Sales & Use Tax

BDO helps companies understand their sales tax exposure, mitigate risk and establish processes and systems to effectively manage ongoing compliance.

We help businesses improve efficiency, increase productivity, and streamline the indirect tax function

The simplest way to manage complex and tedious indirect tax processes is to automate them.

U.S. sales and use tax, and other indirect tax rates and requirements vary by state, which creates layers of complexity for companies doing business with customers online and across the country. Globally, value-added tax (VAT) and goods-and-services tax (GST) have complex tax determination, calculation, and reporting requirements. Indirect tax automation enables tax departments to manage every step of the reporting and compliance process more efficiently and accurately — and at the same time lower their costs.

Bringing together tax, digital, and change management professionals, we work with you to enhance the efficiency and effectiveness of the tax department with minimal disruption to your day-to-day.

From analyzing requirements and determining taxability to organizing source data and tax calculations, BDO helps you streamline every step of the sales tax process. We take a holistic approach, designing customized sales tax automation systems that integrate third-party tax software with your ERP and e-commerce platforms.

We implement third-party tax software systems that provide calculations, U.S. domestic and VAT compliance, and exemption certificate management. Our team members are certified implementers of major third-party indirect tax systems.

We design the best-fit solution, whether it’s a real-time solution that works automatically at the time of your sales and purchase, or an offline batch solution that requires less up-front setup but provides considerable value.

We conduct diagnostic reviews of your current systems and recommend potential upgrades, maintenance timelines, and/or custom solutions.

We deliver strategic and technical solutions to internal staff through trainings and ongoing communications on tax and compliance systems. We implement clear procedures and guidelines to mitigate business disruptions and help ensure long-term success.

We build custom reports, including data custody for audit support. We help design and document processes, organize source data and tax calculations, and enhance the use of technology for more accurate, timely, and transparent compliance reporting.

We develop solutions that are pivotal in converting raw data into valuable insights by retrieving data from various sources, refining it to ensure consistency and accuracy, and finally storing it in a structured repository for analysis and reporting.

We create dashboards of your indirect tax data to identify areas of exposure and provide transparency to the data to identify anomalies and errors in the compliance data.

We review your current indirect tax processes and provide recommendations for improvement.

Hands-on Senior Professionals

Tailored Approach

Open, Proactive Communication

Security Focus

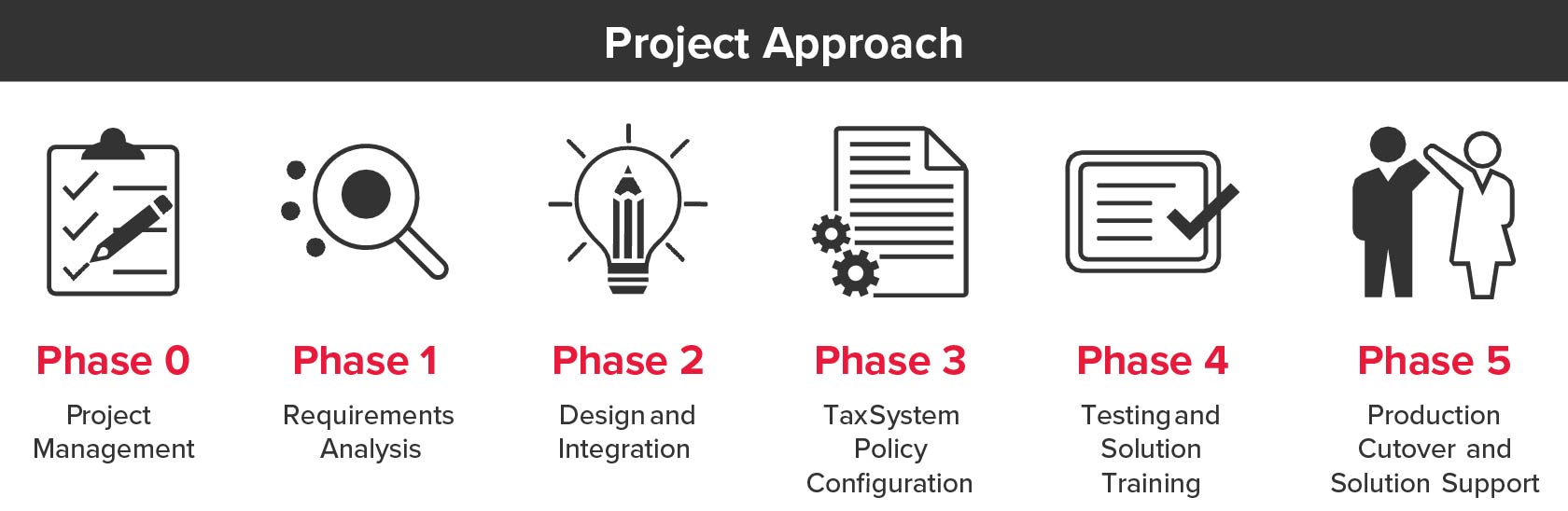

We take a project management-based approach to indirect tax automation.

No Results Found

Talk to a indirect tax automation professional. We will respond in 1-2 business days.

Thank you for contacting BDO. A representative will be in touch shortly.

BDO helps companies understand their sales tax exposure, mitigate risk and establish processes and systems to effectively manage ongoing compliance.

BDO works with companies to design and document processes, extract, transform and load source data, automate tax calculations and streamline tax reporting.

BDO leverages leading-edge technology and our global capabilities to meet your cross-border tax obligations and anticipate the effects of global tax reform on your business.

At BDO, you can do much more than fulfill your career ambitions — here, you can explore your full potential. That’s because we’re committed to helping our employees achieve on both personal and professional levels.