2018 BDO Retail Compass Survey of CxOs

Retailers Will Either Sink or Surf in 2018’s Polarized Environment

ECONOMIC EXPECTATIONS VS. RETAIL REALITY FUEL MODEST 2018 SALES OUTLOOK

2017 wrapped up with consumer confidence near historic highs and jobless claims at a historic low. These strong indicators of economic health typically translate to optimism for retailers. At the same time, the term “retail apocalypse” was mentioned 6,809 times in news articles throughout the year as reports of store closures occupy the spotlight.

The disconnect between traditional economic predictors and current industry realities has left retailers with moderate expectations for what’s to come in the year ahead. According to a mix of 100 retail CEOs, CFOs, and CIOs in our first Retail Compass Survey of CxOs, C-suite executives forecast a 3.2 percent increase in total sales for 2018.

Despite the rumble, this outlook is a signal of steady growth, not doom. In fact, more than half (53 percent) of retailers anticipate higher total sales this year compared to 2017 and, overall, online sales are projected to grow 6 percent.

“In 2018, retailers need to focus on their differentiators or invest to secure one. Positive economic trends are not translating into huge sales increases, and the industry is being squeezed on all sides. Many retailers are seeking PE investment or acquiring outside companies with complementary capabilities, while others are throwing in the towel. There’s no room for brands to coast."

Natalie Kotlyar

National leader of BDO’s Retail & Consumer Products practice

RETAIL ISN’T CONTRACTING—IT’S CHANGING FORMAT

While expectations for online sales are unanimously optimistic, opinions differ among the C-suite when it comes to the role of e-commerce within the broader sales picture. According to the U.S. Census Bureau, e-commerce sales currently make up approximately 9 percent of all domestic retail sales.

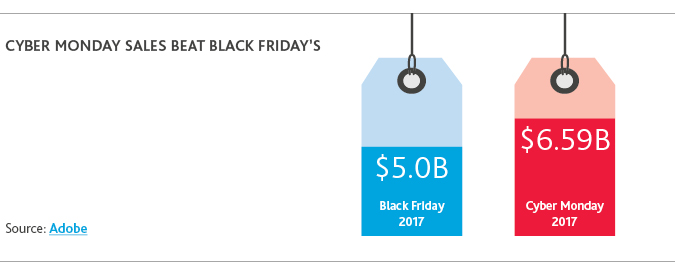

Online platforms have been gaining traction for years, but the pace of e-commerce growth in 2017 was record- breaking, and it wasn’t just Amazon: Wal-Mart’s latest earnings announcement revealed its U.S. e-commerce sales surged 50 percent in Q3 and Cyber Monday became the largest online shopping day in history with spending of $6.59 billion, according to Bloomberg. However, retailers surveyed are divided in their plans to devote more dollars to their e-commerce efforts. Just over half (51 percent) of executives surveyed said they intend to invest more capital in e-commerce and mobile commerce in 2018 than they did in 2017. Cash may be limited and competition may be stifling, but investing in anticipation of continued acceleration online—and even investing to maintain a position on the curve—is worthwhile. The trajectory of online sales as a portion of total sales is trending upwards, and retailers that don’t make the necessary investments are likely to fall behind.

.jpg)

The fact remains, however, that e-commerce currently comprises 9 percent of all retail sales and 91 percent of retail spending still takes place in store. The importance of in-store sales is not lost on retailers: When it comes to investments in physical space, more retailers are expanding or remodeling than downsizing.

Some retailers are investing to create a more connected and convenient in-store experience, whether by cutting time in line or arming store associates to be personal assistants. Others are optimizing their real estate by transforming traditional store fronts into innovation labs, logistical space for delivery or inventory warehouses. The key is to shift from a “bigger is better” mentality to focus on how best to leverage existing space and provide consumers with specialized, frictionless experiences that keep them coming back.

