs expect deal volume to increase in 2017, including 29 percent who expect activity to increase significantly. Just 4 percent expect it to decline slightly.

In terms of their own organization’s growth strategies, about a third of CFOs (31 percent) expect to pursue M&A activities this year, dropping from 40 percent last year.

When it comes to the biggest deal drivers, 31 percent say the primary motivation behind M&A will be technology assets and intellectual property, up from 25 percent in 2015, followed by revenue and profitability (28 percent), market share (24 percent), and engineering and research capabilities (16 percent).

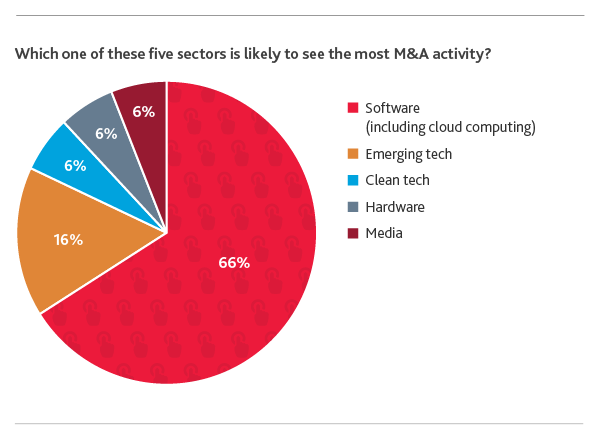

Breaking it down by sector, most tech CFOs (66 percent) forecast software (including cloud computing) to see the most M&A activity, followed by emerging tech (16 percent), and clean tech, hardware and media (6 percent each).

“Last year, merger mania was all about smart services, as traditional hardware and software players jumped on the cloud computing bandwagon in a bid to offset their legacy businesses. In 2017, we expect to see continued appetite for deals in the software-as-a-service space as well as a spate of acquisitions to augment AI and machine learning capabilities. But while a more lenient regulatory environment and corporate tax reform may ease the path to acquisition, antitrust enforcement—particularly in Europe—will continue to pose challenges.” – Shailen Amin, partner in BDO’s Transaction Advisory Services practice

Emerging Tech

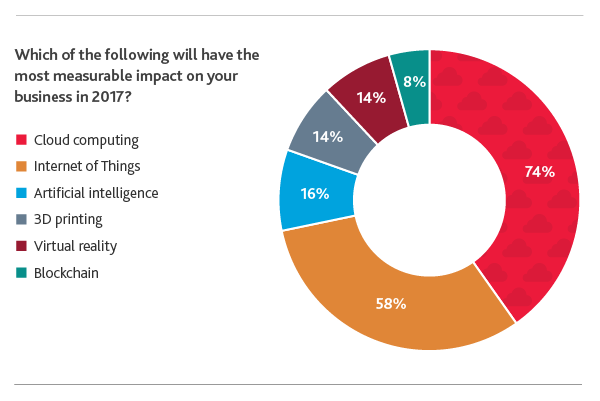

When asked what technology will have the most measurable impact on their business in 2017, most tech CFOs (74 percent) say cloud computing, while 58 percent say the Internet of Things. Sixteen percent say artificial intelligence will have an impact, meanwhile, followed by 3D printing and virtual reality (14 percent each), and blockchain (8 percent).

See BDO’s 2017 Tech Predictions infographic for more on the biggest innovations reshaping tech.

.png)

Cybersecurity Continues to Boost Growth

As cyber risk rises to the top of the corporate agenda, cybersecurity concerns remain a double-edged sword for the technology industry. Global spending on cybersecurity defense products and services is projected to exceed $1 trillion cumulatively over the next five years, according to Cybersecurity Ventures’ Cybersecurity Market Report. In line with this estimate, this year tech CFOs say cybersecurity will be the second-largest driver of growth in the technology industry, with 18 percent viewing it as the most important factor for industry growth, compared to 25 percent in 2016.

