R&D Tax Credit FAQs For Large and Small Businesses

The federal R&D tax credit benefits large and small companies in nearly every industry. Common questions and answers related to the R&D tax credit and those specific to small businesses are outlined below.

- What is the R&D tax credit?

- What are the benefits of the credit?

- What activities qualify?

- What expenses qualify?

- What companies can benefit?

- What are some industry examples of the R&D credit?

- My R&D department is small, or I don’t even have an R&D department. Is the R&D credit worth pursuing?

- I’m not paying income taxes this year. Can I benefit?

- I’m a startup and don’t expect to pay tax for years. Can I benefit?

- What if I pay alternative minimum tax? Can I benefit?

- Why don’t some companies claim the credit?

- How do you calculate the R&D tax credit?

- Can I offset states taxes as well as federal taxes?

- How do I claim the R&D tax credit?

R&D FAQs for Small Business – Path to Payroll Tax Credit

- Does a company have to be a “startup” or “small business” to be eligible for the payroll offset?

- Can companies formed more than five years ago benefit for the payroll offset?

- Are companies that use professional employer organizations (PEOs) eligible for the payroll offset?

- When do I claim the payroll tax offset?

- How do I claim the payroll tax offset?

- What does $5 million in “gross receipts” mean for the payroll offset?

- What if a company can’t use the payroll offset this quarter?

- What if a company has a short taxable year in 2016 or another relevant year?

- What FICA taxes can be offset by the R&D credit?

- What are some examples of the benefit?

What is the R&D tax credit?

Created in 1981 to stimulate research and development (R&D) in the United States, the R&D tax credit is a dollar-for-dollar offset of federal income tax liability and, in certain circumstances, payroll tax liability. Most states provide a similar credit, making the average potential benefit of the federal and state credit in the range of 10-20% of qualified spending. Last year, more than an estimated $18 billion in R&D credits were reported by businesses in almost every industry.

Reflecting the reason for its enactment, the credit’s statutory, IRC Section 41 name is “Credit for Increasing Research Activities,” although it is also more frequently known in the industry as the “R&D Credit,” “Research & Experimentation Credit” or “R&E Credit,” or simply “research credit.”

The R&D credit equals the sum of amounts calculated using two different kinds of expenses: (1) qualified research expenses (QREs) and (2) basic research payments (BRPs).

Generally, both types of expenses relate to activities performed in the U.S. to advance U.S. technologies. They differ as follows:

| Expenses must relate to: | BRPs | QREs |

|

Yes | No |

|

Yes | No |

|

Yes | No |

QREs must explicitly be for specific commercial objectives. QREs don’t have to be for original investigations for the advancement of scientific knowledge; they can be derivative or duplicative investigations. Furthermore, QREs don’t have to be for the advancement of scientific knowledge; they can be for product, process, and software development or improvement.

Although U.S. corporate taxpayers reported almost $400 million of BRPs in the last year for which the IRS has reported statistics (2013), taxpayers reported far more federal QREs that year, over $470 billion, which is more than 99% of that year’s R&D-creditable expenses.

If you or your company made or is making QREs or BRPs, you may be eligible for R&D credits, whether your activities succeed or not.

These FAQs relate to the QRE-based R&D credit. For more information about the BRP-based credit, please contact us.

What are the benefits of the credit?

- Increased cash flow

- Increased earnings per share

- Increased return on investment

- Reduced federal and state tax liability

- Reduced effective tax rate

What activities qualify?

In general, activities qualify if they meet each element of a “four-part test” and aren’t excluded.

Four-part Test

- Qualified purpose. The purpose of the activity is to improve the functionality, performance, reliability, or quality of a product, process, software, technique, invention or formula that is intended to be used in the taxpayer’s business or held for sale, lease or license (component).

- Technological uncertainty. The taxpayer encounters uncertainty regarding whether it can or how it should develop the component, or regarding the component’s appropriate design.

