Tax Strategist: State Transfer Pricing Takes Center Stage

For many years, transfer pricing has been at the center of the international tax stage. U.S. taxpayers, however, should be careful not to overlook the fact that transfer pricing considerations are also important for state and local tax purposes. For taxpayers with intercompany transactions or arrangements among related U.S. legal entities, state transfer pricing practices will determine the amount of taxes owed at the state level.

State transfer pricing addresses (i) the proper pricing of goods, intangibles and services exchanged between two entities under common control, and (ii) other proper allocation of income and expenses between commonly controlled entities. Put very simply, many state Departments of Revenue (DORs) care about transactions between a taxpayer’s separate U.S. legal entities, even in cases where the IRS does not. If taxable income is shifted away from a state due to mispriced intercompany transactions or other erroneous sharing of common income or expenses, whether intentional or not, that state’s DOR is not going to be happy.

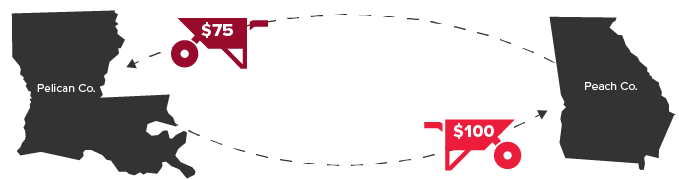

Consider the following example:

Pelican Co. and Peach Co. are both wholly owned subsidiaries of the same U.S. parent. Pelican Co. operates out of Louisiana, while Peach Co. operates out of Georgia. Pelican Co. manufactures wheelbarrows that it sells both to third parties and to its related party, Peach Co. Pelican Co. charges its third-party customers $100 for each wheelbarrow but charges Peach Co. only $75, which is the amount of expenses incurred by Pelican Co. in manufacturing the product.

The “cost only” price Pelican Co. charges Peach Co. is irrelevant for U.S. federal tax reporting purposes because the transaction is eliminated at the U.S. consolidated return level. However, the Louisiana DOR may argue that Pelican Co. should have charged Peach Co. the established $100 fair market price for the sale of its wheelbarrows and increase Pelican Co.’s Louisiana taxable income by $25. Worse yet, because there is not currently a competent authority mechanism to resolve disputes between states over transfer pricing adjustments, Peach Co. may not be able to convince the Georgia DOR to reduce its Georgia taxable income by the $25 in additional wheelbarrow expense, resulting in double taxation at the consolidated group level.

.png)

This example of an inadvertent but erroneous transfer price may be more commonly seen in the following circumstances:

State DORs are aggressively reviewing these and other types of intercompany transactions, sometimes with the assistance of third-party consultants that may or may not be paid on a contingency-fee basis. The resulting proposed adjustments can be staggering for taxpayers and, whether justified or not, may cause a taxpayer to spend years in examinations and appeals procedures. The best way for taxpayers to mitigate this risk is to focus on state transfer pricing now – before filing state tax returns and well before receiving an inquiry from a state auditor.

But How?

Unlike a transfer pricing analysis performed at the global level, a state transfer pricing analysis begins with a comprehensive review of transactions between members of the same U.S. consolidated group. For state reporting purposes, it is important to, at minimum, scrutinize intercompany transactions for the following:

A proper analysis of state transfer prices should be documented prior to reporting the impact of the transfer prices on an originally filed state tax return. Contemporaneous documentation of and support for reported transfer prices is essential during a state DOR examination – not only is it difficult (if not impossible) to collect such documentation after the initiation of an examination (often three or more years after a taxpayer has filed its return), but state auditors are becoming increasingly skeptical of documentation collected only for purposes of audit defense.

Further, state transfer pricing documentation should be reviewed and updated on a regular, periodic basis to be certain it is in line with current arm’s-length prices. This is particularly important following a significant market shift, such as the those caused by the supply chain and other disruptions many industries have faced in the midst of the pandemic.

Why Now?

Taxpayers that have not yet focused on state transfer pricing compliance are advised to begin that process now for two reasons.

First, the worst time to begin gathering support for your state transfer prices is after a state DOR initiates an audit. Although in past years taxpayers could often submit international transfer pricing documentation to appease state auditors, modern-day DORs generally will not drop a transfer pricing audit based on proof that sufficient taxable income has been reported in the U.S. International transfer pricing support is now only the starting point of a state transfer pricing audit. Taxpayers also are required to demonstrate how transactions between U.S. consolidated group members reflect market reality at the state level.

Second, there has been a recent evolution of state transfer pricing audit initiatives by state DORs. These initiatives began with rudimentary audits that relied almost entirely on guidance from for-profit consultants. However, as state DORs and the Multistate Tax Commission have continued to study the intricacies of transfer pricing, they have developed in-house expertise that allows for more thoughtful analysis of a taxpayer’s intercompany transactions.

Fortunately, this evolution has also led to opportunities for taxpayers to engage directly with the states and thereby establish agreeable state transfer prices without a lengthy examination. Indiana and North Carolina were the first states to venture into formalized negotiations with taxpayers — Indiana through a formal Advanced Pricing Agreement (APA) program and North Carolina through its Voluntary Corporate Transfer Pricing Resolution Initiative. More recently, Louisiana launched a Transfer Pricing Managed Audit Program, which appears to combine the prospective applicability of Indiana’s APA program with North Carolina’s collaborative negotiation of transfer prices impacting prior-year returns. Various other DORs have publicly announced they may be willing to work with taxpayers through similar, informal programs to give both sides certainty on the reporting of transfer prices.

After a somewhat rocky start, more taxpayers are warming to the idea of working collaboratively with DORs on state transfer pricing. Whatever the reason these taxpayers are choosing to voluntarily engage with the DORs, they all have at least one thing in common – they have dedicated resources to thoroughly understand their existing intercompany transactions and resulting state transfer prices. Without that background, the DORs cannot meaningfully engage with taxpayers to provide certainty on either past or future tax positions.

How BDO Can Help

State DORs are rapidly gaining expertise on analyzing transfer prices between commonly controlled entities, including a more thorough understanding of common intercompany arrangements and appropriate transfer pricing methodologies. This evolution creates opportunities for taxpayers that perform an analysis of their transfer prices and exposure for those that do not. BDO can help companies identify proper state transfer pricing methodologies and identify and evaluate their state transfer pricing exposure, either in preparation for examinations or to directly engage states through their various formal and informal state transfer pricing programs. For more information, contact BDO.

SHARE