To Compete in Fintech, Banks Must Build on Pandemic-Driven Digital Transformation

Lockdowns during the pandemic precluded face-to-face transactions at bank branches, forcing even “late adopter” banking customers to embrace digital banking and compelling financial institutions to roll out digital alternatives for those transactions—sometimes overnight. When the pandemic eventually subsides, banks may be tempted to rein in those digital transformation initiatives. That would be a mistake—while many effects of the pandemic will fade, the shift to digital banking is permanent.

In fact, according to a Plaid/Harris Poll survey, 73% of Americans consider fintech solutions to be “the new normal,” with 67% planning to continue using these solutions even after the pandemic ends. And while the industry’s early-pandemic agility was admirable, legacy banks still aren’t keeping up with consumers’ rapidly-evolving expectations. Financial institutions need to look beyond just offering digital counterparts for teller-window transactions. To stay competitive, banks must accelerate the development and acquisition of proprietary fintech applications to enhance the customer experience, encourage customer conversion and support selling and cross-selling. As a recent Javelin research report concluded, “From this point on, success increasingly will be measured by how wisely financial institutions pick and promote features that deepen digital entanglement.”

Here are three questions banks need to explore as they look to seize fintech opportunities in 2021.

1. What are your current capabilities and what technology solutions should you deploy next?

Before the pandemic, many banks had mobile apps and web portals that allowed customers to check account balances, view electronic statements, schedule automatic bill payments and transfer funds. Some financial institutions offered more advanced services, like remote check deposits. However, bricks-and-mortar banks still required customers to open accounts and apply for loans in person. When lockdowns forced branches to close, financial institutions scrambled to roll out solutions that would allow customers to carry out those functions remotely. This sudden progress, however, has only gotten them on the same lap as digital-only online banks and lenders, which have been offering these services for more than a decade. Fintechs are still far ahead in the innovation race.

So how can you maintain the momentum and continue to close the gap? First, take stock of the digital banking features you offer, then look around at what both traditional and fintech competitors are doing. Are there digital banking services or solutions that you implemented during the pandemic that could be enhanced, expanded or repackaged to match those competitors’ feature sets? A quick and relatively easy win can help generate the enthusiasm and support you’ll need to undertake bigger changes and challenges.

Next, analyze customer data and feedback to help identify which fintech solutions to prioritize for development and support. This will be easier for banks that have mature digital capabilities for their customers, as they’ll have more customer profile and behavior data to work with. If you find your data collection and analysis capabilities lacking, this may be an area to consider focusing on first. Robust data analysis supports artificial intelligence technology, enables product “bundling” and makes selling and cross-selling campaigns more effective.

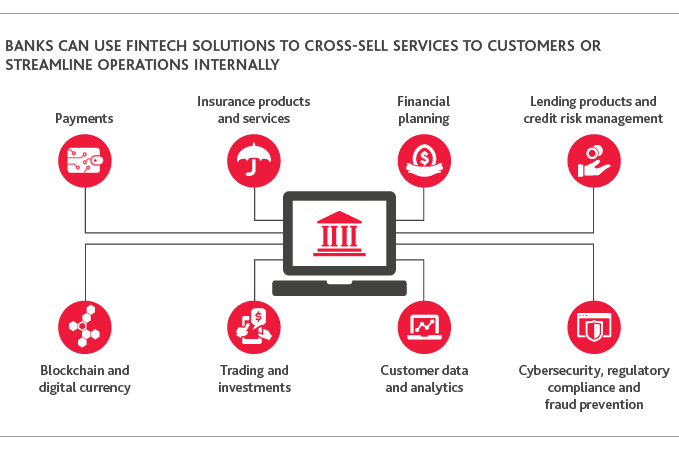

While most fintechs are focused on one segment of the industry—like payments or mortgage lending—there is a preference by consumers to use a single platform to perform multiple financial transactions. Traditional banks have the existing customer base, domain expertise and available capital to invest in bundling services and becoming that “one-stop shop.” Financial institutions need to be aware, however, that they’re not the only ones bundling to meet this one-stop shop consumer preference. Niche fintechs are joining forces to offer complementary products, developing new capabilities in-house and even acquiring banks to expand their share of customers’ consumption of financial services.

Just as important as what you offer is how effectively you communicate those features to current and prospective customers. Highlighting fintech capabilities will improve customer acquisition and retention, especially among members of the Millennial and Gen Z generations who have embraced stand-alone fintech applications like Zelle and Venmo to conduct financial transactions. In addition to traditional sales and marketing efforts, consider calling attention to your bank’s association with well-known fintech providers. For example, Bank of America announced that in Q2 2020, Zelle payment traffic increased 70% year over year. AI tech and data analysis can support up-selling and cross-selling of elements of these bundles and bolster customer awareness of a bank’s full range of products and features.

Any new digital solution or initiative should support the organization’s overall digital strategy, and be evaluated on how it fits holistically with the bank’s people, processes and technology. You’ll also need to consider any downstream effects of the new capability, including potential regulatory or compliance issues, the total cost of ownership and how new products or features will impact existing sales and marketing initiatives, such as customer incentives and rewards.