- Process of experimentation. To eliminate the uncertainty, the taxpayer evaluates alternatives through modeling, simulation, systematic trial and error, or other methods.

- Technological in nature. The success or failure of the evaluative process is determined by the principles of engineering, physics, chemistry, biology, computer science, or similar natural or “hard” science, as opposed to principles of, e.g., economics, social sciences generally.

Don’t you have to achieve a major scientific breakthrough or do revolutionary or pioneering research to qualify?

No.

This misconception has at times been encouraged by poorly conceived administrative guidance. Fortunately, after a few years, the agency responsible for the guidance became aware that the guidance was misleading and unfounded.

Activities don’t have to succeed to qualify. Generally, they have only to attempt to discover technological information lacking to a taxpayer who is trying to develop or improve a business component’s functionality, performance, reliability, or quality by systematically evaluating whether or how it could do so, or the component’s appropriate design.

What activities don’t qualify?

Some activities are excluded because they weren’t judged to incentivize an increase in the kind of R&D in the U.S. the credit was designed to stimulate.

Excluded activities include:

- Research conducted outside the U.S.

- Routine data collection or ordinary testing for quality control of existing components

- Market research

- Management

- Consumer preference testing

- Research “funded” by an unrelated third party, i.e., for which the taxpayer either doesn’t retain rights to the results of the activity or necessarily have to pay for the activity because an unrelated third party is contractually obligated to pay for it, even if the activity fails to produce the desired result.

Other activities that don’t qualify because, generally, they don’t meet the four-part test:

- Administration

- Training

- Repairs and maintenance

- Preproduction planning for a finished component

- Tooling-up for production

- Trial production runs

- Trouble shooting

- Accumulating data relating to production processes

- Activities relying on the social sciences, arts, or humanities

- Research after commercialization

- Adapting existing components to a particular customer’s need

- Duplicating an existing component via reverse engineering

Important note: If an activity above meets the four-part test, it likely qualifies. If the IRS examines the activity, it may subject it to greater scrutiny, but the key question is whether the activity meets the four-part test.

Can software development activities qualify?

Yes. Activities to develop software to be held for sale, lease, or license that meet the 4-part test above and that are not statutorily excluded can qualify.

Activities to develop software intended “primarily for internal use” must meet additional requirements but can also qualify.

What expenses qualify?

- Taxable wages for employees who perform or directly supervise or support qualified activities.

- Cost of supplies used in qualified activities, including extraordinary utilities, excluding capital items or general administrative supplies.

- 65%-100% of contract research expenses for qualified activities, provided the taxpayer retain substantial rights to the activity’s results and must pay the contractor whether it succeeds or fails.

- Rental or lease costs of computers used in qualified activities, e.g., payments to cloud service providers (CSPs) for the cost of renting server space to develop or improve a component.

What companies can benefit?

In general, any company—in any industry and of any size—that invests in activities of the kind outlined in this FAQ can benefit if in the course of carrying on a U.S. trade or business the company paid, pays or expects to pay:

- Regular federal income tax;

- A similar state tax in one of the more than 40 U.S. states that provide for incentives for R&D and R&D-related investments; or

- In certain circumstances outlined below, federal payroll tax; or

- Similar taxes in one of the more than 35 non-U.S. countries that also provide for such incentives.

Industry generally doesn’t matter: Although most R&D credits are claimed by companies in manufacturing (usually 60-70% of total credits claimed), information (15-20%), professional, scientific, and technical services (10-15%), wholesale and retail (5-10%), and financial and insurance (5%), millions of credits are claimed each year by companies in other industries, including natural resources, like mining and oil-and-gas; services, e.g., health, entertainment, administrative, and hospitality; architecture and construction; real estate, rental, and leasing; transportation and warehousing; agriculture; forestry; fishing and hunting.

And size never matters: Businesses with $0 in sales and one employee can have significant R&D credits.

What are some industry examples of the R&D credit?

