BEPS 2.0 – Global Tax Framework

Changing the Global Taxation Playing Field

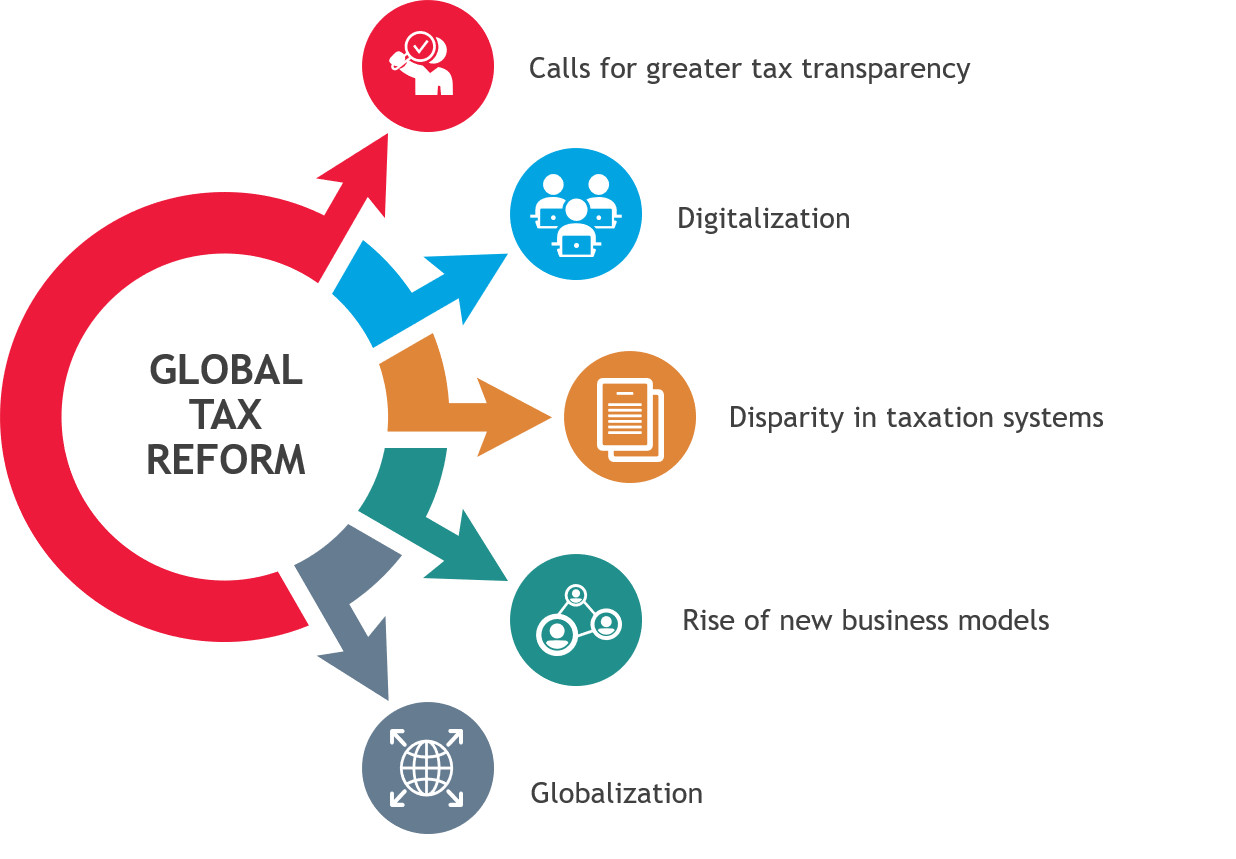

The evolution of global tax reform efforts – embodied in the OECD’s two-pillar framework -- is intensifying. Tax policymakers across the globe have agreed to address the globalization of digital business activities by working toward a global tax framework that promotes greater equity. Tax reform results in ongoing change that will have considerable implications for multinational businesses.

BDO keeps a close watch on global tax reform developments and provides insights on what those developments may mean for global organizations.

Key Takeaways

1.

Global tax reform continues to take shape after years of negotiations. Addressing the tax challenges arising from the digitalization of the economy and the globalization of business is the OECD/G20 Inclusive Framework’s number one priority. To address the challenges, the Inclusive Framework developed a two-pillar solution comprised of Pillar One and Pillar Two.

2.

Change is now upon us. Although the negotiations regarding Pillar One are behind schedule, the Inclusive Framework is making steady progress. The Inclusive Framework announced on May 30, 2024, that it is nearing completion of the negotiations on a final Pillar One package that includes a text of the Multilateral Convention (MLC) for Amount A and a framework for Amount B, with the goal of reaching a final agreement in time to open the MLC for signature by the end of June 2024.

Pillar Two has been enacted in many jurisdictions, including most EU member states, effective for tax years beginning after December 31, 2023. Numerous other jurisdictions are in the process of adopting Pillar Two legislation. Pillar Two disclosures in the 2023 annual financial statements are required for SEC registrants. Pillar Two taxes must be accrued starting in the first quarter of 2024.

3.

U.S.-based multinational enterprises (MNEs) should monitor developments and review the final rules in their home jurisdiction to assess any potential impact to their business. They should also keep track of implementation progress in all countries in which they operate.

4.

Pillars One and Two are transforming the international tax landscape. BDO has broad and deep expertise in helping MNEs navigate global tax reform opportunities and challenges. Our Transfer Pricing and International Tax practices can help you evaluate the potential impact of Pillars One and Two on your business.