2. What is the best approach to integrate fintech capabilities into my organization?

Once you’ve identified the need for a new digital banking solution or product, how do you figure out the best way to bring that capability to fruition for your organization? Generally, there are three options: Build, buy or partner.

Due to the costs, complexity, talent and protracted timing issues of either building or buying solutions, many traditional banks are opting to partner with fintechs to acquire the capabilities they’re looking for. In fact, according to CB Insights, in 2020, U.S. banks continued to make deals with fintech companies at a rapid clip in part for that reason, despite continued uncertainty around COVID-19.

There is also an opportunity to partner with other fintech providers under a co-branding or a white label approach. And partnering can work in two directions: A number of community banks have taken to partnering to offer financial services or lending products via a fintech that they haven’t traditionally offered, such as installment loans. Partnering with a fintech can also provide banks with turnkey access to technology, such as credit risk assessment tools, to streamline internal processes. The advantages to partnering with a fintech or licensing their technology are primarily the speed at which the solution can be deployed for the licensee’s customers, the lower cost of accessing the technology and the ability to get out of a relationship relatively easily if the technology does not meet expectations. Drawbacks include the complexity of partnership or licensing agreements. For example, some of the questions that must be addressed include who owns the data produced by the technology, and what rights of access will the licensee have?

Another option is to form an alliance with a digital-first bank. Digital-first banks, also known as challenger banks, are a byproduct of legacy banks’ pre-pandemic sluggishness in adopting fintech solutions. Digital-first banks, like Revolut, SoFi, Nubank and Chime, operate digitally without any branches. They offer basic banking services like checking and savings account and money transfer services that are stripped down to allow for reduced fees and higher interest rates for their customers. They were borne out of one of the main pre-pandemic complaints about traditional banks—opening an account was too time-consuming and had to be done in-person at a bank branch. Because most digital-first banks are not chartered as banks with state or federal regulators, however, many align themselves with traditional banks so that they can offer FDIC insurance on their customers’ deposits.

3. How do I create a competitive advantage in fintech?

To compete against their peers—both stand-alone fintech companies as well as traditional competitors—banks must embrace continuous innovation. That means constantly identifying new fintech opportunities and seamlessly embedding those solutions into service offerings and operations. As Dee Choubey, CEO of digital-first bank MoneyLion, said in a recent Forbes magazine article, “we have to be a product factory” in order to retain and attract customers. While new products are the end-goal, the process of nurturing projects throughout the lifecycle of your broader initiative is just as important. The time, money and effort invested in developing a new capability can go to waste without the support of a robust change management regime that guides employees through this process.

Here are best practices for implementing a successful change management strategy:

- Internally, the organization needs a senior-level champion to help drive firm-wide buy-in, learning and adoption.

- The organization must agree on the anticipated ROI. KPIs for revenue protection and generation, cost containment, risk mitigation and other factors must be established with that ROI in mind.

- The organization must devise a timeline for implementation, with quick wins and incremental milestones along the way, and measure success against these on an ongoing basis.

- Human resources teams will need to have a place along the initiative’s lifecycle to help determine if new talent needs to be acquired to help the bank optimize the new fintech capabilities, or if it’s sufficient for current employees to be re- or up-skilled through training and continuing education programs.

- The legal and compliance departments must have ongoing input into any innovations that might affect bank adherence with Bank Secrecy Act/Anti-Money Laundering, Beneficial Ownership/Customer Due Diligence, Regulation CC and Current Expected Credit Loss regulations—among other local, state and federal rules—as part of overall risk management efforts.

- Similarly, IT will need to be involved to ensure that any new or enhanced technology solutions are protected against cyber threats and adhere to government regulations on the collection and use of personal data.

- Design teams have to ensure the new digital initiative is supported by good CX (customer experience) and user-centric design. The goal should be to aim for a seamless, omnichannel customer experience across platforms.

To paraphrase an old saying, “no plan of implementation survives first contact with the customer,” which is to say that managers and frontline staff will have to be agile and adaptable as each initiative is launched and expectations meet reality. Staff must be incentivized to relay feedback about customer responses and concerns back up the management chain, while support teams in IT, design and marketing use data analytics to infer customer reactions and make improvements as needed.

For more information on developing a change management culture in your organization, click here for BDO insights.

Building on the momentum in innovation necessitated by the pandemic, banks are faced with an endless range of options to enhance the products and features they offer current and prospective customers. The one option they can’t afford to choose is to stand still.

With fintechs breaking out of their niches by joining forces and acquiring banks, and digital-first banks offering customers no-frills, lower cost options, the window of opportunity for financial institutions to leverage their biggest competitive advantage as a one-stop shop is closing. Banks need to accelerate the development and implementation of fintech solutions that enhance the customer experience—not only to fend off competition from the fintech industry, but also from other banks. They must also be cautious and deliberate in the shape, size and manner of change they undertake. Done right, legacy banks would be in a position to not only play defense against fintechs, but also go on the offense in expanding their capabilities and protecting their revenue and market share.

SHARE