Any company, in any industry, that has devoted resources toward developing new products, processes, or software –whether successfully or not –is eligible. For examples and more detail, check out our resources for the following industries: manufacturing, technology, life sciences and healthcare.

My R&D department is small, or I don’t even have an R&D department. Is the R&D credit worth pursuing?

Probably.

Even companies with small or no R&D department may benefit from the credit. In fact, most taxpayers who benefit from the R&D credit don’t have departments explicitly named “R&D Department.”

The time and cost to estimate your R&D credit is generally very small relative to the benefit in most cases.

I’m not paying income taxes this year. Can I benefit?

You may still be able to benefit currently from your R&D credits.

Startup taxpayers in certain circumstances may offset up to $500,000 of their federal payroll tax liability using R&D credits.

Many states provide credits that are refundable, i.e., states pay the amount of the credit as a refund whether you’re paying income tax now or not.

And if you don’t owe income taxes this year but paid income taxes last year, you can carry your credit back to the preceding year to offset some or all of that year’s tax liability.

If you don’t owe income taxes this year or last year, you might not be able to benefit from the credit this year. You still can carry it forward to future years, up to 20 years forward for federal and some state R&D credits, and even indefinitely forward for other states, e.g., California.

I’m a startup and don’t expect to pay tax for years. Can I benefit?

Startups may use R&D credits against up to $500,000 of their payroll taxes in five separate taxable years—a total of $2,500,000—if they have:

- Gross receipts less than $5 million in the taxable credit year; and

- No gross receipts for any of the four preceding taxable years.

What if I pay alternative minimum tax?

Smaller companies may use R&D credits against the alternative minimum tax (AMT) provided they:

- Are not a public company; and

- Have $50 million or less in average gross receipts for the preceding three tax years.

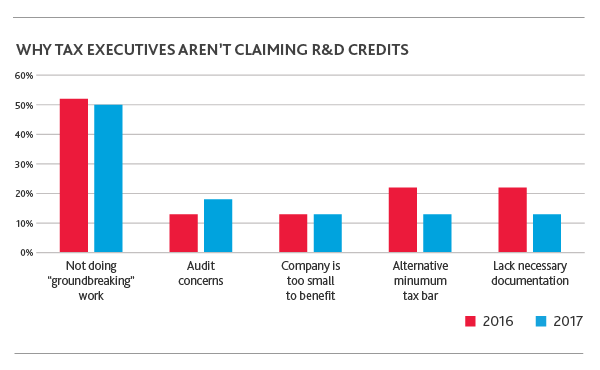

Why don't some companies claim the credit?

Some aren’t eligible. Many more, though, are eligible but have a misunderstanding about the credit.

For example, many executives have told BDO that they weren’t claiming R&D credits because:

Source: 2017 BDO Tax Outlook Survey

Happily, these reasons are incorrect or overstated:

- Far from needing to be “groundbreaking” to qualify, activities don’t even have to succeed to qualify.

- Claiming credits on an original return doesn’t mandate a tax audit.

- The size of a company isn’t directly relevant to the size of its credits, which is calculated based on qualified spending, not sales. In the last year for which the IRS has published statistics, almost 250,000 corporations with receipts under $25,000,000 reported R&D credits.

- There are no specific documentation requirements to claim the credit; numerous court cases—including by the U.S. Tax Court—have affirmed that R&D credits can be substantiated with oral testimony.

How do you calculate the R&D tax credit?

Generally, there are two methods for computing the QREs-based credit, regular and alternative simplified.

The two methods are the same in that they both calculate the credit as a percentage of the excess of qualified spending in the year for which the credit is being calculated over a “base amount.” For this reason, these credits are sometimes called “incremental” credits.

The credits are different in three ways.

- Rates - The Regular Credit’s (RC’s) statutory rate is 20%, the Alternative Simplified Credit’s (ASC’s) is 14%.

