The New Markets Tax Credits (NMTC) Program is a federal initiative aimed at supporting businesses that make capital expenditure (CapEx) investments and create community impact in low-income areas in the U.S. Through the NMTC program, companies making these investments can receive tax credit-subsidized loans for use in their projects. Among other preferential terms, these NMTC loans generally provide for forgiveness of the principal at the end of a seven-year term, delivering a permanent cash benefit to investors.

These FAQs provide insights and answers about the program, offering an overview of its features and explaining how businesses can benefit from participation.

- The NMTC program was created in 2000 as part of the Community Renewal Tax Relief Act and was designed to subsidize capital investments in low-income communities. Businesses that invest in eligible low-income communities (Qualified Active Low-Income Community Businesses or QALICBs) are eligible to receive tax credit-subsidized NMTC loans that have principal forgiveness features after a seven-year term, providing a permanent cash benefit to the QALICB. In addition to principal forgiveness, these loans offer other beneficial features, including interest-only terms and below-market interest rates.

- Businesses that make CapEx investments in eligible low-income census tracts are eligible to apply and receive NMTC financing. Businesses can be either for-profit or not-for profit.

- Additionally, the NMTC program supports a wide range of business sectors, including manufacturing, healthcare, retail, renewable energy, education, and more. Businesses involved in the following activities are not eligible for NMTC financing: massage parlors, gaming facilities, liquor stores, racetracks, tanning facilities, and golf courses. The NMTC program also imposes certain restrictions related to farming and residential rental properties.

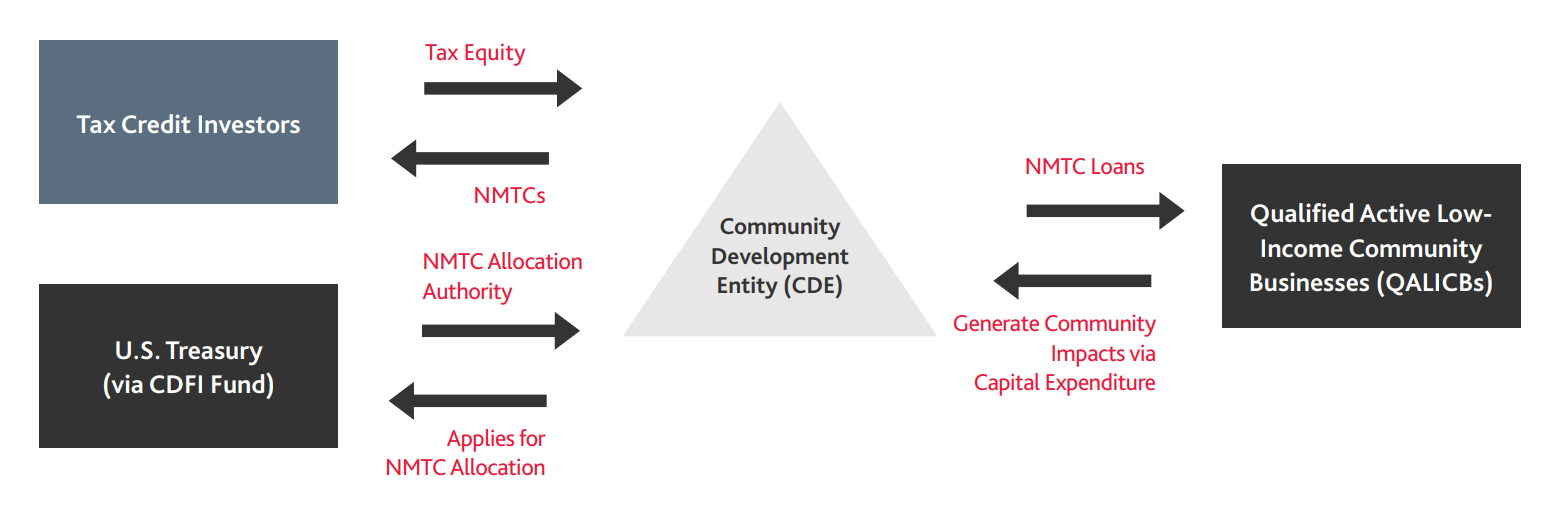

- Every year, certified Community Development Entities (CDEs) apply to the Community Development Financial Institutions (CDFI) Fund, a branch of the U.S. Treasury, for New Markets Tax Credit Authority (also known as an NMTC allocation). If awarded an NMTC allocation, CDEs use this tax credit authority to offer tax credits to Tax Credit Investors in exchange for NMTC equity. CDEs can then use the capital to make loans and investments to QALICBs with projects in low-income communities. Each CDE has its own specific strategy for its NMTC allocation (for example, some CDEs may provide NMTC financing only to businesses in certain states or certain industries) and will evaluate which projects to finance based on the community impact generated by the CapEx investment.

