New Markets Tax Credits: Funding that Fuels Economic and Social Impact

Businesses in low-income communities often can improve conditions for residents — and securing proper funding can significantly enhance their ability to do so. Since 2000, the New Markets Tax Credits (NMTC) Program has distributed more than $136 billion to revitalize underserved communities, typically in alignment with local social initiatives. Despite its long-standing availability, this form of tax credit financing is often overlooked as a source of cash for project development.

The following insights may bring some clarity regarding the program and the opportunities it offers.

Economic Development Tax Credits for Low-Income Community Investment

The NMTC program was enacted as part of the Community Renewal Tax Relief Act of 2000, and incorporated into the Internal Revenue Code as Section 45D. Since then, it has provided funds, most often in the form of tax credit-subsidized loans for Community Development Entities (CDEs) to distribute to businesses with projects located in low-income communities. Projects must offer specific benefits, such as job creation, better healthcare options, development of renewable energy sources, enhanced nonprofit services, and other resources that benefit local residents. NMTC loans offer preferential terms, such as no principal repayment during the seven-year compliance period, lower interest rates than traditional financing, and typically, forgiveness of the principal after seven years.

How the NMTC Program Works

Parties Involved

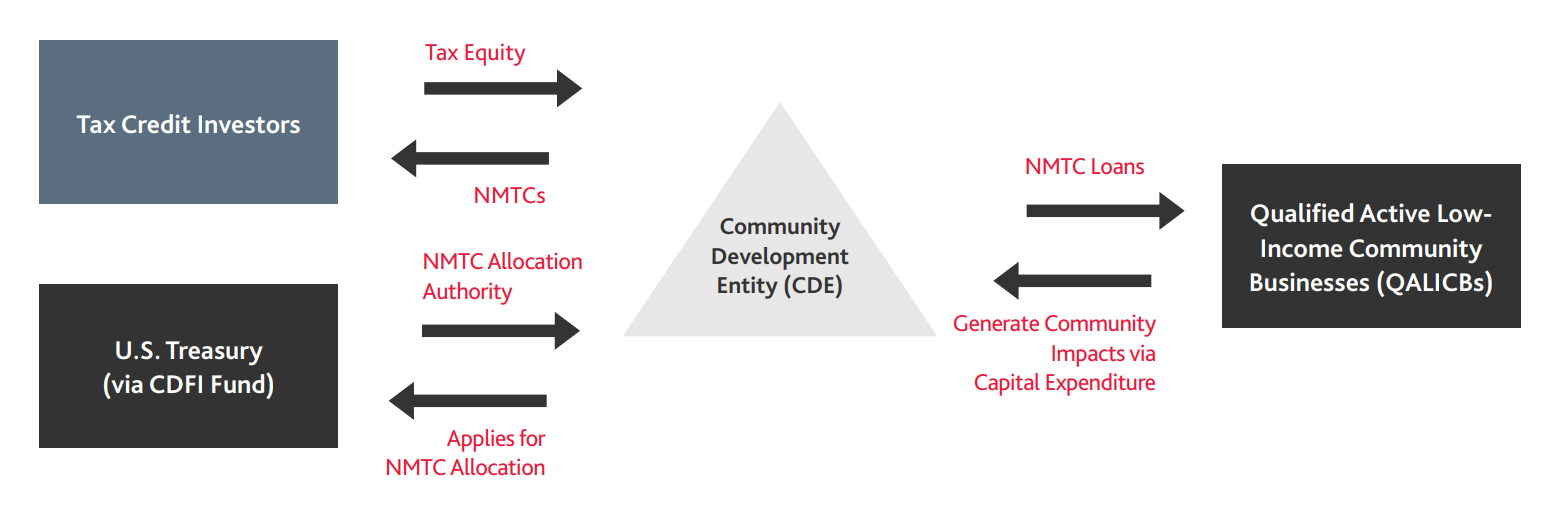

The NMTC program involves several key players who work together to stimulate economic growth in low-income communities. These players include:

- The Community Development Financial Institutions (CDFI) Fund, a part of the U.S. Department of the Treasury, is responsible for administering the NMTC program. The CDFI Fund awards NMTC allocations to CDEs.

- Community Development Entities (CDEs) apply for NMTC allocations and then distribute the funds to projects in low-income census tracts. CDEs act as intermediaries, channeling the tax credit investments to where they are most needed. They are responsible for ensuring that the investments meet the program's objectives and comply with regulatory requirements.

- Tax Credit Investors are private investors or financial institutions that provide capital to CDEs to fund NMTC loans. The investors receive a financial return in the form of tax credits purchased at a discount, which can be used to offset the investor’s federal tax liabilities. The NMTC is a 39% statutory credit, which is calculated based on the portion of the project being subsidized. This incentivizes private investment in low-income communities, leveraging public funds to attract private capital.

- Qualified Active Low-Income Community Businesses (QALICBs) are the businesses or projects located in low-income communities that need funding. QALICBs are the primary beneficiaries of the NMTC program, using the funds they receive to support operations, expand services, or undertake new projects that can create jobs and have a positive impact on the local economy.

Each participant in the NMTC program plays a crucial role. By working collaboratively, these participants funnel funds to help drive economic development and improve the quality of life in underserved areas.

Application Process for QALICBs

Applying for the NMTC program involves several steps that help ensure the funding is allocated to projects that will have a meaningful impact on low-income communities, including the following key stages:

Throughout the process, the NMTC program ensures that investments are directed towards projects that can deliver significant economic and social benefits to low-income communities.

Advantages of Early Application for QALICBs

In a program as highly competitive as the NMTC, applying early can make the difference between securing a portion of the limited funds available or missing out on crucial funding opportunities. Early applicants are often better positioned to take advantage of available opportunities, and additional benefits may be possible for those who act swiftly.

- Better Planning and Execution: Securing funding in advance may allow businesses and developers to improve efficiency, allocate resources more effectively, set realistic timelines, and deal with potential challenges proactively.

- Enhanced Investor Confidence: Receiving NMTC funds early can demonstrate that the business is well-prepared and forward-thinking. Investors may be more likely to commit to a project that is well-planned with a clear roadmap.

- Alignment with Community Needs: The allocation of NMTC funds can indicate that a developer is more vested in engaging with community stakeholders and aligning their project with their priorities.

However, even businesses committed to community improvement may find the application process daunting, especially when navigating it alone.

Applying for Benefits Through the NMTC Program

Could Your Community-Based Project Use Additional Financing?

Securing the funds needed to fuel community improvements is an ongoing and complicated process. When combined with other financing, the NMTC program can provide your project the cash it needs to reach its ultimate goals. Since the path from application to approval can be challenging, it helps to have the assistance of professionals who know the way. BDO’s deep experience with the NMTC program and related tax consulting issues allows us to assist potential NMTC recipients through the entire process, from initial planning and application through transaction closing and post-allocation reporting. Contact our Business Incentives & Tax Credits team to learn more.

SHARE