- Important note: The RC’s higher rate does not mean that a particular taxpayer’s RC will always be greater than its ASC. Its RC could be greater, but it could be much lower. This is because the RC and ASC calculate their “base amounts” differently.

- Base Amounts – The RC’s base amount is calculated using the taxpayer’s gross receipts and QREs; the ASC’s base amount uses just QREs, hence its name, “Alternative Simplified Credit.” In some cases, the gross receipts a taxpayer needs to calculate its RC relate to tax years from as remote as the 1980s, which is part of the reason more and more taxpayers are electing the ASC.

- Election - The ASC must be elected for a tax year either on an original return by simply completing the ASC section of the Form 6765 on which all federal R&D credits are reported, or on an amended return, whereas the RC does not have to be elected under any circumstances, just reported or claimed.

- Important note: A taxpayer may elect the ASC on an amended return only if (1) the taxpayer has not previously claimed an RC on its original return or an amended return for that tax year, and (2) that tax year is not closed by the period of limitations on assessment under IRC Section 6501(a).

Can I offset state taxes as well as federal?

Yes.

Most states offer a credit for expenditures to attempt to develop or improve a product, process, or software, and most adopt or follow rules similar to those of the federal R&D credit.

Some states require taxpayers to file an application other than just the tax return on which the credit is claimed to be eligible for their credits. Some also limit their credit to certain industries or the amount of credits that will be allowed each year.

In many cases, though, state credits are even more generous than the federal credit. For example, some states have higher credits rates; or they allow taxpayers to sell or to transfer their credits to other taxpayers; or they pay taxpayers the value of their state credits even if the taxpayers aren’t currently paying taxes; i.e., their credits are “refundable.”

How do I claim the R&D credit?

Identify and gather support for the credit to which you’re legally entitled. Report the credit on a timely-filed (including extensions) federal tax return using Form 6765. If the entity reporting the credit is a pass-through, the partner or shareholder will report their share of credits via Form K-1 on their 1040 returns to monetize the credit.

When do I claim the R&D credit?

The credit is claimed on a timely-filed (including extension) federal income tax return for the year in which the qualified expenses were incurred. The credit may also be claimed by amending a previously-filed return on or before the statute of limitations date to report credits related to expenses incurred during that period. The statute of limitations generally grants three years after the original deadline or filing date (whichever is earlier) to amend returns.

Can the credit be claimed for a prior year?

Tax years that are open to amendment under relevant statutes of limitations may be amended to include credits. This period is generally three years from the unextended due date or the return filing date, whichever is later.

What are the risks of claiming the R&D credit?

- IRS exam. Like any other tax position, it is possible that the IRS will examine an R&D credit position. Original tax returns that include R&D credit positions have not been more likely to be examined than those that do not include R&D credit positions. Amended tax returns claiming R&D credits that are used in the years under examination have been more likely to be examined. If examined, R&D credits may be allowed or disallowed, in whole or in part. If credits are allowed, the IRS may consider the taxpayer’s other tax positions to identify additional tax liability, but only to the extent of offsetting the credit. This has been uncommon.

- Disallowed credits. It is possible the IRS would examine and disallow some or all the R&D credits. Credits that have been appropriately identified and supported are generally allowed. Credits related to vague or undocumented activities often are not.

- IRS penalty and interest. If the IRS disallows a credit it may assess a penalty if it finds that the credit was either claimed through negligence or the disregard of rules or regulations, or results in a substantial understatement of income tax. Generally, this penalty equals 20% of the credit disallowed, i.e., of the tax the IRS believes was underpaid. The IRS may also assess interest due on that 20% from the date that the tax should have been paid, but this has not been our experience.

What documentation is needed to claim R&D credits?

A taxpayer claiming a federal R&D credit on an original return must retain records in sufficiently usable form and detail to substantiate that the expenditures claimed are eligible for the credit.

However, the IRS takes the position that a taxpayer must provide more specific documentation when filing an amended return or other refund claim based on the federal R&D credit. This IRS-mandated documentation includes, for example, a list of each business component and research activity to which the R&D credit claim relates.