- The NMTC program is currently set to expire on December 31, 2025, with the final two rounds (CY24 and CY25) of approved NMTC allocation expected to be released in the fall of 2025, totaling $10 billion. The NMTC program has generally received bipartisan support and, most recently, the Senate Finance Committee released legislative text as part of the Senate Republicans’ proposed budget reconciliation bill on June 16, 2025 that included a provision to permanently extend the NMTC program.

NMTC Project Requirements

- To be eligible for NMTC financing, projects must be located in an eligible low-income census tract and must generate significant community impact. Community impact encompasses a wide range of initiatives, including but not limited to:

- Quality job creation, generating positions that offer living wages and/or benefits such as health insurance, 401K or retirement plans, and paid time off.

- Accessible job creation, whereby positions are made available to individuals who have only a high school degree or the equivalent, or individuals who face other barriers to employment (for example, the longer-term unemployed, displaced workers, or the formerly incarcerated).

- Creating or expanding employee training programs or providing opportunities for career advancement.

- Increasing access to goods or services such as healthy foods, healthcare and childcare services, education programs, and more.

- Minority outreach efforts such as targeted hiring of minority individuals or engaging minority-owned or controlled contractors/subcontractors during construction.

- Environmental efforts such as supporting the production or distribution of renewable energy resources; reducing energy or water use; helping builders meet Leadership in Energy & Environmental Design (LEED) certification or similar green building standards; remediating environmental contamination.

- NMTC loans can be used towards CapEx such as costs related to new construction, building rehabilitation, or expansions, and equipment purchases. In some cases, NMTC loans can also be used to provide small amounts of working capital (usually in combination with the aforementioned CapEx).

- NMTC loans can be used for project costs that will be incurred within 12 months of the NMTC closing date or for prior project costs that were incurred within 24 months of the NMTC closing date.

- There are no restrictions on the project size to qualify for NMTC financing.

- For smaller projects, QALICBs should consider transaction costs and other factors when determining whether NMTC financing is beneficial for the project.

- While there is no minimum or maximum project size, CDEs generally prioritize projects that generate community impacts that are meaningful in comparison to the project size.

Securing NMTC Allocation

- CDEs typically require QALICBs to complete an application or intake form that provides information about the project, including a project description, its timing, anticipated community impact, and information on other financing sources and the project budget. CDEs may also request typical financial reporting documents, such as prior year audited financials and the project’s financial projections, as part of the application process.

- The CDE will then evaluate the QALICB’s application and, if approved, will offer a term sheet for an NMTC allocation.

- QALICBs can apply for an NMTC allocation anytime throughout the year; however, CDEs typically seek to deploy their allocation quickly once they receive it. NMTC allocations are awarded to CDEs once annually. CDE applications for the 2024-2025 NMTC allocation round were due on January 29, 2025, and the awards are expected to be announced in late 2025.

- The NMTC funds must be fully spent within 12 months of the NMTC closing date (i.e., the date the NMTC loans are issued to a QALICB), so CDEs typically look for projects that are ready to start construction. However, projects that are already underway are also eligible to receive NMTC financing.

- The timeline to receive NMTC financing varies for each transaction. Once a term sheet from a CDE has been received, the typical closing timeline is approximately 8 to 10 weeks, during which time the transaction documents are drafted and negotiated.

- Once a project has received NMTC financing, the project must stay within the designated low-income census tract for seven years, in addition to meeting other NMTC requirements.

- QALICBs will also have reporting obligations to the CDEs and Tax Credit Investor. The reporting requirements vary slightly for each transaction, but typically include community impact reporting and other customary financial reporting (such as financial statements and tax returns).

How BDO Can Help

Securing an NMTC allocation can be a complicated process. Our experienced team is committed to helping businesses navigate the process and make it as easy as possible, so you can concentrate on your CapEx project. We offer comprehensive support at every stage of the NMTC process, from assessing project eligibility and securing NMTC allocation from CDEs, to loan closing support and fulfilling compliance requirements. Contact our Business Incentives & Tax Credits team to learn how we can support and assist you in securing NMTC financing for your project.