Mitigating Common Integration Risks to Capture Deal Value Drivers

A strong start builds a foundation for a successful integration, but leadership often hesitates, afraid to enact change too early and thereby missing the window to initiate programs required to meet the projected goals of the transaction. Ineffective integrations can result in not only the failure to realize intended benefits, but also the potential loss of value and perhaps more serious unintended consequences.

When faced with lukewarm results post-transaction, investors and management teams increasingly enlist experienced third-party advisors to help ensure that their investments yield the desired results. By taking a proactive approach to planning and implementation, companies can mitigate common integration risks and help maximize expected deal value. To avoid a poorly executed integration, it is important to have an effective management structure, a well-defined plan and availability of the resources necessary for implementing the integration strategy.

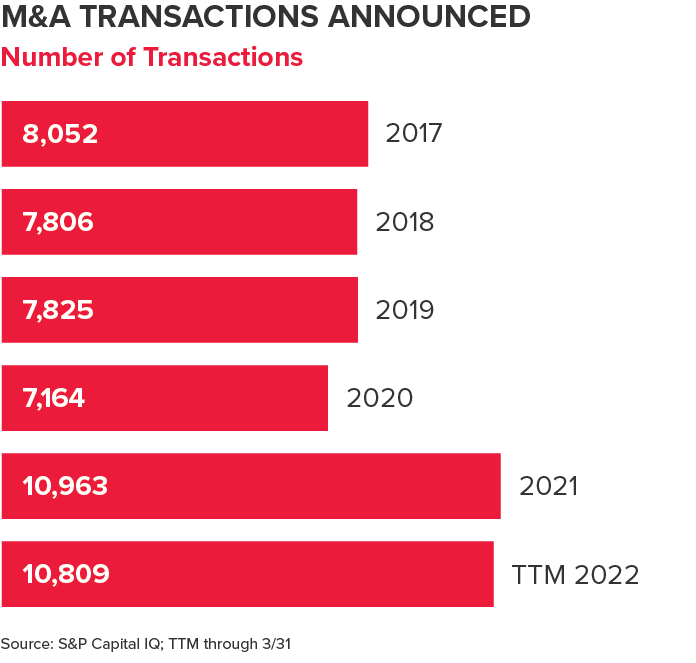

A Strong M&A Market in 2021

2021 brought a record year for M&A transactions, and robust M&A activity has continued into 2022, along with strong competition for deals. Market volatility — stemming from rising operational costs, higher interest rates, inflationary concerns and geopolitical tensions — is now putting greater pressure on margins and increasing risk for investors.

.png)

Statistics of Failed Integrations

The statistics on failed mergers and acquisitions are surprising. According to BDO’s 2022 Middle Market CFO Outlook Survey, 27% of companies say “synergies fell short of expectations” for acquisitions made in the past three years, and another 8% say they did not successfully capture the available synergies. Other, older surveys have even put the failure rate of M&A somewhere between 50% and 80%. Applying M&A integration best practices improves the chance of success, which is critical to achieving returns and avoiding business disruption.

Common Integration Risks

Poorly executed integrations can have long-lasting negative impacts on companies and even threaten the business’ viability. Some common integration risks that companies can beware of and prepare for include the following:

-

Not realizing synergy, value creation and financial performance goals – Private equity sponsors and companies invest significant capital and energy to find the right deal and negotiate the best price for the transaction — based on deal theses that hinge upon achieving synergy and value creation opportunities. These opportunities typically have a shelf life, and the window to achieve them can close quickly, putting the transaction’s success at risk. Synergy and value creation opportunities should be validated as soon as possible, ideally during due diligence. Once validated and agreed upon by the key stakeholders, those opportunities should be pursued in a deliberate and organized manner post-close.

-

Loss of key employees – Employees are one of the stakeholder groups at risk in any transaction. A buyer risks losing their key employees, as well as those of their target, during a transaction. When information about the potential transaction comes out — whether through the formal announcement or leaked information — employees can become anxious and concerned about their future, and they may start looking for another job. Additionally, competitors can take advantage of that employee anxiety and try to recruit key talent. Therefore, it is important for the buyer and seller to have a proactive and coordinated communication plan to address employee matters and concerns. The plan should answer the employees’ “me” questions, such as: will I have a job?, how will my job change?, will my compensation and benefits change?, why will this transaction be good for me?, etc.