BDO can help determine whether and to what extent your records meet the standards IRS examiners typically apply and, if not, what other evidence you may be able to adduce to support your credits.

Although IRS agents are not required to follow them, the standards outlined in IRS audit techniques guides provide a roadmap to the auditors.

- Audit Techniques Guide: Credit for Increasing Research Activities

- Research Credit Claims Audit Techniques Guide (RCCATG): Credit for Increasing Research Activities § 41

- Audit Guidelines on the Application of the Process of Experimentation for All Software

- Pharmaceutical Industry Research Credit Audit Guidelines

What if my company is already claiming the R&D credit?

Based on experience, the majority of companies that have claimed R&D benefits have not taken full advantage of them, even if an “R&D Study” has been done. BDO offers the following complimentary services to help companies determine whether they are leaving cash on the table or could more efficiently and effectively claim their R&D credits:

- Cost & Calculation Review: Like a tax examiner, we look for errors and red flags, including those caused by use of outdated files and regulations. We also look for understated, missed, and non-qualified costs to enhance both your credit’s materiality as well as its credibility.

- Documentation Review: R&D benefits are often only as valuable as the documentation available to support them. As part of a documentation review, we assess whether and how tax examiners will accept—or disallow—your credit in light of the nature and extent of your documentation and make recommendations to improve it, for both current and future tax years.

- Systems & Technology Review: We help companies develop and implement procedures and technologies to identify, document, and calculate future credits, more efficiently and more effectively.

R&D FAQs for Small Businesses - Path to Payroll Tax Credit

Does a company have to be a “startup” or “small business” to be eligible for the payroll offset?

No. It just has to have:

- Gross receipts less than $5 million in the taxable credit year;

- No gross receipts for any taxable year preceding the 5-taxable year period ending with the taxable credit year; and

- R&D credits it can use in that year.

So even companies that have been around for more than five years and have spent billions of dollars to try to develop or improve a component could be eligible; e.g., a significant percentage of life science companies with $0 gross receipts for long periods of time before their drug receives U.S. Food and Drug Administration approval.

Can companies formed more than five years ago benefit for the payroll offset?

Yes. If the company meets the criteria as noted above, it can benefit, regardless of what year it was formed.

Although the law is intended to benefit small businesses, large businesses could also potentially benefit.

Are companies that use professional employer organizations (PEOs) eligible for the payroll offset?

Yes.

When do I claim the payroll tax offset?

The payroll tax offset is available on a quarterly basis beginning in the first calendar quarter that begins after a taxpayer files their federal income tax return.

For example, companies need to file their Q1 federal income tax returns by March 30 to apply the payroll tax offset to the second quarter. As a result, the earliest taxpayers are likely to see a benefit is July, when they file their quarterly payroll tax returns for the second quarter (Form 941).

If you extend your income tax return, you’ll be able to take advantage of the offset in the quarter after you file your federal return: file the return by June 30; take offset on the October 31, Form 941 filing; file return by September 30; and take offset on January 31, Form 941 filing.

How do I claim the payroll offset?

- Identify and gather support for the credit to which you’re legally entitled.

- Report the credit on a timely-filed federal tax return and elect the payroll offset.

- Claim no more than $500,000 of the credit annually on your quarterly Forms 941.

- A company’s payroll tax offset can be applied against its liability for the employer portion of Social Security tax (up to $250,000) and, beginning after December 31, 2022, an additional offset may be applied against Medicare tax (up to $250,000). However, companies may not use the payroll tax offset against any other employment tax liability, and the offset may not be refunded in the absence of liability.

What does $5 million in “gross receipts” mean for the payroll offset?

There are three things to consider regarding gross receipts.

- Businesses related or under common control must aggregate their gross receipts.

- Gross receipts for any taxable year of less than 12 months must be annualized by multiplying the gross receipts for the short period by 12 and dividing the result by the number of months in the short period.