Five Key Areas to Explore

![]()

Background

![]()

Two-Pillar Framework

![]()

Preparation

![]()

BDO's Take

![]()

Insights

Background

Base erosion and profit shifting (BEPS) refers to tax planning techniques used by global organizations to shift profits to low-tax jurisdictions to lower total tax liability. Over 140 jurisdictions are working with the OECD/G20 Inclusive Framework on 15 BEPS action items to address perceived tax avoidance techniques, improve coordination of international tax rules, and enhance transparency in international tax. The two-pillar framework is an outcome of the BEPS project.

The Inclusive Framework announced on October 8, 2021, that it had agreed a two-pillar solution to address the tax challenges arising from the digitalization of the economy. The announcement included a description of each pillar’s components, and a detailed implementation plan.

Top Drivers of Global Tax Reform

Two-Pillar Framework

Pillar One | Pillar Two | |

|---|---|---|

| Summary | This changes some nexus and profit allocation rules for taxation. The signatories to the October 2021 IF statement committed to provide the necessary coordination between the new rules and the removal of all digital service taxes. | This attempts to stop the “race to the bottom” by jurisdictions lowering their corporate income tax rates. Pillar Two establishes a global corporate minimum tax rate of 15%. |

| In-scope MNEs | Threshold: Global revenue above EUR 20 billion and profitability above 10%. That threshold could be reduced to EUR 10 billion upon review seven years after the agreement enters into force. | Threshold: Global revenue above EUR 750 million. |

| Out-of-scope Industries |

|

|

Preparation

U.S. MNEs that are in scope for either pillar of the framework will see an increase in the complexity of their tax profiles and could see an increase in their total tax liability.

Companies should scenario plan to determine the tax costs and administrative burdens imposed by Pillar One and/or Pillar Two and how those challenges may require changes in their tax strategies and processes. This could necessitate a reevaluation of business and operating models to better align with global tax policies.

Actions MNEs Can Take | How BDO Can Help |

|---|---|

| Assisting with impact assessments and modeling

Assisting with compliance

Assisting with restructurings and simplifications

Assisting with technology implementation

Assisting with communication

|

BDO's Take

The legislative bodies of the 140+ countries that have signed the October 2021 agreement will need to take action to enact the new rules into domestic law. Work on the implementation of Pillar Two into domestic law is well underway in many jurisdictions, including all EU member states, with most adhering to a planned entry into force in 2024. In some jurisdictions, Pillar Two legislation has already been enacted. It is important to continue to monitor global developments to determine which jurisdictions will keep to this timetable.

Insights

The latest updates and historical perspectives around the globe.

January 2024 | Pillar Two Rules May Impact Financial Statement Disclosures

February 2024 | OECD Simplifies Arm's Length Applications

March 2024 | Pillar Two: Impacts and Implications for Private Equity

April 2024 | Global Perspectives on the OECD’s Amount B

May 2024 | Pillar Two Fundamentals – A Practical Overview

August 2024 | Tax at the Speed of Tech Podcast Series

September 2024 | Global Restructuring, Operating Models and Pillar Two

October 2024 | What Pillar Two Means for Income Tax Accounting

November 2024 | How to Prepare Now for OECD Pillar Two Compliance

OECD RELEASES THIRD INSTALLMENT OF PILLAR TWO ADMINISTRATIVE GUIDANCE

AUG 2023 | OECD ISSUES PILLAR TWO ADMINISTRATIVE GUIDANCE, INFORMATION RETURN, AND STTR GUIDANCE

JULY 2023 | PILLAR 2: TIME FOR US MULTINATIONAL ENTERPRISES TO ACT

JUNE 2023 | BEPS 2.0: ADDRESSING THE IMPACT OF GLOBAL TAX REFORM

MAY 2023 | TAX TECHNOLOGY ON THE GLOBAL STAGE - TAX AT THE SPEED OF TECH PODCAST SERIES

SEPT 2022 | FOUR REASONS TO ALIGN YOUR SUPPLY CHAIN AND TAX STRATEGIES

SEPT 2022 | OECD HOLDS PUBLIC CONSULTATION ON PILLAR ONE PROGRESS REPORT

AUG 2022 | U.S. BOOK MINIMUM TAX AFFECTS SOME NON-U.S. MULTINATIONALS

APRIL 2022 | OECD’S PILLAR TWO RULES COULD HAVE LASTING IMPACT ON MULTINATIONAL GROUPS

MARCH 2022 | BDO SUBMISSION TO THE OECD ON THE PUBLIC CONSULTATION DOCUMENT

FEB 2022 | OECD ISSUES DRAFT RULES FOR TAX BASE DETERMINATIONS UNDER AMOUNT A OF PILLAR ONE

DEC 2021 | EU PROPOSED DIRECTIVE FOR PILLAR TWO

NOV 2021 | GLOBAL TAX: OECD ANNOUNCEMENT OF AGREEMENT ON INTERNATIONAL TAX REFORM

OCT 2021 | OECD ANNOUNCES AGREEMENT ON GLOBAL TAX REFORM

OCT 2021 | REGIONAL PERSPECTIVES ON GLOBAL TAX REFORM

AUG 2021 | GLOBAL TAX REFORM: WHAT CAN TAXPAYERS DO TO PREPARE FOR THE CHANGES?

JUNE 2021 | G-20 BACKS G-7 SUPPORT FOR GLOBAL MINIMUM TAX AND NEW ALLOCATION RULES

JUNE 2021 | G-7 FINANCE MINISTERS ANNOUNCE SUPPORT FOR GLOBAL MINIMUM TAX AND NEW ALLOCATION RULES

Webcast

BEPS pillar two: insights, readiness, and risks

June 18, 2024

Webcast

Pillar Two Fundamentals – A Practical Overview

May 15, 2024

Webcast

Global Perspectives on the OECD’s Amount B

April 16, 2024

Webcast

Assessing the 2024 Tax Landscape

April 3, 2024