.jpg)

TRANSACTIONS TALLY UP TO TACKLE CHANGING DYNAMICS

Demanding, tech-enabled consumers and aggressive competition are driving retailers to make improvements. To do so, some are tapping public or private capital, and others are absorbing businesses to fill gaps in their offerings. On the other end of the spectrum, highly-leveraged and underperforming retailers are filing for bankruptcy as sales and margins fizzle. There’s no middle ground.

This reality is punctuated by the flurry of activity—between mergers and acquisitions, IPOs, and bankruptcies—that morphed the retail landscape in 2017: Amazon and Target both acquired grocery players, while Coach bought Kate Spade and rebranded to Tapestry; online personal shopping service Stitch Fix filed for IPO; and rumors swirled around luxury retailer Valentino doing the same. Meanwhile, Nordstrom neared a family buyout and Toys “R” Us joined at least 20 other retailers in filing for bankruptcy. Retailers expect 2018 will be another busy year.

.jpg)

.jpg)

Retailers are also feeling the heat as Amazon continues to permeate the market. According to a Bloomberg analysis from July 2017, the behemoth was mentioned by corporate executives as

a risk 635 times over 90 days on earnings calls, compared to 162 times for the President. With this threat top of mind, more than 1-in-4 retail executives think strategic acquisitions will be driven by attempts to protect or gain market share.

According to our first Retail in the Red: Bi-Annual Bankruptcy Update, Amazon is not the sole cause of distress within the industry. The plurality of retailers that filed for bankruptcy in the first half of 2017 had accumulated over $5 billion of liabilities in aggregate. This increase in liabilities is likely due to a substantial uptick in leveraged private equity buyouts. In our CxO survey, it’s CIOs who most expect this trend to escalate in the year ahead. In fact, 57 percent of retail CIOs believe there will be more bankruptcies among retail and consumer products companies in 2018 compared to 28 percent of CFOs.

Additional liquidity fueled by the strong 2017 holiday shopping season could make bankruptcy protection unnecessary, but executives across the board have varying outlooks for how specific sectors will fare in 2018.

.jpg)

CUSTOMER RELATIONSHIPS CRITICAL TO RELEVANCY

To stay out of the red, it’s crucial for retailers to build lasting relationships with target customers now that access to goods is no longer a differentiator. That requires a deep understanding of the expectations, preferences and grievances that drive behavior.

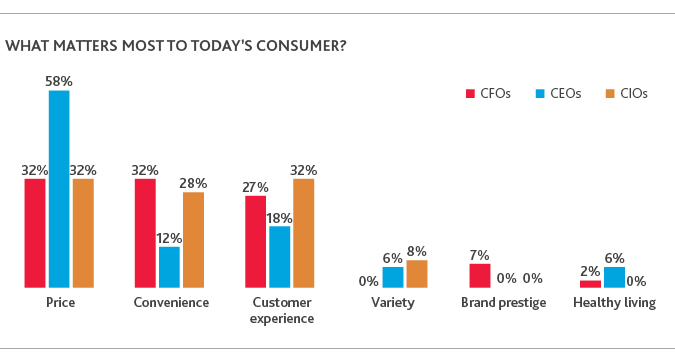

The highest percentage of retail executives surveyed think price is most critical to today’s consumer by a large margin. Meanwhile, just a quarter of respondents perceive convenience or customer experience to be shoppers’ main priority. And while variety, brand prestige, and healthy living may motivate a specific fraction of the population, these factors could be more of a perk than necessity for the vast majority.

CIOs and CFOs’ view that price, convenience, and customer experience are of near-equal importance to consumers may be based on insight-driven observations and underscore a core challenge for retailers: They can’t offer it all.

.jpg)

Savvy retailers demonstrate empathy by catering to their unique shopper profile. For instance, fast-fashion brand Zara knows that its primary consumers are Millennials looking to discover the latest fashion trend rather than because they have a specific item in mind. Its owned, lean supply chain enables this discovery experience with swift in-season turnaround and speed to market. By contrast, Wal-Mart shoppers are more deliberate—they’re looking to fulfill their shopping list at the lowest price. Wal-Mart’s “everyday low prices” strategy hinges on scale, volume, and bare minimum operating expenses.

