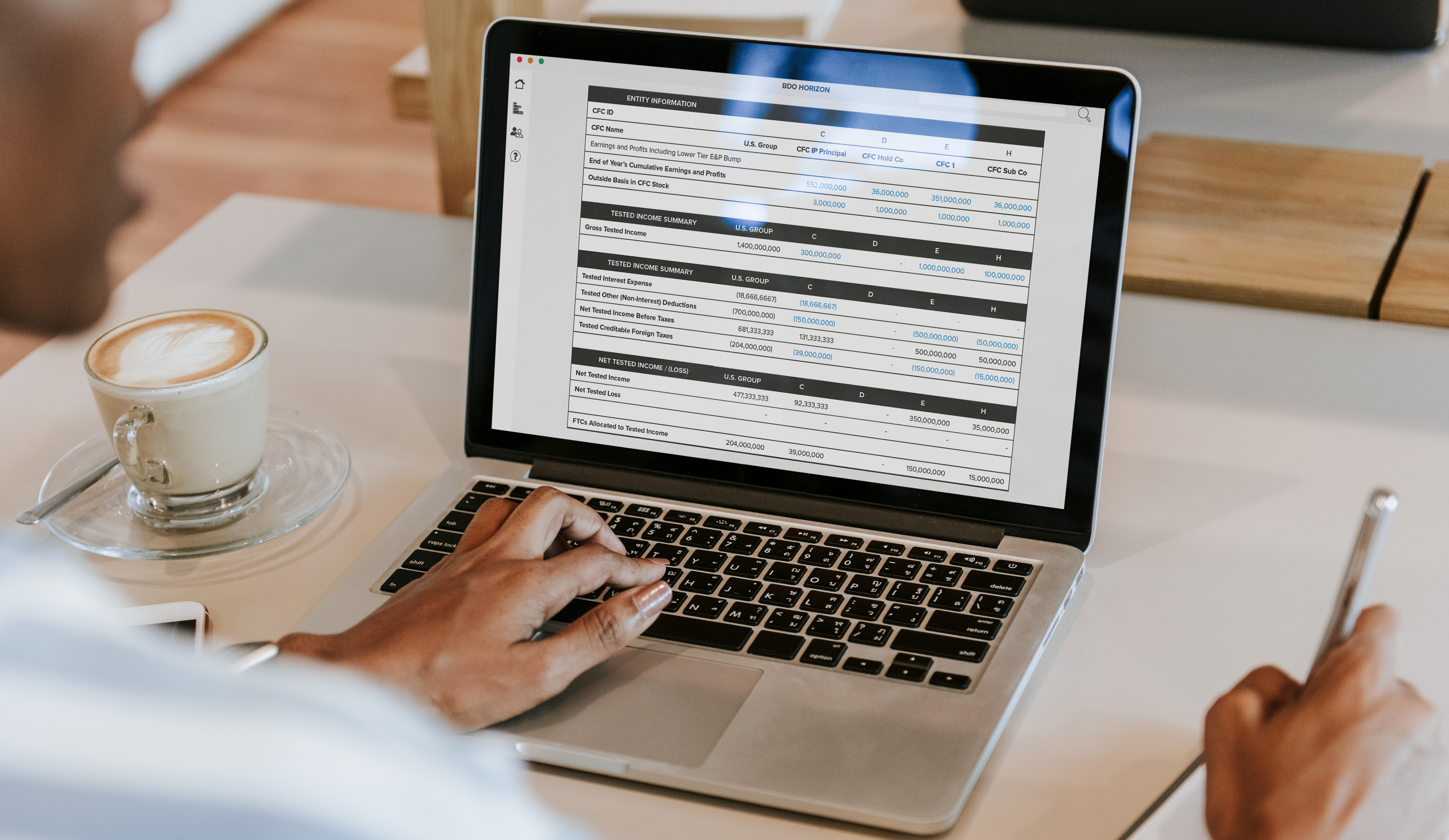

Manage Compliance Complexity with BDO’s International Tax Horizon

BDO’s proprietary international tax analysis tool, Horizon, gives corporations a comprehensive view of their international tax profile, with an emphasis on U.S. calculations, so you’re never left wondering if you’re in compliance.