How Interest Rates, Inflation, and Geopolitical Uncertainty Influence TMT M&A Valuations

Technology, media, and telecommunication (TMT) companies are keenly aware of rising inflation and interest rates. Their influence on valuations is an eagerly discussed topic for both companies and investors.

The new uncertainties present novel challenges to management teams who have rarely been confronted with similar market conditions. Thankfully, existing tools, initiatives, and strategies can be repurposed and be part of the toolbox for mitigating these risks.

The rising storm

Inflation has been on the rise in many countries. 39 out of 46 countries analyzed by Pew Research saw increased inflation between Q3 2020 and Q3 2021.

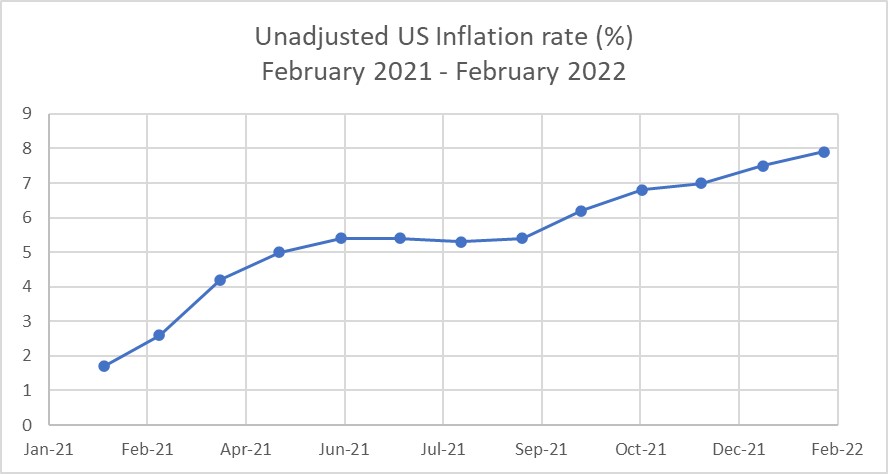

In the US, unadjusted inflation hovered around 8% at the end of February, according to Statista data. Similarly, UK inflation hit a 10-year UK high of 5.1% in November 2021. It continued to rise, hitting 6.1% in February.

Data: Statista, Graph: BDO Global

This is far beyond the Federal Reserve’s stated 2%-mark for healthy inflation.

Central banks across the globe are reacting to increased inflation by raising interest rates. In March, the US key rates were raised by 0.25% to 0.5%. It follows similar moves by, among others, Great Britain, South Korea, New Zealand, and South Africa.

Simultaneously, supply chain risks and production prices are increasing.

It may seem like a perfect storm for TMT companies and investors, further complicating areas like earnings forecasts already affected by COVID-19, the ongoing US-China trade conflict, computer chip shortages, and more.

TMT valuations and M&A under stress?

Rising inflation and interest rates can influence M&A and valuations in a variety of ways:

-

Debt financing acquisitions becomes more costly

-

Inflation can lower real returns on investments

-

Asset divestment can become more difficult

-

Generating returns can become increasingly difficult

In short, increased financial uncertainty and longer-term rising interest rates and inflation tend to impact valuations negatively.

In short, concerns are that M&A valuations will be challenged after a decade defined by stable, low interest rates and rising valuations. The last time worldwide median target EV/EBITDA multiples were below their 30-year average was in 2014.

Some reports back up the point of view, indicating that M&A values, and average valuations, are falling.

However, the effects are nowhere near universal.