Ensuring symbiotic business and operations strategies is vital to effective execution, but these efforts are futile without relentless commitment to understanding individualized consumer needs. This calls on consistent communication across the retail C-suite that trickles down through the business and ultimately, to the shopper.

CONNECTIVITY AND ENGAGEMENT NEEDS PROMPT INVESTMENTS

The precondition for strong connectivity across the business and with customers has retailers dedicating resources to spur engagement and bolster their tech infrastructure to support it. Specifically, retail executives plan to invest more in their advertising and marketing strategies, IT systems and technology, and e-commerce and mobile channels in 2018.

The combination of capable, secure IT systems and targeted marketing efforts is a recipe for meaningful feedback and predictive insights that retailers should weigh heavily in business decisions. For instance, it’s important for retailers to consider how consumers—whether consciously or subconsciously—react to marketing and advertising efforts. They seek a form of engagement that helps to facilitate a decision and have a visceral reaction to being “spammed.” This might mean moving away from frequent discount notification emails and toward personalized, anticipatory promotions.

Some retailers are transcending traditional infrastructure that support operations and plan to experiment with innovative digital transformation initiatives in 2018. The future of connected in-store technology, for instance, is embodied by Amazon Go. This concept eliminates all factors that currently add friction to the shopping experience: checkout lines, payment, and human interaction. While Amazon had the advantage of contriving a store around this concept, there are steps traditional retailers with legacy systems can take to transform digitally.

As brands are expected to offer unprecedented degrees of convenience and speed, over one-third of retailers are planning to invest in initiatives that enable Internet of Things (IoT) and automation adoption in the year ahead. Between voice-controlled shopping, one-click ordering, robotic packaging and drone delivery, it’s evident that no aspect of retailing is exempt from technological disruption. For businesses, both consumer-facing and in-house innovation is a mandate, not an amenity.

GUARDS UP AGAINST CYBER CRIMINALS

For years, the industry has been considered a prime target and goldmine for cyber criminals given the trove of customer and company data stored. But as new technologies emerge and advance, so do the nature of cyberattacks.

Last year saw some of the worse cyberattacks and data breaches in history across industries, from the infamous WannaCry ransomware that plagued hundreds of organizations globally, to Equifax’s data breach that affected as many as 153 million consumers. With consumer tensions on high, even the smallest appearance of a cyber threat—whether real or imagined—can spell reputational death or demise to even the most highly regarded brands in the industry.

As retailers plan to invest in more digital transformation, they’re also allocating more dollars to secure these initiatives in the year ahead. The majority of executives surveyed said they have increased their cybersecurity spending in the past 12 months, but there are varying degrees of action taken to mitigate risk.

Interestingly, less CEOs cite that their businesses have taken any of these steps to strengthen cyber controls compared to CIOs. This may be that CEOs are more likely to lack awareness of firm-wide cyber efforts, compared to those more directly involved. To effectively guard against cyber attacks, it’s important for responsibility to extend outside IT departments. All executives and employees must maintain constant vigilance of evolving cyber risks through the implementation and management of a successful cyber risk management program.

SUCCESSFUL CYBER RISK MANAGEMENT PROGRAMS SHOULD INCLUDE:

- EMPLOYEE EDUCATION - Human negligence is often the biggest risk to organizations. Designing training programs around various organizational roles can help employees practice good cyber hygiene and better understand the consequences.

- ACTIVE MONITORIN - Threat monitoring and analytical tools are critical weapons in an organization’s defense arsenal to detect and prevent attacks. Early detection can enable retailers to rescue critical data and prevent further damage.

- INCIDENT RESPONSE PLAN - When an issue emerges, time is of the essence. Developing a plan that details breach notification protocols and identifies the critical stakeholders involved in containing, removing, and communicating the threat can ensure the organization’s response is immediate and comprehensive.

- SECURITY PATCH MANAGEMENT PROGRAM - Keeping operating systems and software updated with the latest security patches can reduce the number of exploitable entry points for cyberattacks.