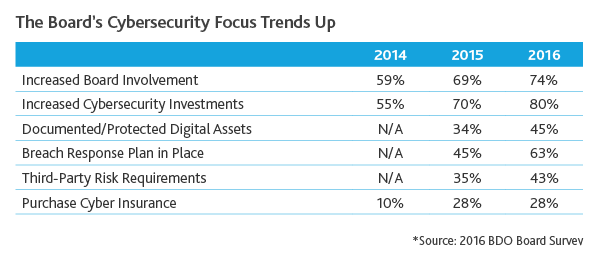

The trend is in line with cyber pressure felt by board directors in general, as our 2016 BDO Board Survey revealed. Twenty-two percent of board directors last year reported their company had experienced a cyber breach during the past two years—doubling since 2013 (11 percent). Most board directors (74 percent) also said their board was more involved with cybersecurity than 12 months ago, and 88 percent were briefed on cybersecurity at least once per year.

Cybersecurity concerns are also pushing tech companies to boost their own defenses. The European Union (EU)’s approval of the General Data Protection Regulation (GDPR), which will require stricter data privacy controls from all U.S. organizations that handle or process the personal data of EU citizens effective May 2018, has driven compliance concerns around data privacy laws.

Forty-four percent of tech CFOs say data privacy laws are their most serious compliance concern in the year ahead, overtaking last year’s top compliance concern, financial reporting (27 percent). Other concerns are export controls (15 percent), general fraud and corruption (14 percent) and bribery in foreign markets (1 percent).

In addition to tightening data privacy regulations, the climbing costs of a data breach are also cause for concern. Global annual cybercrime costs are expected to reach $6 trillion annually by 2021, according to a Cybersecurity Ventures report. This includes costs of the destruction of data and lost productivity to further business interruptions down the line. There are more intangible costs as well, including reputational harm and the loss of public trust.

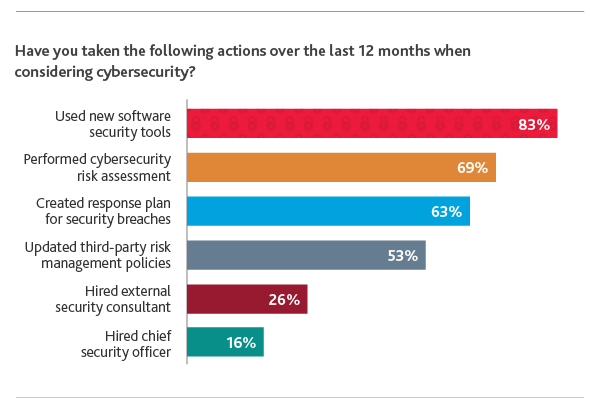

In the last 12 months, 83 percent of tech CFOs say they have used new software security tools (compared to 93 percent in 2016), 69 percent have performed a cybersecurity risk assessment (81 percent in 2016), 63 percent have created a response plan for security breaches (75 percent in 2016), 53 percent have updated their company’s third-party risk management policies (65 percent in 2016), 26 percent have hired an external security consultant (42 percent in 2016) and 16 percent have hired a chief security officer (13 percent in 2016).

“Advanced technologies and innovations like the Internet of Things, cloud computing and virtual reality present enormous opportunity for not only the technology sector, but also others like healthcare, retail and manufacturing. As we have seen in recent large-scale attacks using connected devices, though, these innovations also present new attack vectors and vulnerabilities. The tech industry has shown good progress in identifying cyber risks and mitigating them through implementation of enhanced policies and procedures. However, tech companies must remain steadfast in their prioritization of cybersecurity, continuously embedding and updating controls into their product and service offerings.” - Shahryar Shaghaghi, Technology Advisory Services national leader and head of International BDO Cybersecurity

Spotlight on GDPR and Cybersecurity

Reflecting a growing global concern around data privacy in the wake of the Edward Snowden revelations, the EU approved the GDPR in April 2016 to boost EU citizens’ right to data privacy. The measure replaces the EU’s previous Data Protection Directive and streamlines the data privacy laws of its 28 member states effective May 25, 2018.

Key articles of the GDPR include:

-

Extended Jurisdiction. Unlike the Data Protection Directive, which allowed each member state to have its own data protection laws, the GDPR automatically becomes law in every member state upon implementation—serving as a unifying force between countries. Furthermore, the regulation’s jurisdiction extends to any company—foreign or regional—that processes the personal data of EU citizens, regardless of where it is headquartered. Thus, a U.S. company located outside the EU is still subject to the GDPR should it transfer data to, from or within the region. The jurisdiction applies to both data controllers and processors.