- What should be included as “gross receipts”?

- Current guidance from the IRS defines gross receipts for purposes of this provision as total sales (net of returns and allowances) and all amounts received for services. In addition, gross receipts include any income from investments, and from incidental or outside sources. As currently defined, a company that reported interest only on its tax return would need to consider amounts as gross receipts in evaluating whether or not they meet the criteria in taking the payroll tax offset.

What if a company can’t use the payroll offset this quarter?

If a company can’t use the credit to offset its payroll taxes this quarter, it may carry the credit forward to subsequent quarters in which it can use it, provided the $500,000 annual cap isn’t exceeded. Amounts over $500,000 can be carried forward for 20 years to offset future regular tax liability on the company’s tax return.

What if a company has a short taxable year?

For businesses with a short taxable year—e.g., businesses that started up in current tax year—gross receipts must be annualized. This is true for all short taxable years that affect the determination of whether a company is eligible for the payroll offset. For more on the definition of “gross receipts,” please see this section.

What FICA taxes can be offset by the R&D credit?

Up to $250,000 of the employer portion of Social Security payroll tax liability and up to $250,000 of the employer’s Medicare payroll tax liability can be offset by R&D credits.

Generally, companies are required to pay Social Security (6.2%) and Medicare (1.45%) taxes on each employee’s salary. As an example, a company that employs 100 employees with an average salary of $95,000 per person would pay approximately $589,000 in Social Security payroll taxes and $137,750 in Medicare payroll taxes. As such, a company would need to have more than $9 million in annual payroll subject to Social Security and Medicare taxes and $5 million in eligible R&D costs to offset the maximum $500,000 in payroll taxes each year.

Most employers are required to deposit their payroll taxes to the federal government on a monthly or semiweekly basis and file a quarterly payroll tax return (Form 941). The credit is applied against employment tax on the quarterly return, or against amounts when the tax is deposited monthly or semiweekly.

What are some examples of the benefit?

Example 1. A company incurs $300,000 in eligible costs in an attempt to develop its flagship software product. The company was founded in 2020 and has generated no gross receipts to date. Eligible expenses generate a credit of approximately $30,000. Because the company meets the criteria, it can use $30,000 of credits to offset its FICA payroll tax on its quarterly Form 941 filings.

Example 2. A company incurs $5,000,000 in eligible costs related to developing a new medical device. The company was founded in 2013 and has generated no gross receipts, not even interest income, prior to 2023. For 2023 they generated $4,000,000 in gross receipts. Eligible expenses generate a credit of approximately $500,000. Because the company meets the criteria, it can use up to $250,000 in credits to offset its Social Security tax and up to $250,000 in credits to offset its Medicare tax payroll tax on its quarterly Form 941 filings.

Example 3. A company incurs $6,000,000 in eligible costs related to developing and improving its new line of consumer products. The company was founded in 2023 and has generated $500,000 in gross receipts each year to date. Eligible expenses generate a credit of approximately $600,000. Because the company meets the criteria, it can use $500,000 of these credits to offset FICA payroll tax on its quarterly Form 941 filings. The remaining $100,000 in credits will carryforward for 20 years to offset future regular tax liability on the company’s tax return.

In each example, should the companies continue to meet the payroll offset criteria in future tax years, they can use up to $500,000 in credits each year for 5 years to offset their FICA payroll taxes, for a potential of $2,500,000 in cash savings.

How can BDO help? Self-evaluation & complimentary BDO R&D Review

- Estimate your credit using our R&D Calculator. It takes about 3-5 minutes.

- Have BDO estimate your credit, no charge. We can perform a complimentary review to provide you the information you need to make an informed decision about whether and how to pursue R&D tax credits. Our team of R&D software developers, engineers, scientists, accountants, and lawyers have helped thousands of companies claim over $4 billion in R&D benefits, more than 90% of which they’ve been able to use, even after examination by tax authorities.

- Contact us.

SHARE