“Fostering a corporate culture of cybersecurity which is integrated from the top down is key to defending against cyber threats and mitigating risk. The CEO and Board must lead the way with their sincere support of this principle. They must promote and participate in continuous cyber awareness training for all employees, ensuring all board members, executives and staff understand their individual roles and responsibilities in protecting the company network. It is the human factor which is either the most effective defense or the weakest link when a company is faced with cyber threats.”

THE RISE OF RETAIL REGULATIONS

Many global and national regulations have come into play over the past year to better protect retailers and customers from damaging cyberattacks and data breaches.

In fact, the anticipated onset of legislation led 78 percent of retailers to cite compliance with data privacy and security regulations as a business risk in the BDO 2017 Retail RiskFactor Report, and 30 percent to name Payment Card Industry standards and EMV compliance as a concern.

Now, as 2018 rolls in, many retailers are eyeing the European Union’s General Data Protection Regulation’s (GDPR) impending deadline of May 25 of this year. The consequences of noncompliance with the GDPR, which aims to harmonize data privacy laws across Europe and protect EU citizens’ data privacy, are severe: Retailers whose customer data is affected in a hack can face fines up to £20 million or 4 percent of global turnover, whichever is greater.

Data protection isn’t the only area where regulators are cracking down. Retailers are also gearing up to implement the Financial Accounting Standards Board’s guidance on lease accounting, Accounting Standards Update 2016-02. The leasing standard— which becomes effective in 2019 for public and 2020 for private businesses—has the greatest impact on companies that lease property or equipment, subjecting retailers to a heavy burden.

Overall, most retailers have or are planning to address the lease accounting standards by managing software updates internally (75 percent), as opposed to vetting new software (36 percent) or hiring an external consultant (24 percent). However, nearly double the percentage of CIOs say their firm has or is planning to vet new software (48 percent) than CFOs (25 percent) to address new lease accounting standards. This may indicate that CIOs are better equipped to recognize whether their current software is inadequate to bear the burden of lease accounting changes than CFOs.

Regardless, it’s important for all business leaders to familiarize themselves with the new standards and evaluate the impacts on their businesses. They should also be aware of trickle-down effects, including what this may mean for complying with EBIDTA and other financial performance-based covenants, as well as any implications for income tax and their overall internal control environment.

RETAILERS REIMAGINE TAX STRATEGIES TO ACCOMMODATE REFORM

Now that tax reform is law, businesses across industries are strategizing how to adapt, ensuring no provision is left ignored.

As retailers did their best to forecast what tax changes might end up coming down the pike, a majority (34 percent) agreed that a reduction in the U.S. corporate tax rate would have the greatest impact on their business, followed by a reduction in the U.S. individual income tax rate, changes to state and local taxes, and cross-border tariffs. The ways retailers adjust their financial and tax strategies to maximize returns will define how much money they will be able to spend on initiatives that can help them compete.

“For retailers, tax reform brings both good and bad news. The reduced corporate rate from 35 percent to a flat rate of 21 percent is the most obvious win—the savings will be valuable for the already cashstrapped industry. However, the limitations on interest deductibility, for instance, could impact retailers who are using debt to fund new store openings within the same taxable entity, possibly resulting in higher taxable income. Though technical corrections and changes are sure to come from the Hill, it’s important retailers meet with their tax professionals sooner rather than later to ensure there are no surprises when it comes time to file.”

Scott Ziemer

Tax Partner in BDO’s Retail & Consumer Products practice

Informed consumers. Left-field industry disrupters. Nonstop technological innovation. Mounting debt. These dynamics that have been slowly percolating over recent years have hit full speed and retailers are either sinking or surfing. Looking ahead, retailers have to take a hard look at their investment strategies to assess how they can survive in this binary environment.

About the Study

The 2018 BDO Retail Compass Survey of CxOs is a national telephone survey conducted by Market

Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly with 100 chief executive officers, chief information officers and chief operating officers in Q4 2017. The survey was conducted within a scientifically developed, pure random sample of the nation’s leading retailers.

SHARE