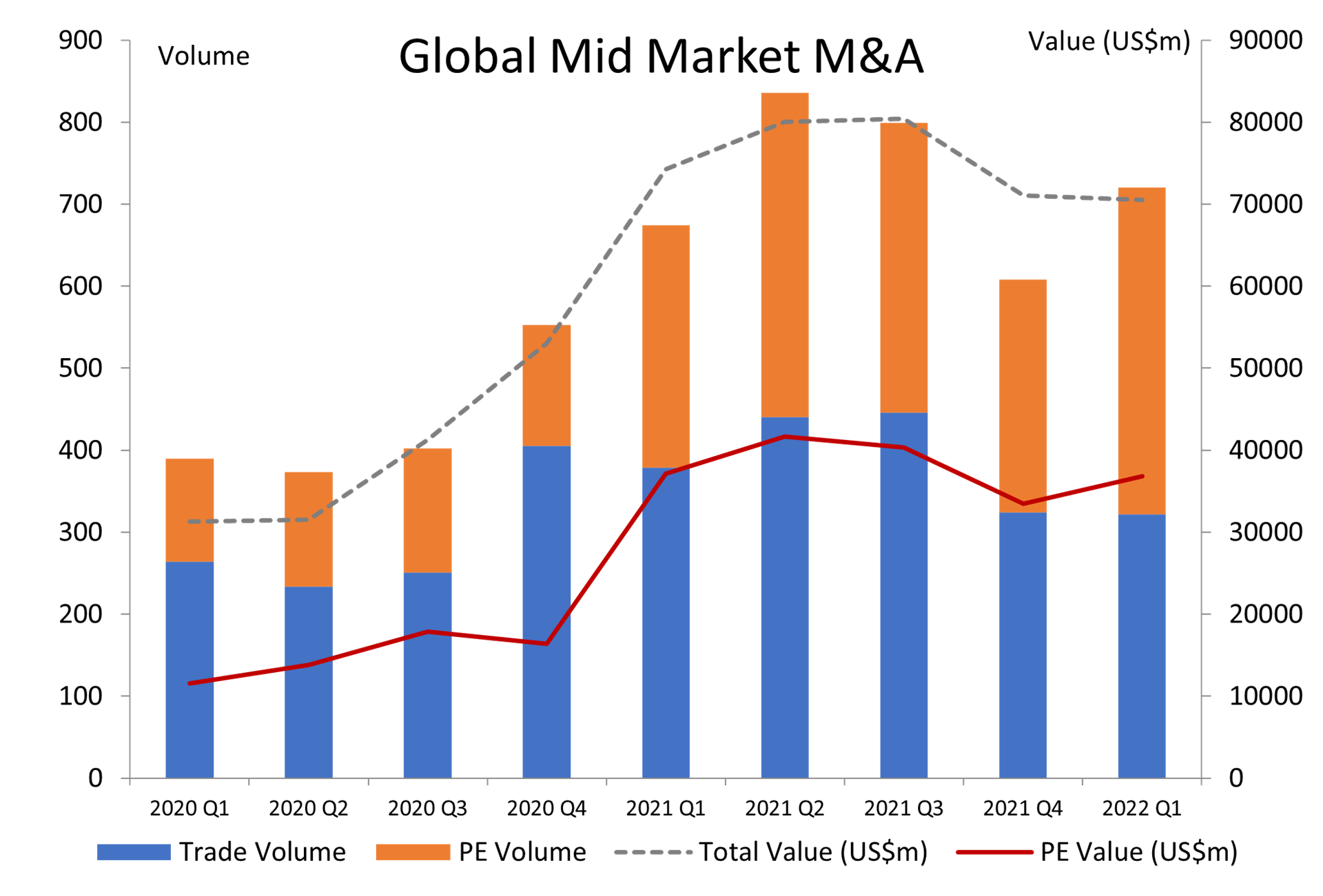

Data: BDO Horizons. Graph: BDO Global

As BDO’s Horizons report for global mid-market TMT M&A shows, the average value of deals may have changed, but mid-market TMT deal activity is up – hardly an indication of reticent investors.

Other research shows that valuations in some sub-industries, for example cybersecurity, have been on the rise.

Different future scenarios

The above data points can seem confusing. Yes, valuations may be challenged, but investors remain positive. Part of the explanation likely that markets and investors have different takes on the level and length of inflationary and interest rate pressures and the influence of geopolitical uncertainty.

Most analysts, broadly speaking, look at three different scenarios:

-

Scenario 1: Current inflation levels are temporary. Supply chain issues will dissipate and minimally impact overall price developments. Interest rates and inflation will soon return to pre-pandemic levels. Companies and investors keep focusing on M&A, human capital, and developing supply chains.