-

Increased Rights of Data Subjects. One of the GDPR’s major goals is to extend the data protection rights of data subjects—requiring organizations to outline clearer requirements for consent, have greater data transparency and respect the right to be forgotten. In terms of consent, companies must make their contracts for the obtaining and utilization of data clear and accessible to consumers, without any extra jargon or legalese. Data subjects, then, have the right to withdraw their consent for the collection of personal information at any time. Data subjects also have a right to know exactly how, when, where and for what purpose their personal data is being processed by their data controller, and should be able to ask for this any time. Finally, under the right to be forgotten, data subjects can request complete erasure of his or her personal data from a controller, should it fall under the conditions for erasure. The GDPR also introduces data portability, under which subjects can transmit their personal data to another controller should they wish.

-

Breach Notification Requirements. Organizations that experience a data breach that may “result in a risk for the rights and freedoms of individuals” must report the breach within 72 hours after first awareness. Data processors must also notify their customers, the controllers, “without undue delay.”

-

Privacy by Design. Under the GDPR, organizations must adhere to “privacy by design,” which means that they must design systems with the idea of data protection in mind from the beginning. Article 23 calls for data minimization, stating that organizations should only process the minimum amount of data needed. Access to personal data should also be limited.

-

Data Protection Officers (DPO) Appointment. Organizations that require the regular monitoring of data subjects on a large scale or of special categories of data or data relating to criminal convictions must assign a Data Protection Officer (DPO) responsible for internal recordkeeping and monitoring.

-

Penalties. Data controllers or processors that do not comply with the GDPR are subject to be fined 4 percent of their annual global turnover or €20 Million, whichever is greater. This is the maximum amount, and a tiered approach exists for lesser breaches.

Tech companies that handle European consumer data will need to pay close attention to both data privacy and cyber in 2017, ensuring their organizations update their data privacy policies and processes accordingly and implement the proper cyber defense tools. With both data controllers and processors under the GDPR’s jurisdiction, tech companies will need to be especially mindful when vetting third-party data managers to decrease the risk of a cyber-attack.

“For U.S. technology companies, balancing domestic regulations with GDPR provisions will be a challenge, as CFOs are voicing. Updating risk models, protocols for handling data, and contract terms and conditions is a smart first step. From there, entities should be prepared to share a comprehensive analysis of their data flow, access, use and security controls.” - Judy Selby, managing director in BDO’s Technology Advisory Services practice

Tech Works to Grasp RevRec

The 2018 compliance deadline for the Financial Accounting Standards Board (FASB)’s new revenue recognition accounting standards is approaching for public entities, with private entities following suit a year later. But our survey still shows an education gap on the standards within the tech industry.

CFOs familiar with the new standards and those who are not are nearly split—with just more than half (53 percent) saying they are familiar, and 47 percent saying they are not.

The standards, ASC Topic 606 Revenue from Contracts with Customers, will require companies to determine revenue recognition based on five steps: identifying the contract; identifying separate performance obligations; determining the transaction price; allocating the transaction price to separate performance obligations; and recognizing revenue when the entity fulfills performance obligations.

The changes will require tech CFOs to carefully analyze the changes and outline their path to compliance ahead of the 2018 (public) and 2019 (private) deadlines. More than three-fourths (81 percent) of tech CFOs say they have already analyzed the revenue recognition changes, and 61 percent have sought guidance on implementation, with 15 percent even adding resources for such.

Tech CFOs have also grown more decisive about which method of transition they will use under revenue recognition adoption: Just 19 percent say they have yet to decide between full retrospective and prospective adoption, a noticeable decline from 45 percent in 2016.

Most (37 percent) say they are likely to choose prospective adoption, while just 4 percent say they are likely to adopt full retrospective. Just a year ahead of the initial compliance deadline, 40 percent say they are still trying to understand the new standards before deciding.

The new standards give entities the option of full retrospective, which requires monitoring revenue in the year of adoption plus two prior years, or prospective, which requires monitoring revenue only in the current year with disclosure of what current revenue would have been under the prior FASB guidance.

The outlook for the tech industry in the year ahead is bright. But companies should stay abreast of potential policy changes and their implications amid a volatile political environment as a new administration looks towards the future.

The 2017 BDO Technology Outlook Survey is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly to chief financial officers (CFOs). Market Measurement used a telephone survey performed within a scientifically-developed, pure random sample of U.S. technology companies in the software, hardware, telecommunications, internet and information technology services subsectors.

SHARE