-

Loss of customers and revenue – Customers are the other stakeholders that are at risk in any transaction. Just like with employees, a buyer risks losing its customers, as well as current customers of their target, during the transaction. When information about the potential transaction comes out, customers can become concerned about their relationship with the buyer or target (e.g., will their main point of contact change?, will they no longer be a priority customer?, etc.). They could also be poached by competitors, or they could try to renegotiate terms, especially if they have a change of control clause in their contract. It is important for the buyer and seller to have a proactive and coordinated communication plan to address customer concerns and convey the value proposition of the transaction. Additionally, if transaction-related activities, such as the integration, are not handled properly, they can disrupt operations and product or service delivery, leading to lost revenue. It is critical to plan for and sequence integration activities to help minimize disruptions to operations.

-

Inability to generate meaningful financial and operational reports – Post-close, companies can struggle with generating meaningful consolidated financial statements and operational reports in a timely manner. This problem can lead to a lack of understanding about the performance of the combined organization. The inability to generate consolidated reports may be caused by misaligned reporting processes, disparate financial and operational systems, incompatible data and/or inappropriate metrics. Generating meaningful consolidated financial and operational reports should be a focus in the first 100 days. If reporting processes cannot be aligned, or financial and operational systems cannot be integrated in that time, then workarounds should be identified and implemented.

-

Increased corporate risks due to inconsistent policies – Buyers sometimes allow targets to continue to operate independently post-close. However, allowing the target to maintain policies that contrast with the buyer’s policies can create undue risks for the combined company. Aligning key corporate policies — such as those for finance and accounting (e.g., statutory reporting, approval levels), HR (e.g., employee harassment, whistleblower complaints), risk management (e.g., regulatory compliance), etc. — is an important integration task that needs to be done at the transaction close or shortly thereafter for most, if not all, transactions.

-

Organizational disruption and employee flight due to misaligned corporate cultures – Buyers can sometimes overlook the assessment and alignment of the target’s corporate culture during the transaction and integration because they prioritize the hard, tangible assets. However, opposing corporate cultures can create a divide between the buyer and target, which can lead to organizational disruption and increased employee flight. Additionally, corporate culture can often be a significant asset for a company, and it can be an important value driver in transactions. A plan for cultural alignment and change management should be developed and executed after close.

Leading Practices for Integration

What can companies do to achieve optimal outcomes and capture deal synergies? Here are some leading practices that can be deployed to help integrations be successful:

-

Start planning early – It is imperative to start the integration and synergy capture planning process early. Many companies underestimate the amount of time, energy and resources needed to integrate their targets. Integration should be an early consideration and, ideally, an embedded part of due diligence. The planning should start as soon as possible post-diligence so both the buyer and target can prepare for and address transaction close or Day 1 priorities, as well as begin executing their integration and synergy capture plans immediately after close.

-

Align integration strategy and priorities with deal rationale – In any transaction, the buyer’s integration strategy and priorities should be aligned with the deal rationale and focus on the deal value drivers. It is important for the buyer to clearly define and communicate the integration strategy and priorities at the onset of the integration so that their integration or functional teams have a shared understanding of the vision.

-

Define a target operating model for the combined organization – One of the most critical acquisition decisions for a buyer is the degree of integration that should be applied to the target. The buyer should work to define a target operating model for the combined organization — and, as necessary, interim operating models — so the functional teams each have a roadmap to the end goal.

-

Establish clear leadership, accountability and governance structure – It is essential to establish an effective integration management structure with the appropriate resources, skills and time to get things done. The integration management structure should facilitate coordination between the different functional teams, as well as communications and transparency. Timely decision-making and issue resolution throughout the integration process are key components.

-

Assess all aspects of Day 1 preparedness – In all cases, the buyer and target will be seeking a seamless Day 1. The goal should be to minimize any disruptions to their operations. Employees need to get paid, customers need to be served and the business needs to run as usual. Day 1 is also a unique opportunity for the combined company to set the right tone in communicating to their stakeholders and kicking off integration execution. As previously mentioned, integration planning should start early. Day 1 priorities include stabilizing the business, establishing financial control, meeting regulatory requirements and managing the stakeholder experience.

Why Companies Seek Support

M&A transactions are complex. Expectations are high. Successfully integrating or merging two companies can be a daunting task, and management resources are already stretched thin. With such high stakes and the possibility of failure, companies should consider leveraging the assistance of experienced third parties. External resources also reduce the burden on employees, so they remain engaged, productive and focused on their main tasks during and after the transaction.

Experienced advisors can help companies hit the ground running on Day 1. However, waiting until an integration faces challenges can make it much more difficult to capture deal value drivers. At BDO, we believe companies and their executives can take a proactive stance by leveraging external assistance when needed.

Restructuring and turnaround services as well as operational value creation services within the United States are offered through BDO Consulting Group, LLC, a separate legal entity and affiliated company of BDO USA, LLP, a Delaware limited liability partnership and national professional services firm. Certain restructuring and turnaround services may not be available to attest clients of BDO USA under the rules and regulations of public accounting.

SHARE