-

Scenario 2: Inflation rates of 3-4% continue for at least a couple of years. Supply chains, energy prices, and increased production costs remain significant factors. Companies will focus on performance improvements. Some companies and investors may look to immediately access inexpensive debt to pursue acquisitions to expand markets and improve efficiency.

-

Scenario 3: Inflation stays highly elevated (8% to 9%) for an extended period. Interest rates rise globally, leading to a severe decrease in the money supply. Supply chains remain stretched as production costs continue to rise. Companies look to diversify and focus on cost savings to weather the fall-out.

Are TMT industries protected?

Analysing each scenario and its likelihood in detail could fill a book. To briefly summarise much of the current thinking:

While much remains uncertain, the most likely future scenario sees inflation and interest rates hikes as short to mid-term factors. One reason is that while there is inflation, there are arguments for it being ‘reflationary’ in nature. The pandemic shocked the world economy, and inflation is more about getting ‘back on track’ than a stand-alone phenomenon.

From a valuations standpoint, some industries are more vulnerable to the direct results of the developments than others.

For example, manufacturing is more likely to be impacted than technology, media, and telecoms.

The reasons include that TMT solutions are core to mitigating the fallout of any of the scenarios mentioned above.

A great analysis from BDO Canada shows how this has contributed to technology companies’ valuations during the pandemic.

| Industry | EBITDA Margin March 2020 |

EBITDA Margin September 2021 |

|---|---|---|

| Software | 14.4% | 18.2% |

| IT Solutions | 9.0% | 17.8% |

| Telecom | 6.6% | 12.5% |

| Media | 19.4% | 24.0% |

Mid-market TMT valuations in North America, March 2020 compared to September 2021. Analysis and graph: BDO Canada

Furthermore, investors may view TMT companies, especially in the mid-market, as more robust and resilient to the current pressures. Combined with immense potential for future growth, it makes TMT companies especially attractive targets.

In other words, it may be that some TMT valuations are down, but they are likely to bounce back quickly from a dip. Furthermore, investors remain extremely interested in TMT investments. Investors are sitting on massive dry powder stores and show strong interest in TMT investments. 89% of M&A executives say they expect to see deal activity in 2022 match or surpass 2021.

So, attractive TMT targets are likely to see high M&A valuations – if they are correctly prepared for the deal process.

Disruptive experience

This is not to dismiss the issues facing all industries, including TMT. Nor are TMT insulated from the effects of rising interest rates, inflation, supply chain issues or rising prices on fuel and materials.

For example, rising nickel prices directly impact battery production, affecting the whole EV industry. The same goes for chip shortages.

However, TMT companies and investors are, more so than others, used to working in spaces defined by rapidly-changing risks, disruptive changes, and novel economic scenarios.

One example is how broadband prices continue to drop – even during high inflation. Part of the reason is internal industry competition and part how technology keeps making things cheaper. However, another part of the answer is new telecommunications services disrupting the old by offering broadband via satellites.

Retooling and aligning

Navigating such uncertainties and potential disruptions do not (always) necessitate completely new tools or approaches. Instead, it can happen through realigning and developing existing tools, including production management, risks mitigation strategies, future projections, and financial setups.

Examples include:

-

Financial: Revisit capital structures, manage costs, redistribute capital within the company.

-

Solutions: Lower production costs, re-engineer value proposition, expand offerings (including through acquisitions).

-

Customers: Look at contract renegotiations, refocus sales and restructure product/solution deals.

-

Projections: Restructure balance sheets, revisit future earnings scenarios and projections.

-

Geopolitical and supply chain uncertainties: Continual analysis of impacts and aligning resilience strategies.

While the tools are familiar, applying them to interest rates and inflation is likely new territory for management teams. Therefore, one of the core pieces of advice to companies is to use your advisors. Their financial experience and expertise can provide you with many different insights that can help develop the company, mitigate potential risks, and increase your profitability - and thereby your valuation.

SHARE